Ethereum Funds See Weekly Inflow Surge to $321.4 Million

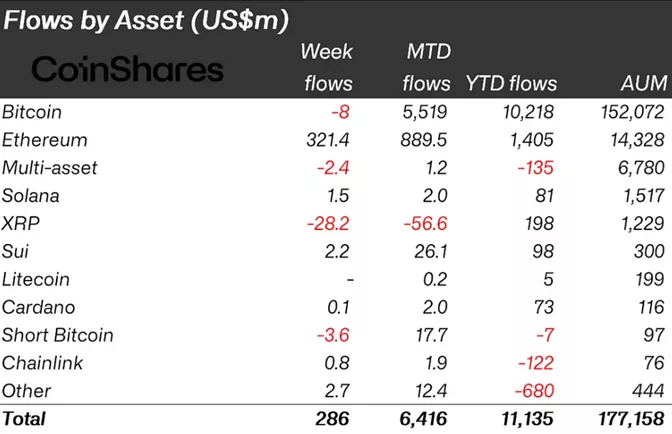

Between May 24 and May 30, cryptocurrency investment funds saw inflows of $286 million, driven by $321.4 million into Ethereum-based instruments, according to a report by CoinShares.

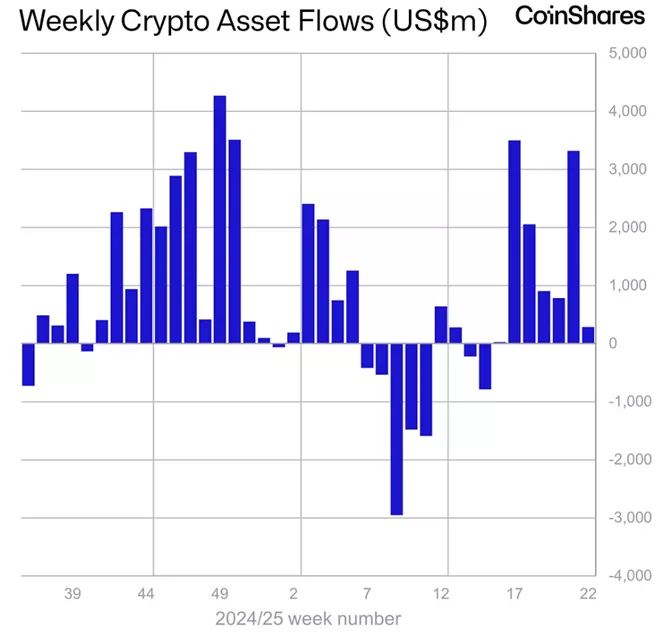

In the previous reporting period, the total figure stood at $3.29 billion. This positive trend has continued for the seventh consecutive week.

The cumulative inflow since the beginning of the year has risen to a record $11.14 billion.

AUM fell to $177.2 billion.

In Ethereum funds, inflows slowed from $326 million to $321.4 million. Over the past six weeks, the figure reached a record $1.19 billion, the highest since December 2024. The successful Pectra update remains a driving force.

Optimism also prevailed in other altcoins, with the exception of XRP-based products, from which investors withdrew $28.2 million.

Funds based on Solana and Sui attracted $1.5 million and $2.2 million, respectively.

Instruments based on the first cryptocurrency saw inflows halt — clients withdrew $8 million, although the previous week they had added $2.98 billion.

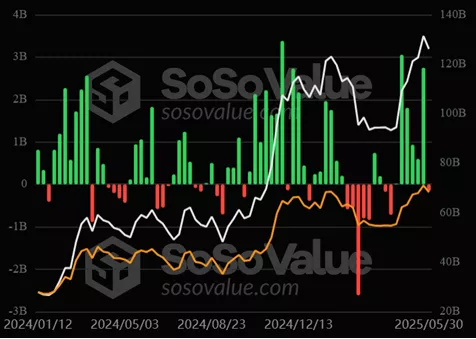

In the segment of US spot Bitcoin ETFs, outflows amounted to $157.4 million. In the previous reporting period, investors had added $2.75 billion to these products.

Earlier, Coinbase predicted a positive impact on the crypto market dynamics from the $5 billion reimbursement to FTX creditors.

Previously, Derive founder Nick Forster indicated expectations of a “healthy” pause in digital gold price dynamics before the bull run resumes.

Before that, Bernstein identified institutional purchases as one of the five key factors for the continued growth of Bitcoin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!