Crypto Fund Inflows Reach Second Highest Level of the Year

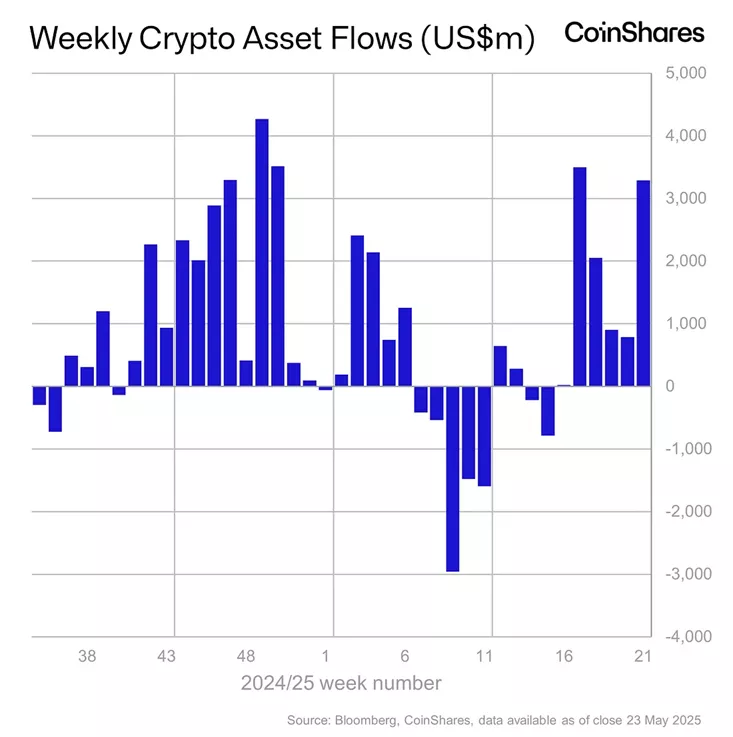

Between May 17 and 23, inflows into cryptocurrency investment funds amounted to $3.29 billion, compared to $785 million in the previous period, according to a report by CoinShares.

This positive trend has continued for the sixth consecutive week.

Total inflows since the beginning of the year have increased to a record $10.82 billion.

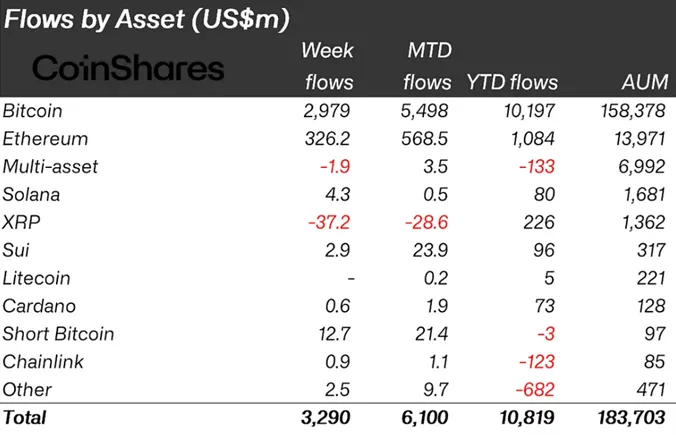

AUM rose to $183.7 billion (at its peak, the figure reached a historic high of $187.5 billion).

Analysts attributed the sustained growth to concerns about the US economy following Moody’s downgrade of the country’s sovereign rating. This led to a spike in US Treasuries yields and heightened interest in diversifying through digital assets.

Inflows into instruments based on the first cryptocurrency increased from $557 million to $2.98 billion.

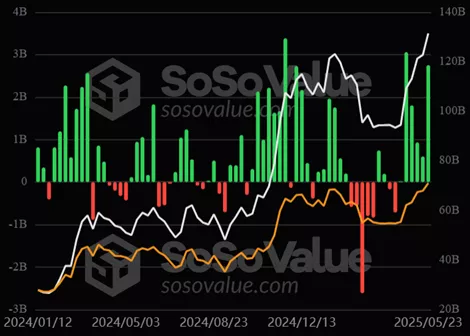

In the segment of US spot Bitcoin ETFs, inflows reached $2.75 billion. In the previous reporting period, clients added $603.7 million to the products.

In Ethereum funds, inflows jumped from $205 million to a high of $326 million since mid-February, following the successful Pectra update.

Optimism also prevailed in other altcoins. The exception was XRP-based products, where an 80-week streak of inflows ended as investors withdrew a record $37.2 million.

Funds based on Solana and Sui attracted $4.3 million and $2.9 million, respectively.

Earlier, CoinDesk specialists presented six charts of various metrics confirming a solid foundation for Bitcoin to rise above $100,000.

Back in Standard Chartered, experts urged buying the first cryptocurrency and forecasted its price increase to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!