Bitcoin Spot ETF Inflows Continue for Fourth Consecutive Day

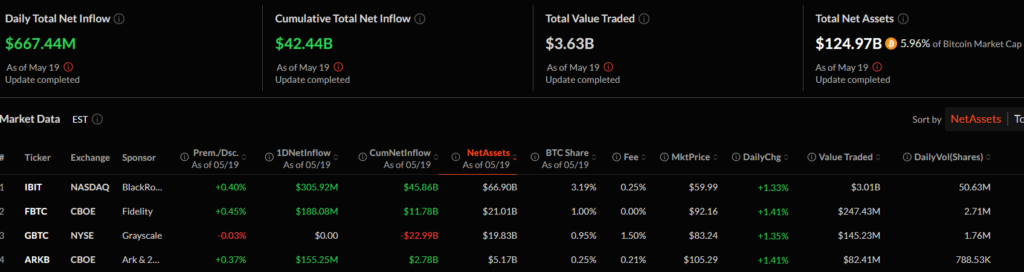

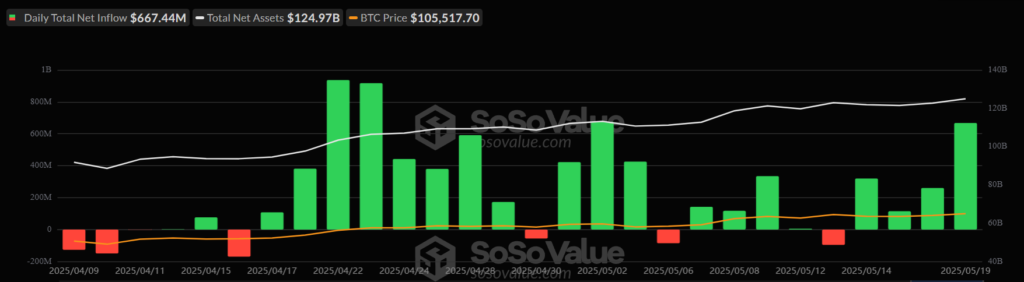

Amidst a market revival on May 19, net inflows into spot exchange-traded products (ETFs) based on the leading cryptocurrency amounted to $667.44 million, according to SoSoValue.

The cumulative figure has surpassed $42 billion. The total assets under management of spot ETFs amount to approximately $125 billion (5.96% of Bitcoin’s market capitalization).

This positive trend continued for the fourth consecutive day:

The largest daily inflows were recorded in:

- IBIT by BlackRock — $305.9 million;

- FBTC by Fidelity — $188 million;

- ARKB (ARK 21Shares Bitcoin ETF) — $155 million.

Outflows ($5.27 million) were noted only for one product — BTCO by Invesco.

Ethereum

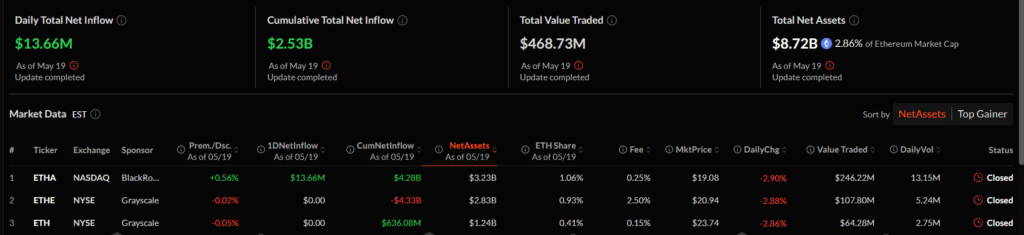

Net inflows into spot exchange-traded products based on Ethereum for May 19 amounted to $13.66 million.

The entire amount was attributed to ETHA by BlackRock. No net outflows were recorded.

The total assets under management by providers of spot Ethereum ETFs amount to $8.72 billion (2.86% of Ethereum’s total capitalization).

In the past 24 hours, Bitcoin rose by 2.9%, nearing the $106,000 mark. Ethereum appreciated by 6.8%, according to CoinGecko.

Earlier, Bitwise’s investment chief Matt Hougan predicted record inflows into digital gold-based ETFs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!