Bitcoin Surges Past $81,000 Amid Trump’s Tariff Pause

The price of digital gold soared above $81,000 following U.S. President Donald Trump’s announcement of a temporary reduction in tariffs for several countries while increasing tariffs on Chinese imports.

On April 2, Trump announced new rates for trading partners. A minimum of 10% for all countries took effect on April 5.

Specifically, from April 9, the rates were increased for:

- Malaysia — 24%;

- Thailand — 36%;

- Indonesia — 32%;

- Taiwan — 32%;

- while for China, the final figure reached 104%.

The new arrangement includes a 90-day period during which reduced tariffs of 10% apply to countries that “have not taken any retaliatory measures against the U.S.”

Simultaneously, Trump announced that new tariffs for China would increase from 104% to 125% immediately. The president justified this by citing a “lack of respect for global markets.”

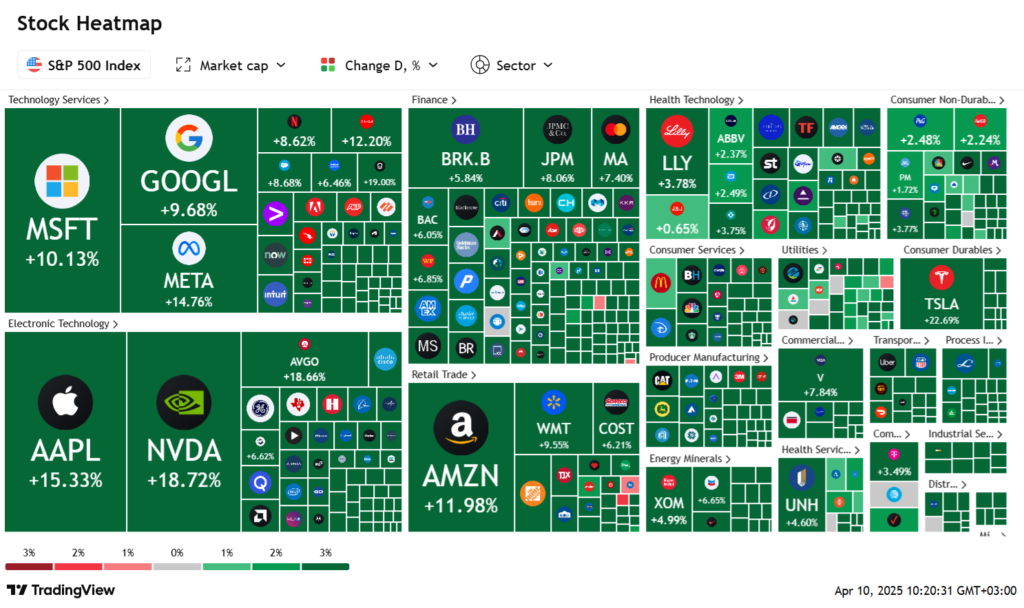

The TradFi sector reacted positively to the news.

The European market also showed significant activity, while the Chinese yuan lost ground.

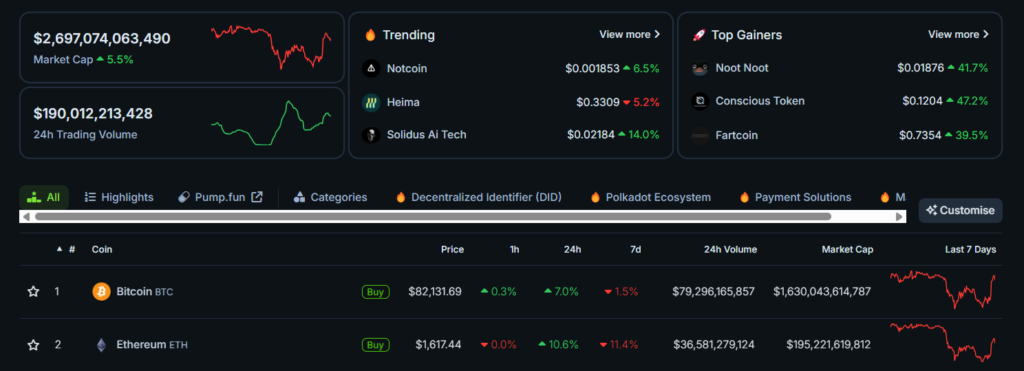

At the time of writing, Bitcoin had risen to $82,131 (+7% in 24 hours), Ethereum to $1,617 (+10.6%), and the total market capitalization exceeded $2.6 trillion (+5.5%), according to CoinGecko.

Google Finance metrics showed similar price movements in U.S. markets. Following Trump’s post, the S&P 500 and NASDAQ indices rose by 9.52% and 12.16%, respectively.

According to CoinPanel analyst Kirill Kretov, the digital asset sector remains sensitive to macroeconomic events.

“If traditional markets react like meme coins, one cannot expect stability from Bitcoin right now,” he noted in a comment to The Block.

Trump’s decision coincided with the release of the March minutes of the Federal Reserve meeting. The document indicates that rising tariffs could exacerbate inflation and affect economic growth rates.

According to NPR, after a dinner with Nvidia CEO Jensen Huang, the president decided to suspend planned restrictions on the export of H20 chips to China.

The policy change is linked to the manufacturer’s commitment to increase investments in AI data processing centers in the U.S., insiders reported.

Back on April 8, Bitwise CIO Matt Hougan stated that U.S. tariffs and a weak dollar would strengthen Bitcoin.

On April 9, QCP Capital expressed doubts about Trump’s and the Federal Reserve’s readiness to support the markets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!