Bitcoin Miner from Satoshi Era Awakens After 15 Years

Bitcoin miner dormant for 15 years becomes active, moving $4.33M in BTC.

On December 2, a Bitcoin miner dormant for 15 years became active, noted analysts at Onchain Lens.

A Satoshi-era miner wallet moved 50 $BTC, worth $4.33M, into 5 new wallets after being dormant for over 15 years.https://t.co/2YskrD2yhJ pic.twitter.com/UN5W8Ptqps

— Onchain Lens (@OnchainLens) December 2, 2025

The miner transferred 50 BTC, valued at $4.3 million, to five new addresses. These assets were received as a reward for successfully mining a block in March 2010, when Bitcoin was worth less than $1.

Currently, the reward for block validation in the network is 3.125 BTC, a figure that halves every four years through halvings. In the next scheduled event in 2028, this will decrease to 1.5625 BTC.

Previously, MARA CEO Fred Thiel stated that mining economics will become unsustainable for many unless transaction fees or Bitcoin prices increase.

Miners have already faced the most severe crisis in history. Amid this, many companies are actively shifting towards artificial intelligence infrastructure.

Concerning Activity

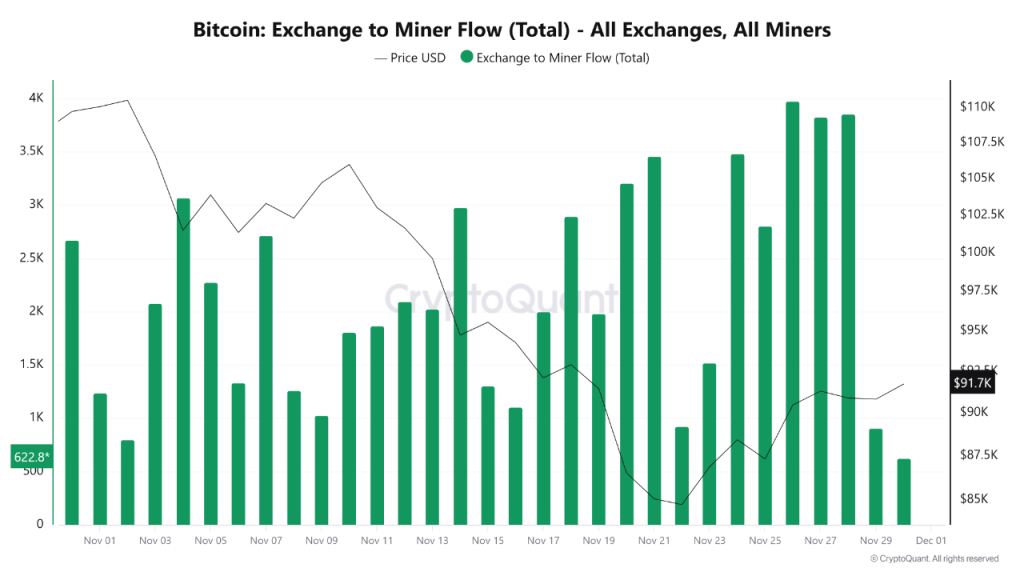

Experts at Arab Chain also noted that in November, cryptocurrency miners moved over 220,000 BTC to Binance. In October, the figure was 186,000 BTC.

Traditionally, large deposits to exchanges are seen as preparation for sale, which worries the market due to potential negative pressure on asset prices.

However, in the current context, experts noted nuances. According to them, for many professional miners, Binance has become a “hub for comprehensive risk and capital management.”

Besides potential coin sales, specialists considered other scenarios, such as earning additional income by providing liquidity on the platform.

In October, analysts at OnChainSchool noted that in less than a year, whales moved over 270,000 BTC, inactive for more than seven years. They have been repeatedly accused of exerting negative pressure on digital gold prices.

Ethereum Whales Join the Fray

In late November, large holders of the second-largest cryptocurrency by market cap, who acquired coins during the project’s ICO, also became active. On the 30th, a wallet dormant for 10 years transferred 5 ETH (~$15,000) to a new address.

During the initial coin offering, the holder invested $12,400, receiving $40,000. Currently, his assets are valued at $119.5 million, yielding a return of 963,900%.

An Ethereum ICO wallet (0x2dCA) with 40,000 $ETH($119.5M) just transferred 5 $ETH($15K) to a new wallet after 10+ years of dormancy.

He invested only $12.4K in the ICO and received 40,000 $ETH — now worth $119.5M, a 9,639x return!https://t.co/UOv2iuHnSy pic.twitter.com/CfgodjKKyQ

— Lookonchain (@lookonchain) November 30, 2025

On December 1, the whale staked all assets held in his wallet, experts noted.

Another Ethereum holder, who accumulated 254,908 ETH (~$757 million) during the ICO, began selling assets.

Initially, he sold 20,000 ETH (~$58 million), and on December 2, another 3,000 ETH (~$8.4 million).

Ethereum ICO participant “0x2eb0” just sold another 3,000 $ETH($8.4M).https://t.co/ZzrpFxJziN pic.twitter.com/4X7ljR5lqb

— Lookonchain (@lookonchain) December 2, 2025

Another “ancient” whale with 154,076 ETH (~$79 million) transferred 18,000 ETH (~$54 million) to the Bitstamp exchange.

An Ethereum OG just deposited another 18,000 $ETH($54.78M) into #Bitstamp 8 hours ago.

Since 2017, this OG accumulated 154,076 $ETH($79.7M) at $517 avg, then sold 87,824 $ETH($148.8M) at $1,694 avg.

He still holds 66,252 $ETH($201M) — with total profits of ~$270M.… pic.twitter.com/cSO2BE7Csj

— Lookonchain (@lookonchain) November 29, 2025

Currently, Ethereum is trading nearly 43% below its all-time high, reached in August this year at $4946. At the time of writing, the asset’s price is ~$2800.

Earlier in November, major investors acquired the second-largest cryptocurrency by market cap for over $360 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!