DeFi Lending Protocols Surpass DEX in Volume

The volume of funds in lending DeFi protocols has reached record levels in the current market cycle, while decentralised exchanges (DEX) have continued to lose ground.

The total TVL of such projects amounts to $53.3 billion—43% of the overall $124.6 billion in the industry. Aave leads with $24 billion. This figure also surpasses the liquid staking segment.

In comparison, the total value locked in DEX has decreased from $85.3 billion in November 2021 to $21.5 billion at the time of writing.

Henrik Andersson, founder of Apollo Capital, attributed this to lending becoming the only sustainable source of income in DeFi. According to him, DEX liquidity pools are losing appeal due to impermanent losses and increased competition.

The “capital-efficient” design of Uniswap v3 allows for higher earnings with smaller investments, but this reduces overall TVL, Andersson noted. He explained that intent swaps, where liquidity is sourced from centralised exchanges (CEX), divert funds from DEX.

Lending protocols like Aave offer Ethereum and stablecoin holders an annual yield ranging from 1.86% to 3.17%. In DEX pools, profits are higher but volatile and depend on daily fluctuations.

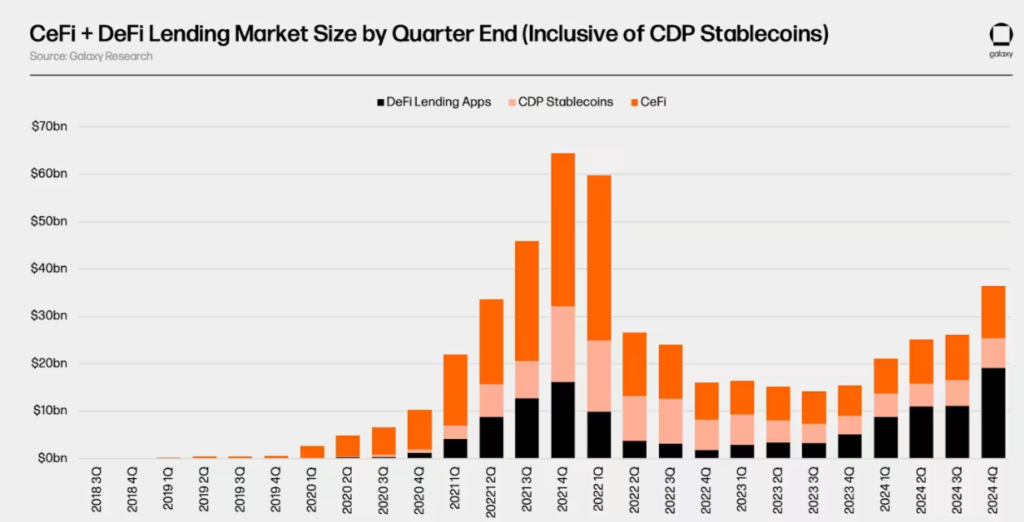

The share of DeFi lending in the market reached 65% by the end of 2024, surpassing centralised platforms. This followed the bankruptcies of Celsius, BlockFi, and other CeFi players, which shrank the market by 78% from its 2022 peak.

According to Galaxy Digital, the volume of loans in DeFi increased by 960% from the end of 2022.

“Institutional investors and regulatory clarity will drive the next phase of growth,” predicts Galaxy.

In the first quarter of 2025, TVL in DeFi protocols fell by 27%, NFT trading volume decreased by 24%, while social and AI applications showed the most growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!