Bitcoin Mining Faces Unprecedented Profitability Crisis, Experts Say

Bitcoin miners face unprecedented profitability challenges, experts report.

Bitcoin miners are experiencing the toughest profitability conditions in history, according to TheMinerMag.

Industry experts noted in a weekly review that the third quarter began with a hash price of approximately $55 per PH/s per day. Following a sharp correction in Bitcoin in November, this mining profitability metric fell to a “structural minimum” of $35 per PH/s.

“At this level, the stress from declining profitability is no longer theoretical but systemic,” analysts stated.

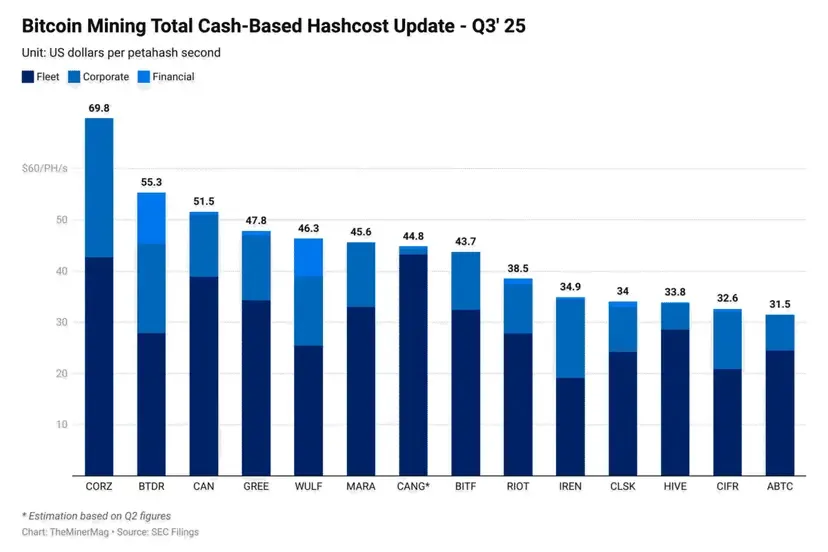

According to financial reports from major public miners, the median “cost of hash” is about $44 per PH/s. This figure includes operational costs for equipment, corporate expenses, and financing maintenance. It indicates that even operators with efficient setups and competitive electricity rates are teetering on the brink of unprofitability.

The payback period for the latest generation of installations has already exceeded 1,000 days—significantly more than the roughly 850 days remaining until the next halving. This programmed event will reduce the block reward from the current 3.125 BTC to 1.5625 BTC.

Companies are responding to the situation with measures to improve their balance sheets, experts noted. CleanSpark decided to fully repay a Bitcoin-backed credit line from Coinbase just weeks after raising over $1 billion through convertible bond issuance. This move illustrates how quickly miners are shifting to reduce debt and preserve liquidity.

The third quarter’s financing dynamics confirm this picture. Industry companies raised about $3.5 billion through convertible bonds with nearly zero coupons. An additional $1.4 billion came in the form of equity capital.

At the start of the fourth quarter, the situation changed. Miners began raising funds through more expensive senior secured bonds with yields around 7%. Cipher Mining and Terawulf alone raised nearly $5 billion for AI service expansion. This trend suggests the period could set a record for industry borrowing.

“This raises an uncomfortable question: can revenues from high-performance computing and AI scale quickly enough to offset both the hash price collapse and increased debt? Preliminary data shows growth, but not enough for the sector to endure several quarters of stagnation in the mining economy. For now, everything points to one thing: the industry is entering a phase of restructuring,” analysts concluded.

CryptoSlate calculated that as of early November, seven out of the ten largest miners by hash rate reported income from AI or high-performance computing activities. The remaining three plan to follow suit.

Bitfarms announced a gradual shutdown of Bitcoin mining operations by 2027, shifting focus to AI infrastructure development.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!