Bitcoin Spot ETFs Witness Largest Inflows Since Trump’s Inauguration

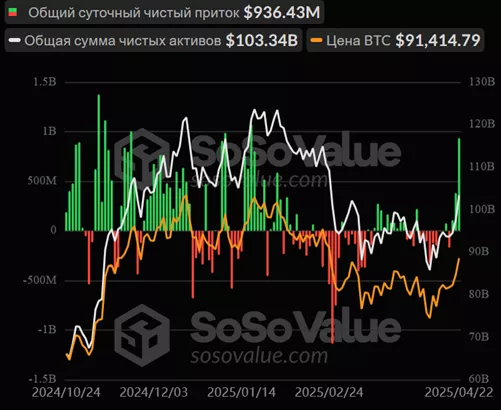

On April 22, investors funneled $936.4 million into spot ETFs based on digital gold, marking the highest level since January 21. The previous day saw inflows of $381.4 million.

The cumulative inflow increased to $36.69 billion. AUM reached $103.34 billion.

On April 22, the positive trend was significantly influenced by:

- ARKB from ARK Invest & 21 Shares — $267.1 million;

- FBTC from Fidelity — $253.8 million;

- IBIT from BlackRock — $252.9 million.

Improved sentiment was aided by a shift in rhetoric from U.S. President Donald Trump regarding tariffs on Chinese imports and the retention of Jerome Powell as head of the Fed.

In a conversation with CoinDesk, Nexo analyst Ilya Kalchev saw the rise in Bitcoin as “a market rethinking of the concept of safety.”

“The first cryptocurrency is no longer traded in the shadow of technology — it is becoming a lens through which macroeconomic uncertainty is assessed,” he added.

Nansen CEO Alex Svanevik noted that over the past two weeks, Bitcoin has become less like Nasdaq and more like gold. The first cryptocurrency increasingly serves as a safe-haven asset against economic upheavals, although concerns about an economic downturn may limit its price trajectory, the expert explained.

Previously, BitMEX co-founder Arthur Hayes predicted a rise in the value of digital gold above $100,000 due to the U.S. Treasury’s buyback of government bonds.

According to Standard Chartered, Bitcoin will continue to appreciate if threats to the Fed’s independence persist.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!