Bitcoin tests $30,000 support

On the evening of July 6, the price of the leading cryptocurrency fell to $29,920, breaching the $30,000 psychological support level.

The price decline occurred rapidly and was accompanied by a surge in trading volumes.

Bitcoin’s price rebounded slightly and is currently hovering around $30,400.

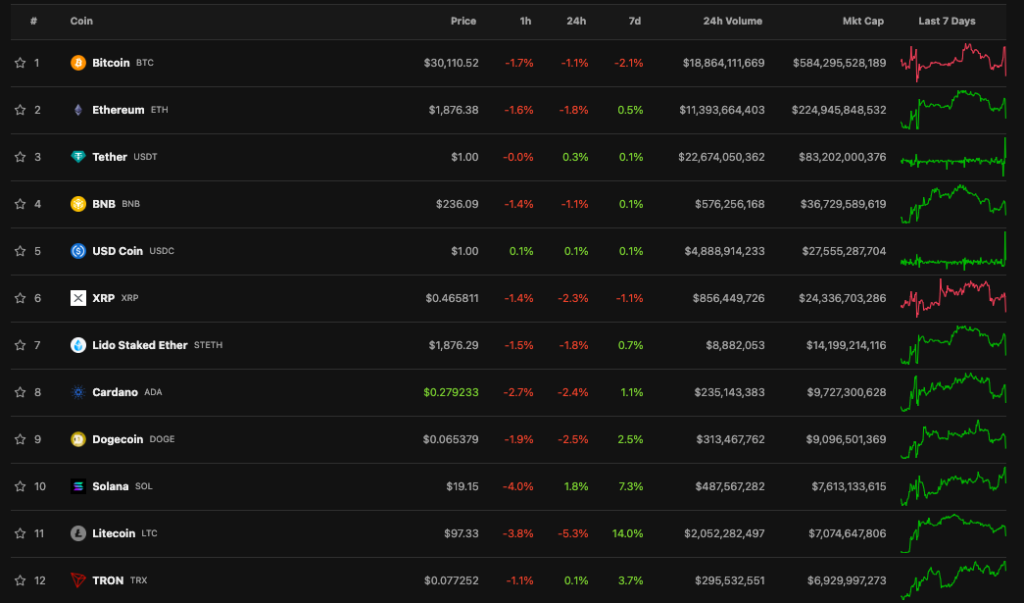

Following Bitcoin, almost all top-10 assets by market capitalization moved into the red.

Trader Michael van de Poppe said that markets are currently pricing in a rate hike in light of positive US employment data. In his view, if digital gold cannot recover to previous levels, the asset could fall further—to $28,500.

According to Reuters, in June the number of employees in the private sector rose by 497,000. Analysts had initially forecast a smaller rise — 228,000 jobs. This points to market resilience despite rising recession risks.

Earlier, ARK Invest said that the share of bitcoins that have not moved for more than a year reached a historic maximum of 70% of the coin’s total circulating supply.

Experts at Block Scholes also recorded a loss of correlation between Bitcoin and the US stock market — the 90-day moving average of the correlation coefficient has fallen nearly to zero.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!