Bitcoin climbs back above $87,000

On April 21, the price of the leading cryptocurrency rose above $87,000. The digital gold tested similar levels earlier this month.

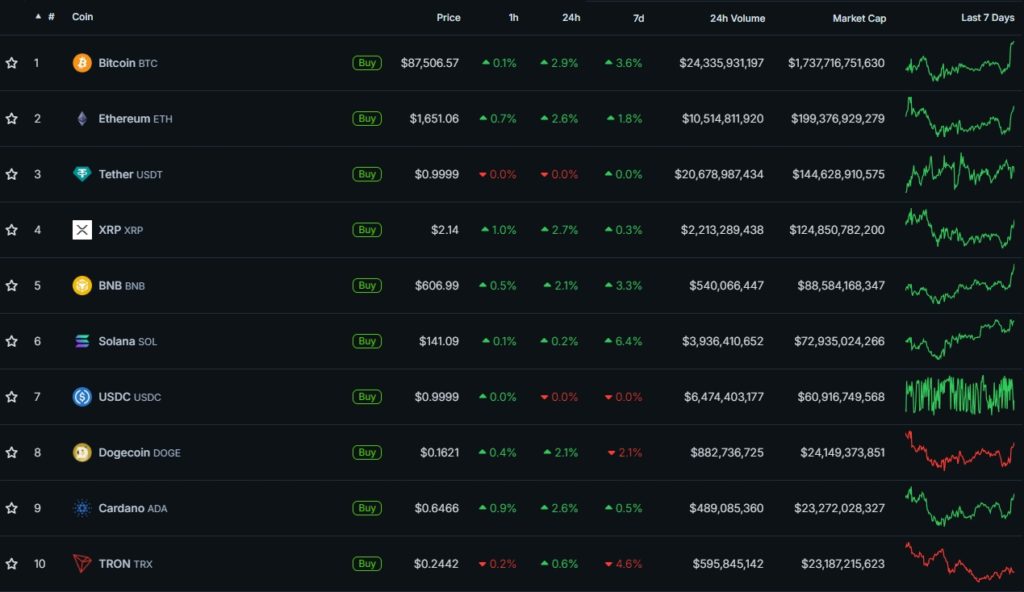

Over the past 24 hours bitcoin gained nearly 3% and is trading near $87,500. Top-10 altcoins by market capitalisation broadly followed the move. The exceptions were Solana (+0.2%) and TRON (+0.6%).

The crypto market’s capitalisation rose by just 0.5% to $2.85trn. Bitcoin’s dominance stood at 61%.

The move by the leading cryptocurrency coincided with gold hitting a new high of $3,389 per troy ounce. Futures on major US stock indices extended their slide.

Futures are extending losses to a new low of the day.

This is what happens when the entire market rallies on hopes of a “Japan deal.”

S&P 500 futures are down -250 points in under 5 trading days. pic.twitter.com/fMwffLubxX

— The Kobeissi Letter (@KobeissiLetter) April 21, 2025

This came against the backdrop of an intensifying US–China trade war, noted The Kobeissi Letter. China’s Ministry of Commerce warned of countermeasures against countries cooperating with the United States against Beijing’s interests.

“China firmly opposes any party that reaches an agreement at the expense of its interests. If this happens, China will not accept it and will respond resolutely with countermeasures,” the ministry said.

The outlet argues that the rise in gold and bitcoin signals a weakening dollar and mounting uncertainty.

“Bitcoin’s break above $87,000 is driven by rising global liquidity, linked to the expansion of the money supply and the renewed institutional interest, underscored by [Strategy] signals of further increasing its holdings and a reduction in available supply,” Kronos Research analyst Dominic John told The Block.

According to MacroMicro, the combined M2 aggregate of the four largest central banks (the US, Japan, the EU and China) has been rising steadily since December 2024, reaching $90.2trn in February.

Michael Saylor’s company Strategy on April 13 reported the purchase of 3,459 BTC at an average price of $82,618. The firm’s bitcoin reserves rose to 531,644 BTC.

At the same time, Strategy recorded an unrealised loss of $5.91bn for the first quarter, caused by the drop in the price of digital gold.

Are bitcoin whales positioning for another rally?

Peter Chang, head of research at Presto Research, says it is too soon to claim that bitcoin is back on a growth trajectory. In his view, macroeconomic uncertainty persists amid ongoing US negotiations with key trading partners.

Even so, he noted the cryptocurrency’s resilience — in April digital gold proved more robust than the main US equity indices.

According to Glassnode, the number of wallets holding more than 1,000 BTC has surged in recent months, from 2,037 at end-February to a four-month high of 2,107 as of April 15. Whale addresses have returned to levels seen in November–December 2024, when the market was rising after Donald Trump was elected US president.

The number of wallets with 100 BTC or more has also increased since the start of the year, reaching 18,026, Glassnode data show. However, the number of holders with balances below 10 BTC has fallen in recent months.

Whales are accumulating massive amounts of Bitcoin.

They know what comes next. pic.twitter.com/wDIaBapOoZ

— Mister Crypto (@misterrcrypto) April 20, 2025

“Whales are accumulating massive amounts of bitcoins. They know what comes next,” said a trader under the nickname Mister Crypto.

Santiment analysts noted that wallets holding from 10 BTC to 10,000 BTC now control 67.77% of the available supply of digital gold. During April’s volatility alone, these addresses added 53,600 BTC.

?? Bitcoin’s key stakeholders comprised of wallets holding between 10 & 10K BTC currently hold 67.77% of the entire supply of crypto’s top market cap asset. During the April volatility, these wallets continue to accumulate, and have now added over 53.6K BTC since March 22nd. ? pic.twitter.com/eCalVW0FQf

— Santiment (@santimentfeed) April 19, 2025

In mid-April, bitcoin call options at $100,000 became the most popular position on the Deribit platform, with total open interest of nearly $1.2bn.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!