DAI price spike on Coinbase triggers $100m liquidations on Compound

A brief spike in the price of the DeFi token DAI on Coinbase led to the liquidation of users’ positions on the crypto-lending platform Compound, amounting to millions of dollars.

On November 26, the price of DAI in the DAI/USDC pair on Coinbase briefly rose from the usual $1 to $1.30.

Hourly chart DAI/USDC on Coinbase.

To borrow on Compound, a user must provide collateral higher than the requested amount. Price feeds are monitored by oracles — if collateral falls below a certain threshold, positions are liquidated.

Alex Svanevik, founder of the analytics platform Nansen, in a comment to Decrypt noted that Compound’s oracle uses Coinbase to obtain price data. The DAI-denominated debt rose by 30%, triggering liquidations across assets that had significantly fallen in price.

“As far as I can tell, Compound did exactly what it should have done. Questions will be asked about the oracle,” he said.

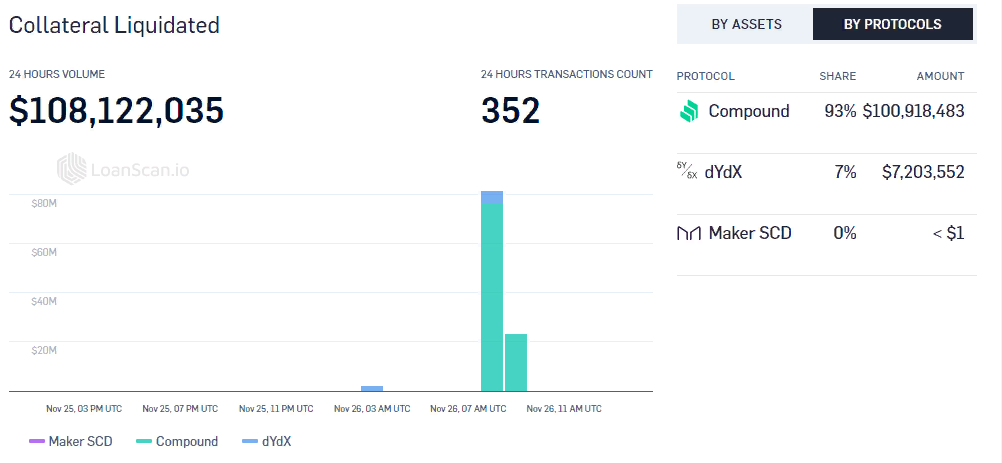

According to the service LoanScan, liquidations of more than $100 million in the DeFi protocol Compound occurred in the last 24 hours. Losses on dYdX exceeded $7 million.

Data: LoanScan.

According to Svanevik, the events affected the third-largest holder of COMP tokens — who lost $46 million.

The 3rd largest COMP farmer took a big hit with the liquidations. Around $46m.

Tx: https://t.co/waOEZlh3U1 pic.twitter.com/QrlkPjJHyc

— Alex Svanevik 🧭 (@ASvanevik) November 26, 2020

Earlier in November, analysts discovered a vulnerability that allows users of the DeFi project MakerDAO to split collateralized debt positions into smaller tranches and evade forced liquidation.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!