Bitcoin Funds Lose Ground as Ethereum Products Gain Strength

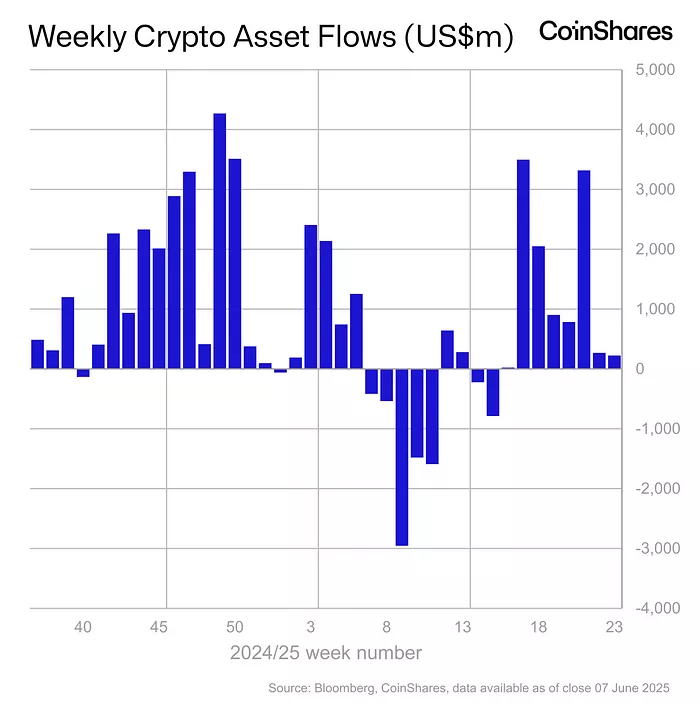

From May 31 to June 6, inflows into cryptocurrency investment funds totaled $224 million: while inflows are slowing, Ethereum maintains a positive trend. This is according to a report by CoinShares.

In the previous reporting period, the figure was $321 million. Over a seven-week series, the total inflow reached $11 billion.

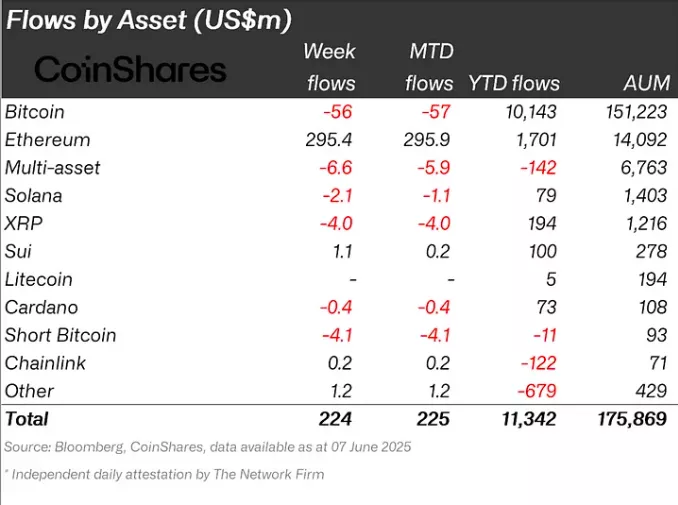

In the past week, the primary beneficiary of growth was the second-largest cryptocurrency by market capitalization, with crypto funds based on it receiving $295.4 million. Meanwhile, investors withdrew $56 million from bitcoin-based instruments.

In the segment of US spot bitcoin ETFs, negative dynamics continued for the second consecutive week.

Amid the weakening position of digital gold, Ethereum now accounts for 10.5% of the total assets under management in cryptocurrency investment funds, which amounts to $175 billion.

Activity in altcoins remains subdued: over seven days, funds based on Solana and XRP lost $2.1 million and $4 million, respectively.

Products on Sui showed an inflow of $1.1 million, while those on Chainlink saw $0.2 million.

“Amid uncertainty regarding monetary policy, there is a noticeable slowdown, and investors have taken a cautious stance awaiting further signals from the US Federal Reserve on inflation,” explained CoinShares regarding the overall decline in activity.

Earlier, Derive founder Nick Forster reported expectations of a “healthy” pause in digital gold’s price dynamics before the bull run resumes.

Bernstein identified institutional buying as one of the five key factors for the continued growth of bitcoin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!