Crypto Projects Attract $10 Billion in Venture Investments in a Quarter

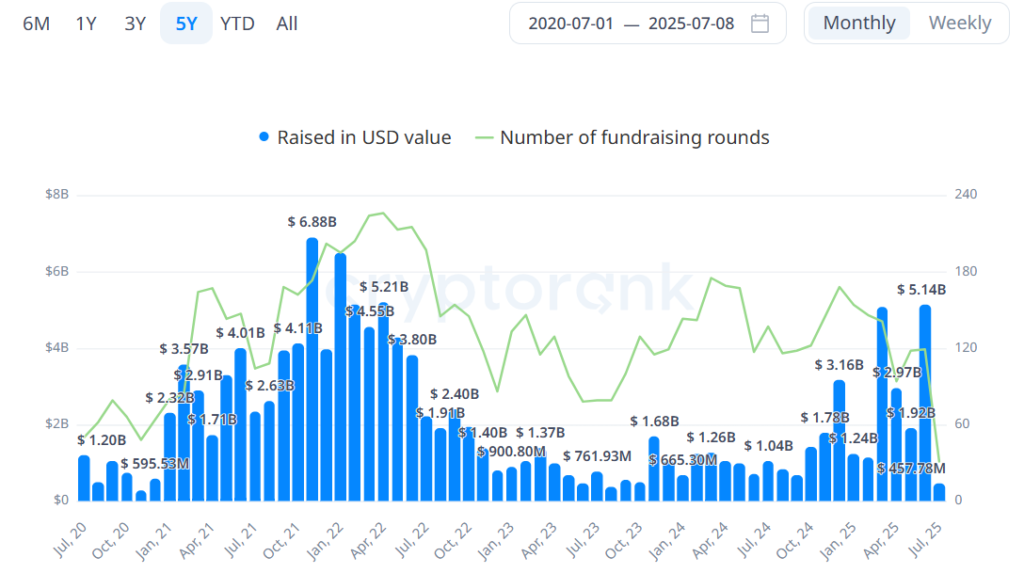

In the second quarter of 2025, venture investments in the crypto industry reached $10.03 billion. This is the highest figure since the $16.64 billion recorded in the first three months of 2022, according to CryptoRank.

During the reporting period, the largest influx of funds, totaling $5.14 billion, occurred in June — the highest since January 2022.

Leaders in Fundraising

In May, Strive Funds, associated with Vivek Ramaswamy, raised $750 million to launch Bitcoin-related strategies.

Twenty One Capital took second place, having raised $585 million in April. Securitize ranked third with a round raising $400 million.

Following them were Kalshi ($185 million), Auradine ($153 million), ZenMEV ($140 million), and Digital Asset ($135 million).

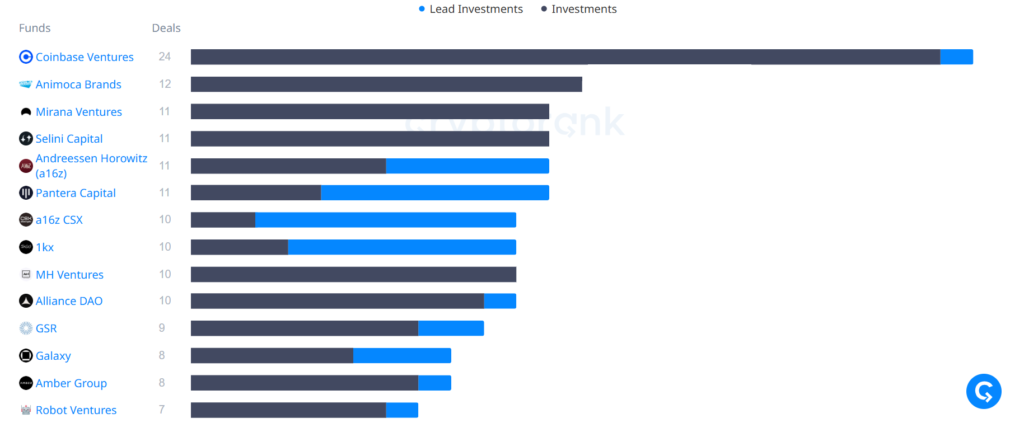

Most Active Investors

Coinbase Ventures was the most active fund in the second quarter, closing 24 deals. Other leading investors included Animoca Brands, a16z, and Pantera Capital.

In June, Coinbase Ventures again took the lead with nine investments, followed by Pantera Capital (8), Galaxy (5), and Paradigm (4).

Sector Distribution

Projects in blockchain infrastructure and DeFi attracted the most interest. Moderate activity was seen in the CeFi, NFT, and GameFi categories. Funding for meme coins remained low.

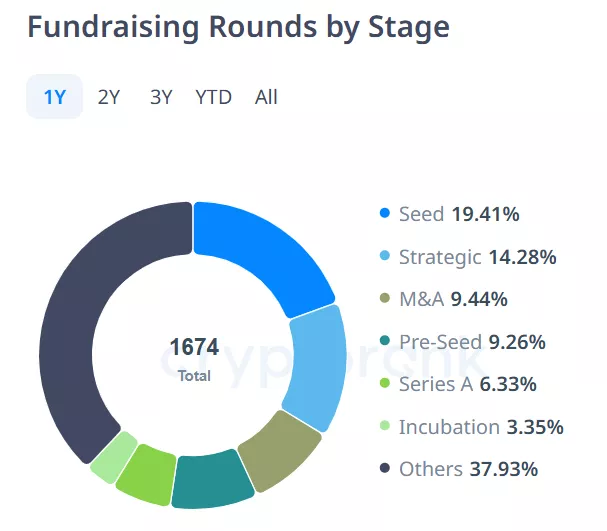

Over the past year, seed stages accounted for the largest share of funding rounds, representing 19.41% of 1674 deals. Strategic rounds made up 14.28%, pre-seed 9.26%, and mergers and acquisitions 9.44%.

In June, Galaxy Digital closed its first external venture fund, raising $175 million against a target of $150 million. A month earlier, Theta Capital Management also secured over $175 million for its fund focused on early-stage blockchain startups.

According to PitchBook, venture deals involving cryptocurrency startups amounted to $6 billion in the January-March period of this year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!