Analysts Split on the Impact of Bitcoin ETF Launch

The launch of Bitcoin ETF trading by ProShares could trigger profit-taking as expectations are realised. Not all experts are convinced that, if the first cryptocurrency-based instrument is approved, the adage will hold.

One of the axiom’s proponents, Dan Morehead asked for a reminder of the upcoming event a day in advance so that he ‘took a few chips off the table.’ The CEO of Pantera Capital is convinced the adage certainly works in the crypto space.

He cited two past events that triggered the market wisdom: the launch of Bitcoin futures on the CME and Coinbase going public. In the first case, digital gold subsequently fell by 83%, in the second by 54%.

After a prolonged contraction of exchange balances, momentum has shifted to a neutral stance. In the last 30 days inflows were roughly matched by outflows, noted in Glassnode’s latest report.

“This aligns with the expectation that once Bitcoin ETF trading begins, we will likely see a sell-off. You move cryptocurrency onto exchanges […] when you plan to use that liquidity,” — analyst Nick Mancini.

This goes in line with the expectation that once trading goes live for a Bitcoin ETF we will likely see a sell off event.

The reason you keep crypto on exchanges is because you plan to make use of that liquidity.

Keep a lookout for a major selling event earlier next week.

— Nick_Mancini.jpeg 💫 (@nickcini) October 15, 2021

In a CoinDesk commentary, Genesis Global Trading’s Noel Acheson argues that the sell-off, even if it occurs, won’t be deep.

“In December 2017 or in April 2021 the market was already ‘frothy’ and showed signs of exhaustion. It isn’t the case now,” she explained.

Noël Acheson’s view is shared by Pankaj Balani, head of Delta’s crypto platform, and Patrick Hoissera, head of trading at Crypto Broker AG. The experts stressed that the most interest will be generated by the instrument’s trading volume on its first day.

Stack Funds CEO Matthew Dib noted that the potential pullback could be modest given the market’s moderate leverage and the substantial premium on the September 22 futures. The latter are trading at $68,880.

“We’re not seeing any warning signs that the market is overheated in the short term,” he concluded.

According to BYBT, funding costs in the perpetual futures market ranged from 0.01% to 0.024%, not signaling extreme values.

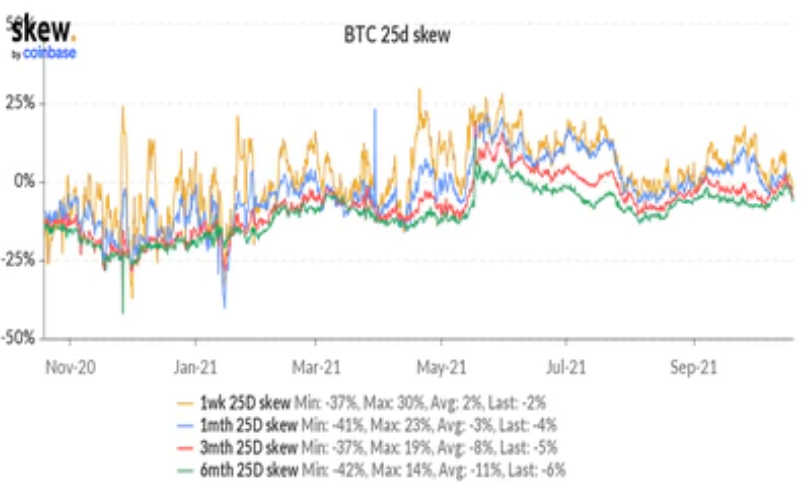

Skew calculations indicate a dominance of bullish sentiment in contracts with maturities from one week to six months. They also reflected the predominance of demand for call options and interest in $100,000 and $200,000 strike levels for year-end expiries, noted by Glassnode analysts.

Beyond its short-term impact, the launch of Bitcoin ETF trading is also a prompt to assess the SEC’s long-term prospects. Fundstrat co-founder Tom Lee forecast that in the first year investors will channel $50 billion into this and similar instruments.

#Bitcoin bull Tom Lee: Futures ETF could see $50 billion in first-year inflows. pic.twitter.com/NROTJDz0qF

— Bitcoin Magazine (@BitcoinMagazine) October 19, 2021

For comparison, AUM of all crypto funds for institutional investors as of October 15 reached a record $72.3 billion, including Bitcoin-based funds at $50.26 billion.

CryptoQuant CEO Ki Young Ju believes that the Bitcoin ETF launch will catalyse the long-term growth of the flagship cryptocurrency, analogously to gold.

According to the expert, from 2004 to 2021 the market cap of the main precious metal rose from $1 trillion to $11 trillion. The total market value of digital gold recently also surpassed $1 trillion.

🟨 Gold market cap

Before ETF in 2004: $1 Trillion

After ETF in 2021: $11 TrillionIf $10T demand came from an inflation hedge, not industrial use, this year is going to be interesting for #Bitcoin.

🪙 BTC market cap

Before ETF in 2021: $1 Trillion https://t.co/aiDB3iv7Wm— Ki Young Ju 주기영 (@ki_young_ju) October 15, 2021

As Arcane Research notes, futures analysis suggests Bitcoin is set to reach an all-time high to reach an all-time high.

According to Arcane Research, by the end of October the SEC should respond to similar applications from Invesco, VanEck, Galaxy Digital and Valkyrie Investments. The product from the latter has formally already received listing on Nasdaq.

Follow ForkLog on YouTube channel at YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!