Analysts weigh the impact of Lido’s liquid staking on Ethereum

LSD-protocols have changed the supply structure of Ethereum and its issuance dynamics. On lending platforms, derivatives such as stETH have become more attractive than ETH, while stETH liquidity on DEX has declined.

Liquid staking transforms the supply dynamics of #Ethereum and creates a shift in the demand for Ethereum’s native token.

We discuss how stETH has become particularly attractive on lending platforms, whilst stETH liquidity on decentralized exchanges diminishes.

Discover more… pic.twitter.com/QQCocNoP3T

— glassnode (@glassnode) October 3, 2023

Glassnode experts noted the growing popularity of stETH relative to ETH, whose demand is stagnating.

The shift is driven primarily by the appeal of stETH for building leverage relative to providing liquidity in the stETH-ETH pairs on DEXs.

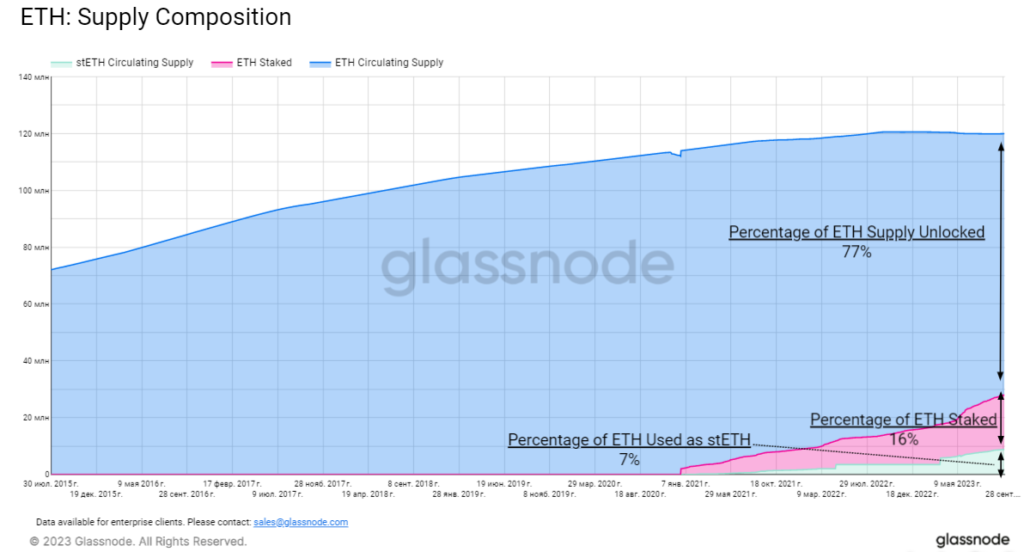

As a result, roughly 7% of Ethereum’s supply has effectively been replaced by the derivative fromLido Finance (23% of the second-largest by market cap’s issuance is locked in staking, 32% of this amount is allocated to the protocol). This figure continues to grow.

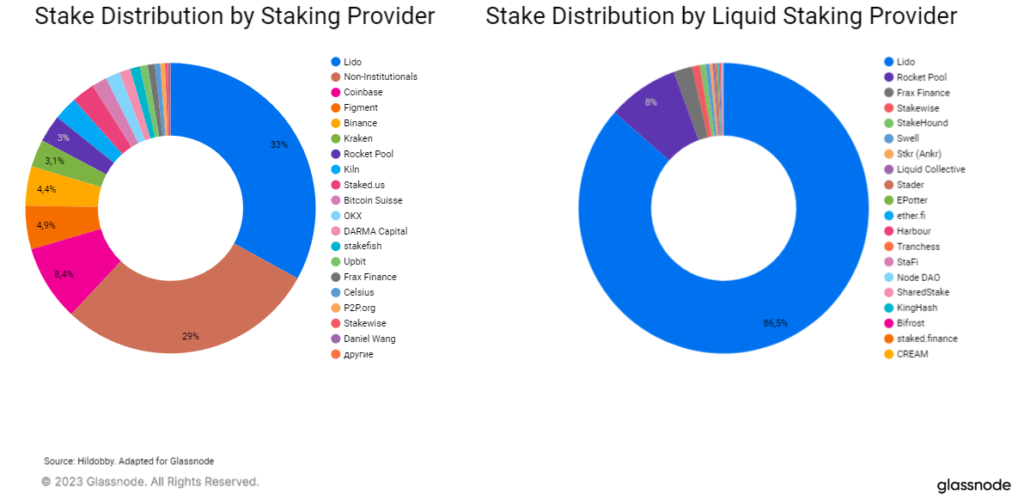

Lido Finance accounts for 32% of all ETH staked. Its share among LSD providers reached 86.5%.

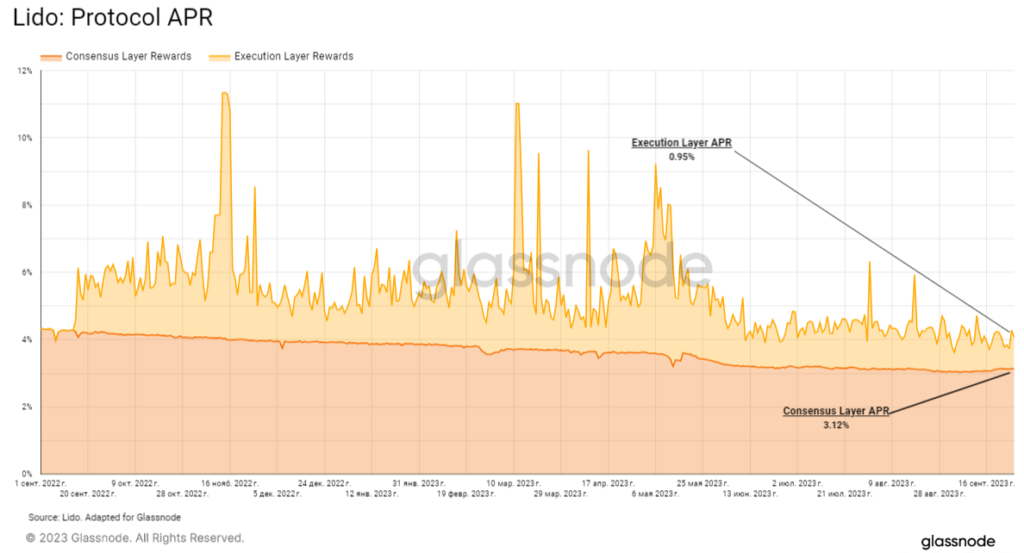

At the time of writing, the project’s APR stood at 4.07%, and Lido’s fee at 10%. 28.8% of the total staking rewards of the second-largest cryptocurrency by market capitalization in ETH go to stETH holders, with 1.6% to the node operators and the project’s treasury (together 32% — Lido’s share).

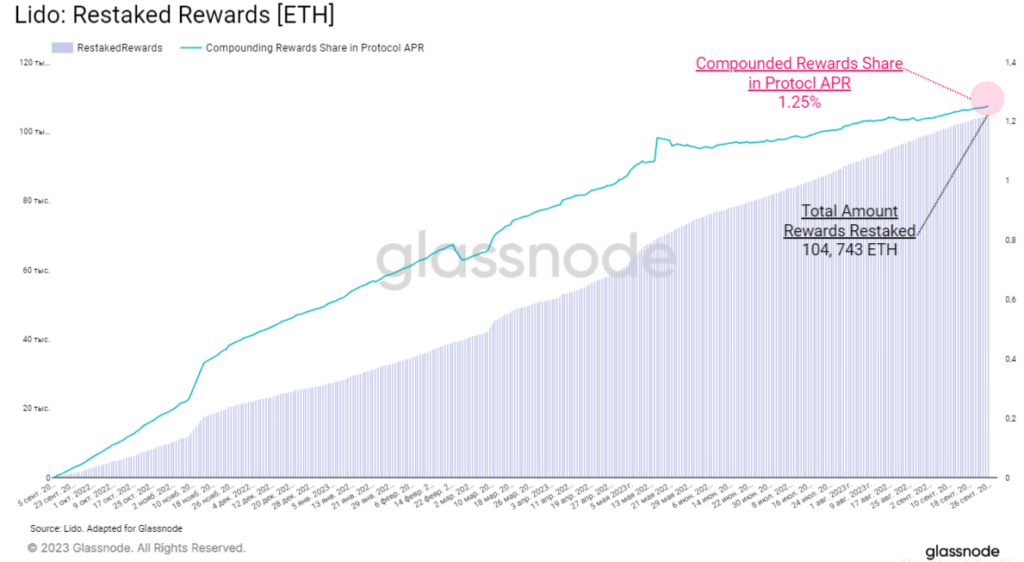

Lido also adds 0.95 percentage points to the APR on top of the already mentioned 3.12% from staking, through MEV earned by validators and priority fees. The 104,743 ETH earned from this activity was reinvested by the protocol, raising this additional yield for stETH holders to 1.25%.

Holders of stETH receive automatic balance updates based on the rewards owed to them, making the asset a yield-bearing version of ETH. Given this property, the community has formed the view that the token could ‘replace ETH as Ethereum’s reserve currency’.

Analysts tested this hypothesis using the dynamics of addresses holding WETH and stETH. They found that after the Terra collapse in May 2022 the number of wallets with WETH+ETH declined by 5%. Over the same period, the metric for a stETH+wstETH rose by 142%.

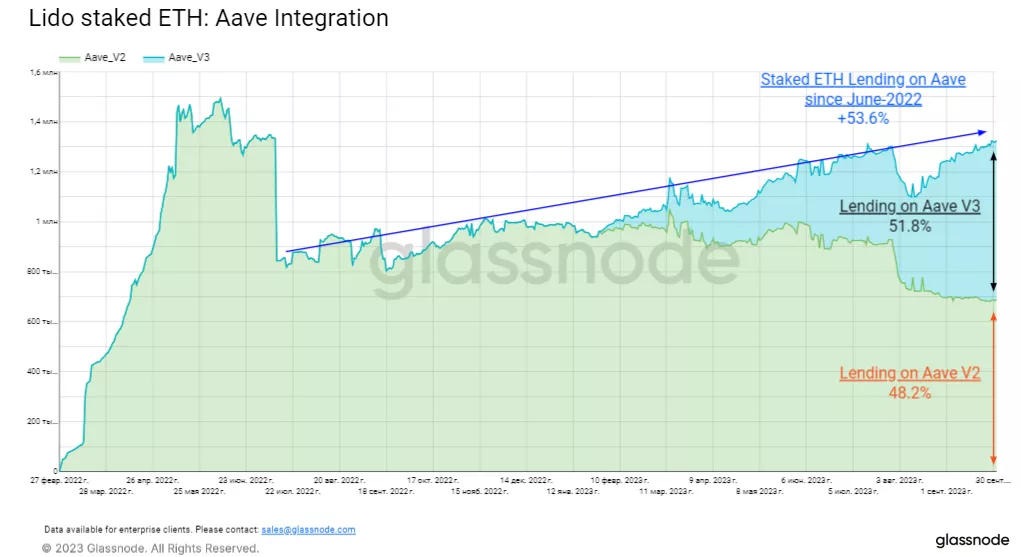

Analysts noted that a similar trend appears in the volume of on-chain value transferred. In 2022, for ETH+WETH the metric ranged from $6 billion to $10 billion. In 2023 it began to cluster near its lower bound.

The stETH metric reached a peak volume in spring 2022 and remained relatively stable through the year. In 2023 it regained momentum, jumping from $127 million to $450-880 million.

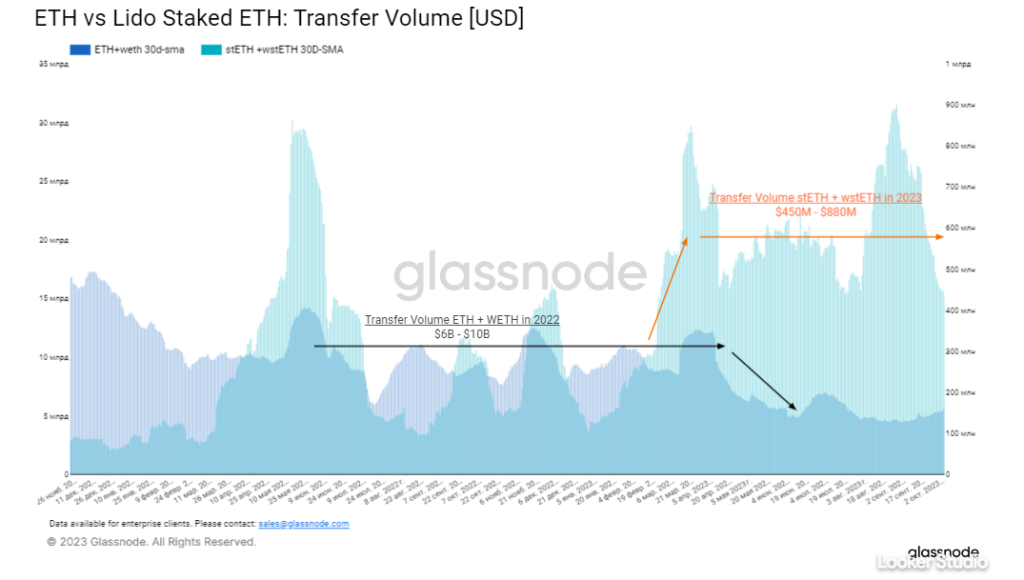

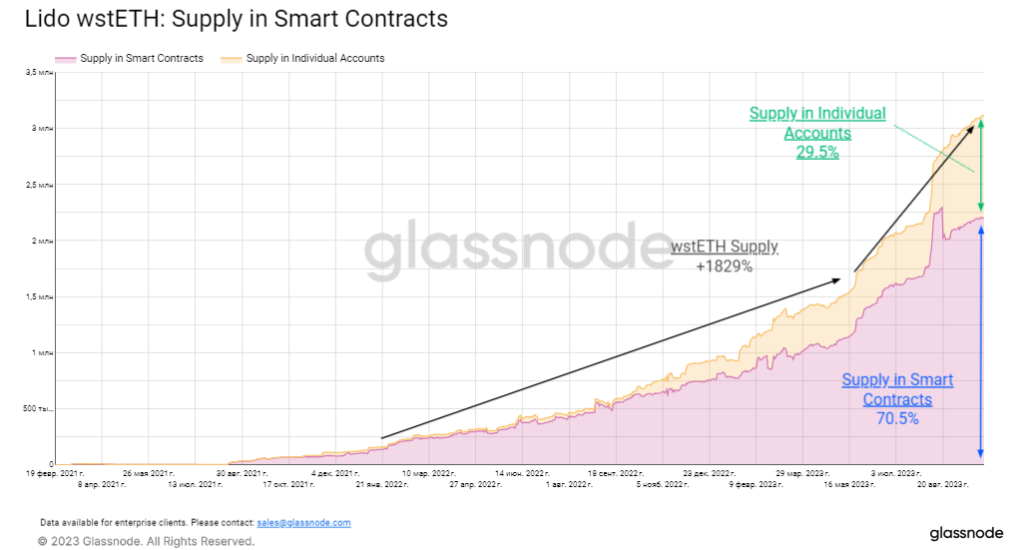

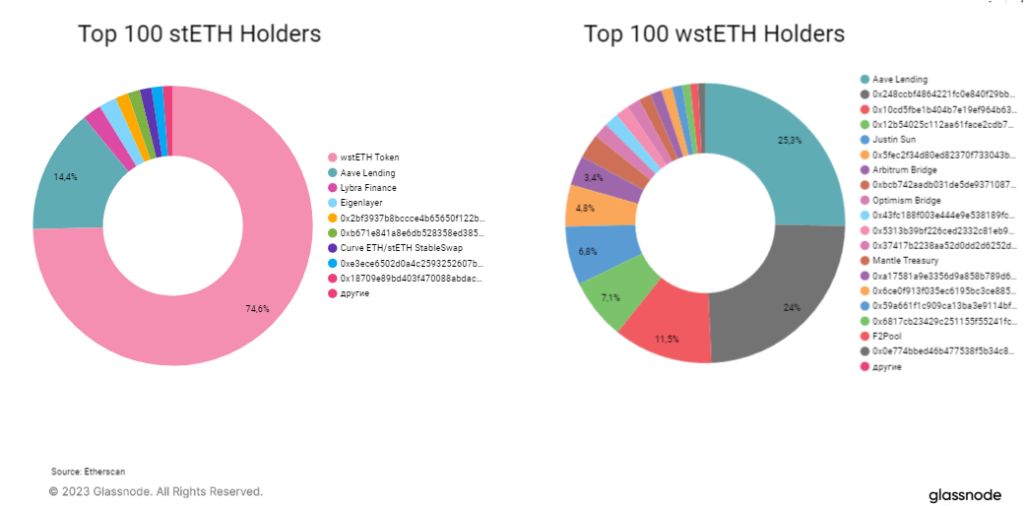

Analysts have noted increasing use of stETH in DeFi. Since early 2022 there has been a significant rise in the supply of wstETH (by 3 million), signaling growing user preference for the token over stETH.

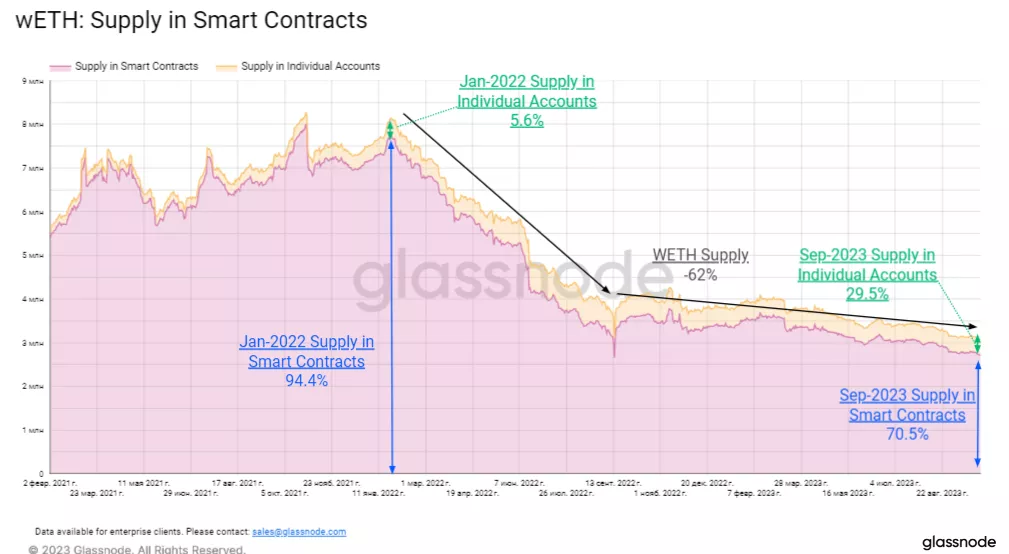

According to experts, only 70.5% of wstETH is locked in smart contracts.

Analysts attributed the large asset holdings on wallets to efforts to reduce the taxable base. Automatic balance updates for stETH are considered taxable income—users may prefer the wrapped version, whose value increases, rather than the number of tokens, they explained.

By contrast, the supply of wETH over the same period declined by 62%. The waning interest in the asset coincided with reduced use in smart contracts.

wstETH has replaced 74% of the stETH supply. The token found its greatest use in Aave (14.4% of stETH and 25.3% of wstETH), DEX attracted a small share. Curve accounts for only 1.4% of stETH, and other platforms even less.

Such a low figure is a ‘worrying’ factor from a liquidity perspective, as stETH and wstETH are traded predominantly on DEXs, the experts noted.

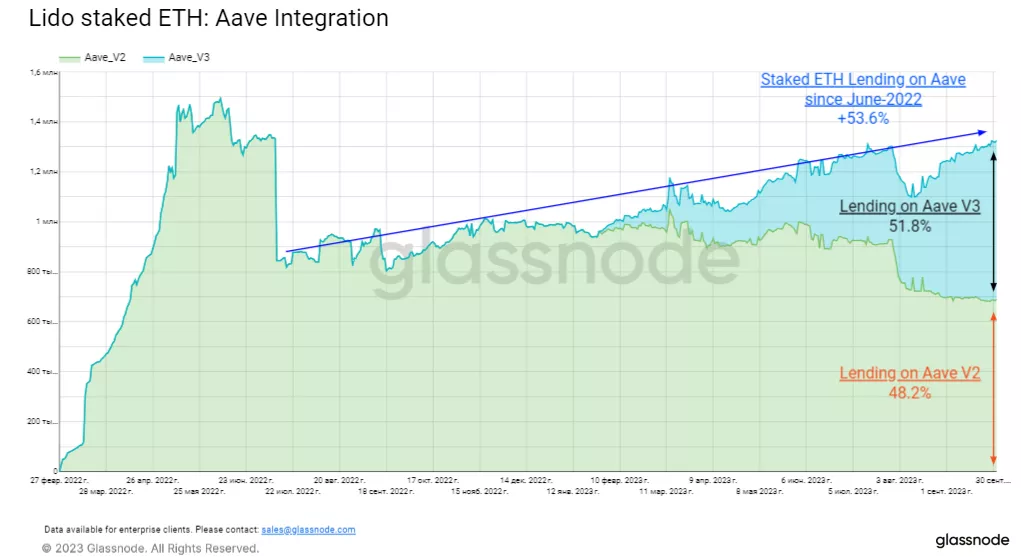

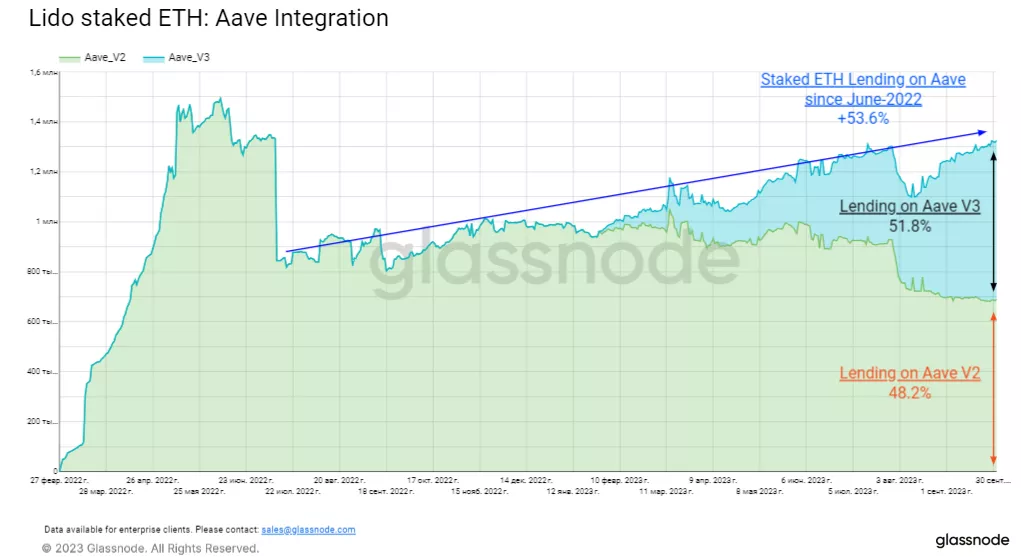

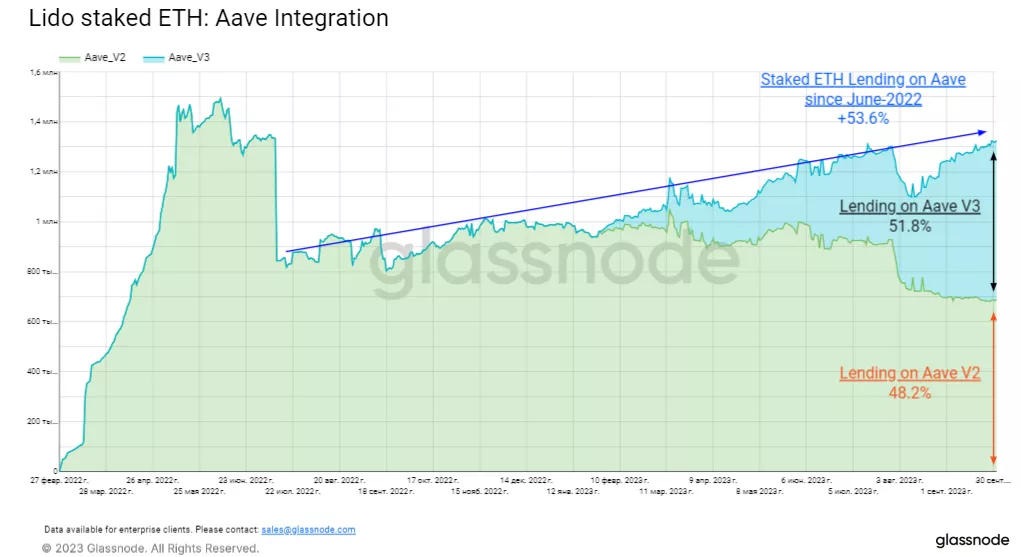

Presented below are charts showing that reserves of three Curve pools with stETH have collapsed by 90.2% since May 2022. Over the same period, the metric for Aave rose by 53.6% (stETH distributed roughly evenly between v2 and v3).

The transition is likely driven by the fact that leveraged stETH positions offer more attractive yields than providing liquidity on DEXs, the experts explained.

In August, Lido reported growth in TVL and ‘impressive’ deployment of the project.

Earlier, the developers launched the second version of the protocol. It introduced a staking router (Staking Router), intended to diversify the validator set and foster further decentralization.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!