XRP Surges 18% Following Ripple’s DeFi Expansion Announcement

Ripple unveils DeFi plans for XRPL, boosting XRP by 18%.

Developers at Ripple and XRP Ledger (XRPL) have unveiled a plan to introduce new DeFi options to the network, enhancing the utility of the native token as an intermediary and settlement asset. XRP responded with a rise.

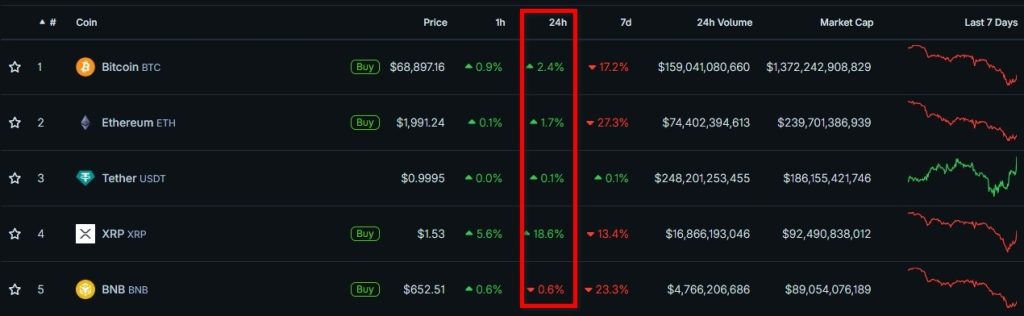

During the market crash on February 6, Bitcoin tested the $60,000 level, and Ripple’s token fell to $1.22. As the market recovered, the leading cryptocurrency gained approximately 2.5% over the day, as did the total market capitalization of digital assets. XRP prices jumped by 18.6% to $1.53.

Source: CoinGecko.

“XRPL has evolved into a high-performance blockchain for tokenized finance with compliance tools, real-time settlements, and asset-level programmability. Concurrently, the XRP powering the network is showing sharp growth in both direct and indirect applications,” the developers stated.

In positioning XRPL as a DeFi platform for institutions, they discussed implemented and planned solutions for payments, asset exchange, capital management, and lending. All functions directly or indirectly utilize XRP.

Ripple Expands XRP Economy

According to a blog post, corporate clients on XRPL already have access to the following options:

- Multi-Purpose Token (MPT) — a tokenization standard allowing metadata programming without smart contracts, such as maturity dates and tranches, transfer restrictions, and other parameters;

- Credentials — an identification layer for issuers to confirm KYC status and accreditation or approval from regulators;

- Permissioned Domains — provides access control based on the aforementioned credentials to ensure regulatory compliance on the blockchain;

- Simulate — models a transaction preview on the mainnet, reducing risks for costly and complex operations;

- Deep Freeze — allows token issuers to prevent misuse of assets by freezing them to enforce sanctions and other legal norms;

- XRPL EVM Sidechain — connected via Axelar sidechain, enabling developers using Solidity to leverage XRPL solutions in the familiar Ethereum Virtual Machine environment.

Among the features expected this year, Ripple and XRPL teams highlighted:

- Permissioned DEX — a decentralized exchange built on Credentials and Permissioned Domains, providing access to operations considering AML/KYC requirements;

- Lending Protocol (XLS-65/66) — a lending protocol for offering loans with fixed terms and stable interest rates automatically.

Developers also plan to implement confidential transactions for MPT assets, expand token issuance conditions through the Smart Escrows option, and launch an institutional DeFi portal to unify payments and lending on a single platform.

Back in November 2025, RippleX team leader Ayo Akinyele and Ripple CTO David Schwartz introduced the concept of native staking for XRP.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!