Bitcoin’s Slide to $81,000 Triggers $1.7bn of Liquidations

Bitcoin slid below $83,000 as volumes surged, sparking $1.7bn in liquidations.

Bitcoin extended its correction; amid a surge in trading volumes, the price fell through $83,000.

At one point, it touched a local low near $81,100.

The sell-off coincides with a broader retreat from risk and cooling global markets, notably tech and precious metals.

Total crypto market capitalisation fell 5.6% on the day to $2.9trn, according to CoinGecko. It is among the largest daily drops since 10 October, when Donald Trump’s tariff threats wiped $0.5trn off the market.

The slide triggered a wave of liquidations — about $1.68bn of positions were forcibly closed over the past 24 hours. Longs bore the brunt.

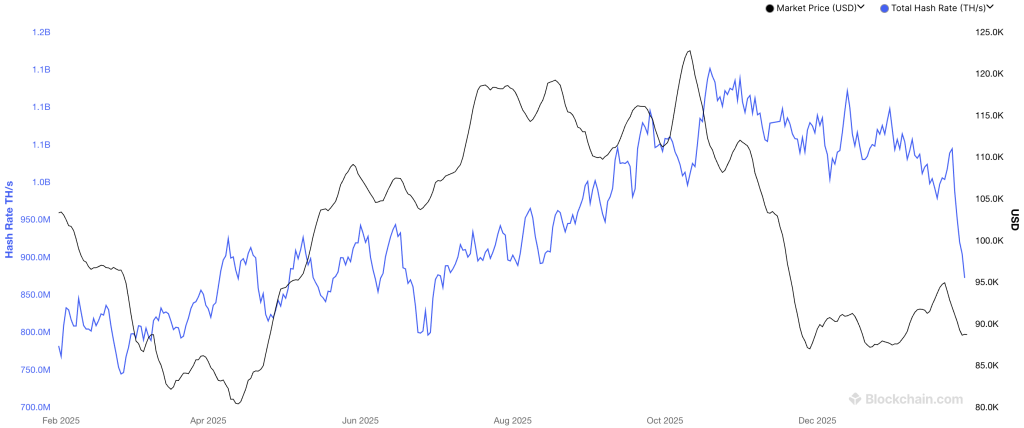

Amid the correction, the hashrate of digital gold saw its steepest drop since October 2021, according to Glassnode. The decline largely reflects widespread miner shutdowns in the US due to a winter storm.

Analysts also found that over the past 30 days long-term holders sold on average more than 12,000 BTC (~370,000 BTC a month).

Altcoin rout

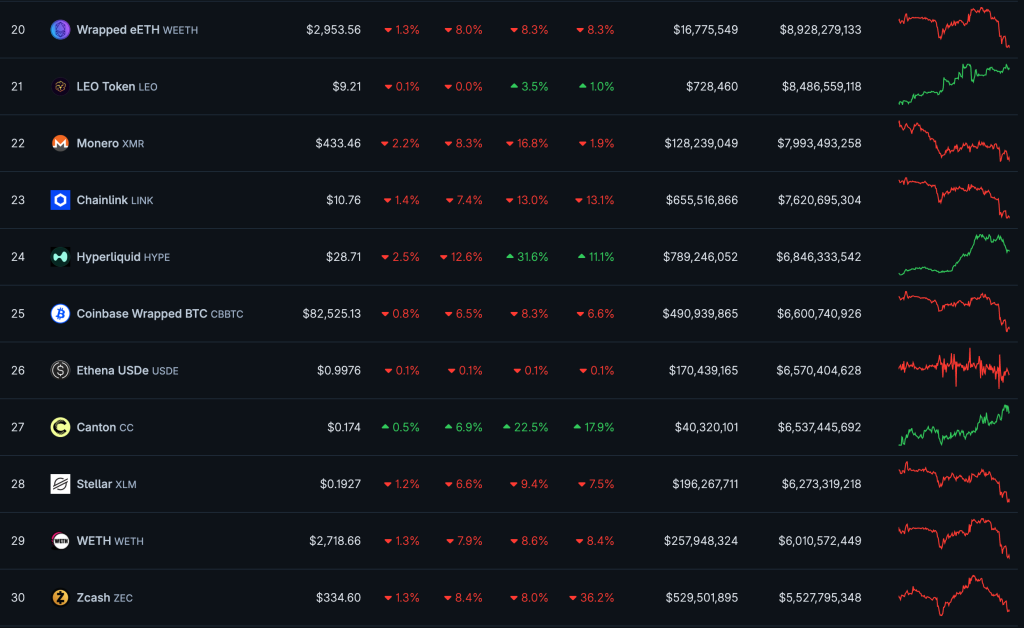

Ethereum slid to $2,700 (-6.7% on the day, according to CoinGecko). Solana hit a nine-month low around $115, while XRP fell to $1.75.

Weakness was evident even before the 29 January sell-off. Over the past week only two assets in the top 30 posted double-digit gains — HYPE by Hyperliquid and CC by Canton. Nearly all other large-cap tokens are in the red.

Tech and metals

Microsoft shares plunged 10%, marking their worst one-day performance since March 2020. That pressured the broader software sector.

Precious metals, which had been setting records in recent weeks, also turned lower alongside equities. Gold fell from about $5,500 to $5,150; silver tumbled from a record $121 to $108 an ounce in just an hour.

Shutdown threat

The sell-off is intensifying amid political risks in Washington. According to CNBC, lawmakers failed to advance a procedural vote on the budget. If the bill is not passed by the weekend, the US faces another government shutdown.

The previous shutdown lasted 43 days and coincided with a 15% drop in bitcoin.

Earlier, CryptoQuant analysts said the crypto market had entered an early bear phase.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!