Celsius Creditors Challenge Reorganisation, Coinbase’s $1.2bn Profit, and More Crypto Industry Highlights

We have compiled the most significant news from the crypto industry over the past two weeks.

- Media reports: Celsius creditors appeal the platform’s reorganisation plan.

- Coinbase’s net profit for January-March exceeded the entire 2023 figure by 12 times.

- Yuga Labs to focus on blockchain game development.

- Kraken partners with DLT Finance to expand in Germany.

- Tiger Brokers launches cryptocurrency trading in Hong Kong in partnership with Hashkey.

- 1inch introduces Fusion 2.0, enhancing swap efficiency.

Media Reports: Celsius Creditors Appeal Platform’s Reorganisation Plan

Celsius creditors are considering appealing the reorganisation plan of the bankrupt lending platform, as the recovery amount from assets was lower than expected. This is according to sources cited by The Block.

They claim the current version significantly reduces compensation for clients with credit accounts holding debts from the creditor’s assets. The publication notes that the appeal had to be filed within “14 days after the contested decision, order, or decree came into effect.” Meanwhile, it is possible that the court may approve changes to the plan, although the process of making these changes is likely to be complex.

In February 2024, it was revealed that Celsius will pay $3 billion to creditors under the approved reorganisation plan.

This decision was supported by 98% of account holders and confirmed by the Southern District of New York court.

Recipients will be able to count on assets in cryptocurrencies, fiat, and common shares of the new bitcoin mining company Ionic Digital.

The latter is expected to conduct an IPO after obtaining the necessary approvals. Over the next four years, Hut 8 will oversee Ionic’s operations under a management agreement.

On July 13, 2023, the US Department of Justice filed seven criminal charges against former Celsius head Alex Mashinsky. These include securities fraud, manipulation of the CEL token price, and misleading investors.

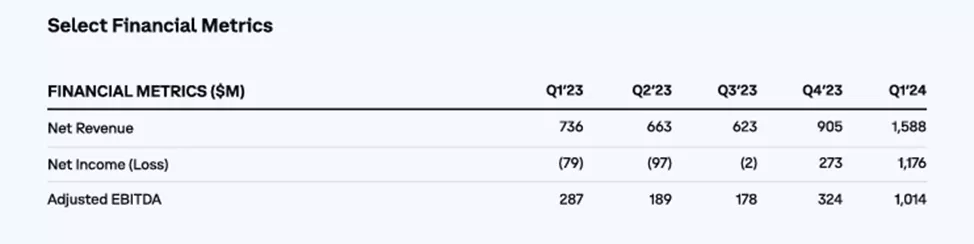

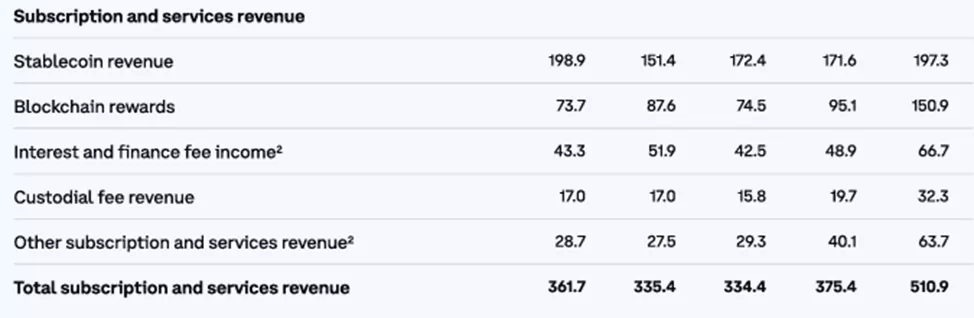

Coinbase’s Net Profit for January–March Exceeds Entire 2023 Figure by 12 Times

In the first quarter of 2024, bitcoin exchange Coinbase achieved a net profit of $1.18 billion with a net income of $1.59 billion. For comparison, the figure for the entire 2023 was $95 million.

By the end of the quarter, the platform had capital of $7.1 billion, including $1.1 billion from the sale of convertible bonds maturing in 2030.

Trading volume amounted to $56 billion, increasing by 93% over the reporting period, while Coinbase Prime reached $256 billion (+105%).

Retail client transaction revenue surged by 99% to $935 million, while institutional revenue rose by 133% to $85 million.

Coinbase showed a 64% increase in custodial service revenue ($32 million). This was made possible by improved market conditions and the launch of spot bitcoin ETFs. The exchange acts as a custodian for eight of the 11 exchange-traded funds.

In March, Coinbase’s chief legal officer Paul Grewal urged the SEC to approve an Ethereum ETF.

Yuga Labs to Focus on Developing Games for the Otherside Metaverse

The studio behind the Bored Ape Yacht Club NFT collection, Yuga Labs, announced a new wave of layoffs as part of business restructuring and a stronger focus on blockchain game development.

gm, really tough day today. I am hellbent on transforming yuga and getting us back to our roots, and that means making hard decisions. by far the hardest is saying goodbye to some talented team members. here was my message to the team this morning. pic.twitter.com/gBkoNf2iK3

— Garga.eth (Greg Solano) ? (@CryptoGarga) April 26, 2024

CEO Greg Solano stated that the organisation “lost its way” and will focus on creating a more compact crypto-native team.

Launched in spring 2022, the Otherside metaverse is a key focus for the studio. The team announced this back in October 2023, initiating the restructuring and staff reduction process.

Solano mentioned that he will soon reveal aspects of the plan for Otherside’s development.

Kraken Partners with DLT Finance to Expand in Germany

Bitcoin exchange Kraken agreed to collaborate with licensed platform DLT Finance to expand its product range for clients in Germany. The latter provides prime brokerage and cryptocurrency custody services.

In April, Kraken launched an open-source non-custodial wallet.

The firm joined the initiative alongside competitors. Previously, Binance and OKX also launched their own wallets.

In March, Kraken introduced a custodial service for its institutional platform.

Tiger Brokers Launches Cryptocurrency Trading in Hong Kong with Hashkey

Nasdaq-listed broker Tiger Brokers added 18 different cryptocurrencies to the list of available instruments for professional investors in Hong Kong. Previously, clients could invest in stocks, futures, US Treasury bonds, and bitcoin ETFs. The partner will be the local regulated platform HashKey.

The company plans to extend its services to retail investors, which requires regulatory approval. Tiger Brokers is also considering the possibility of depositing and withdrawing digital assets.

It was also reported that Wintermute is collaborating with OSL and HashKey — sub-custodians of Hong Kong ETFs. The market maker will handle the buying, selling, and delivery of bitcoins and Ethereum for exchange-traded funds.

In April, Bernstein described the slowdown in bitcoin instrument inflows as temporary. Later, BlackRock expressed a similar view.

1inch Introduces Fusion 2.0 with a Focus on Swap Efficiency

The 1inch DeFi project team has activated the second version of the major Fusion update. The technology allows orders to be processed 35% cheaper and 75% faster thanks to professional resolver traders.

Introducing #1inchFusion 2.0 ☯️ with up to 35% cheaper order settlements and 75% faster execution!

Enjoy our enhanced Dutch auction system with an adjusted market-based price curve: https://t.co/HNqxV5AVwN

Dive into details ?⬇️ pic.twitter.com/gOKdlC5Y6H

— 1inch Network (@1inch) May 9, 2024

1inch Fusion uses an intent-based approach, where users declare a goal, and experts execute it. It ensures no gas fees even after the order expires.

The solution allows users to exchange crypto assets across different networks without paying gas fees, while accessing liquidity across the crypto space and protection from MEV.

In April, 1inch Network introduced a Web3 debit card, created in partnership with Mastercard and Crypto Life.

Key DeFi Segment Metrics

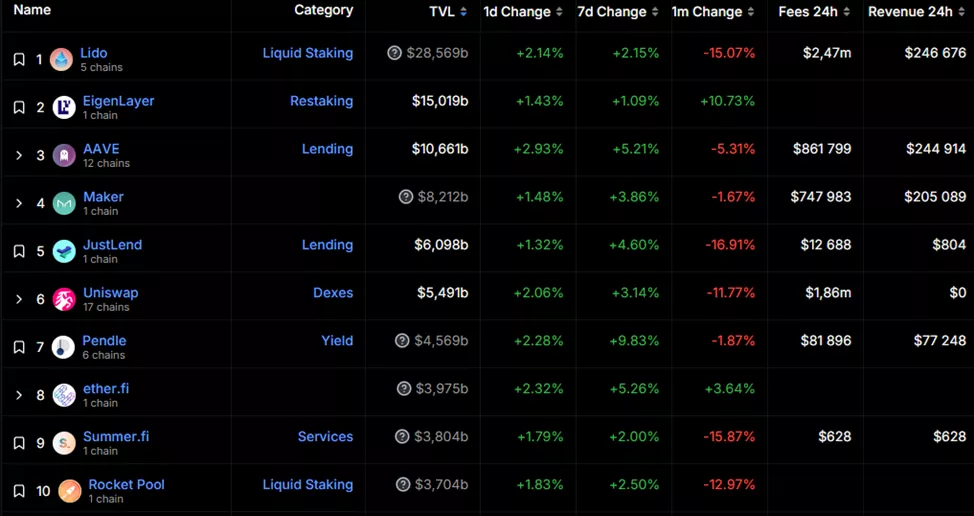

The total value locked (TVL) in DeFi protocols fell to $93.1 billion. Lido remains the leader with $28.6 billion. EigenLayer holds the second spot ($15 billion), while Aave retains third place ($10.7 billion).

TVL in Ethereum applications increased to $53.8 billion. Trading volume on decentralised exchanges (DEX) over the past 30 days plummeted to $132.1 billion. Uniswap continues to dominate, accounting for 56.3% of total turnover (two weeks ago — 50.8%). The second DEX by turnover, PancakeSwap, reduced its market share from 24.2% to 18.7%. Curve took third place (6%).

Also on ForkLog:

- WSJ: Binance ignored market manipulation by DWF Labs.

- SEC rejected Ripple’s $10 million fine proposal, demanding $2 billion.

- Grayscale withdrew its application to launch an Ethereum futures-based ETF.

- BitMEX launched options trading in collaboration with PowerTrade.

- FTX creditors criticised the exchange’s new compensation plan.

- Revolut launched a cryptocurrency exchange.

- Tether’s net profit in Q1 reached a record $4.5 billion.

- MicroStrategy acquired 122 BTC.

- Block committed to allocating 10% of profits to bitcoin purchases by year-end.

Weekend Reading Suggestions

On April 30, former Binance head Changpeng Zhao was sentenced to four months in prison, while experts anticipated a term of 10-16 months and supervision from one to three years.

CoinDesk explained the leniency due to the entrepreneur’s reputation and letters of support from friends, relatives, and colleagues. The verdict sparked heated debates in the industry. ForkLog provided details in a separate article.

The magazine also covered the situation surrounding the arrest of “Bitcoin Jesus” and Bitcoin.com founder Roger Ver on charges of tax fraud by the US Department of Justice.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!