DEX Gains Market Share Amid Decline in CEX Activity

In June, the ratio of futures trading volumes between DEX and CEX reached an all-time high of 8%. Meanwhile, spot trading on centralized platforms fell to its lowest level since September 2024.

A key driver of growth in the derivatives sector was the platform Hyperliquid. Despite a 15% decline in its own trading volume to $210 billion, the exchange strengthened its position amid a more significant drop among competitors.

For instance, Binance’s futures volume fell by 20% over the same period. Consequently, Hyperliquid’s market share in derivative DEX rose from 69.77% to 75%.

APX Finance also made a notable contribution. In June, its trading volume exceeded $34 billion, marking a 350% increase over the month. This is likely due to a user and market maker incentive program.

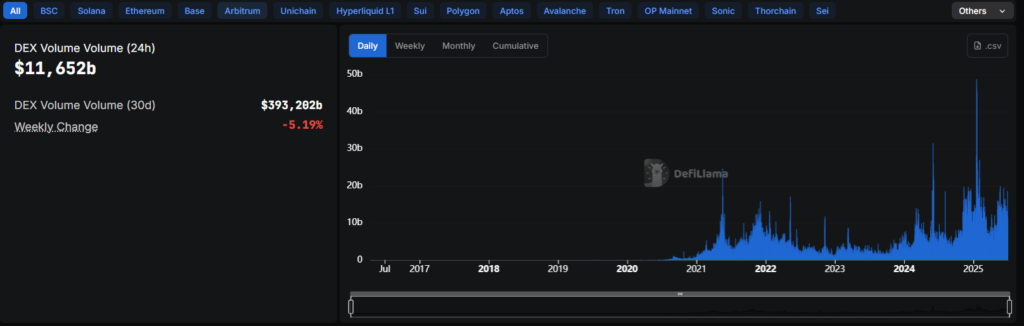

Spot Market Dynamics

A similar trend is observed in the spot market. In June, trading volumes on CEX fell from $1.47 trillion in May to $1.07 trillion. This is the lowest level since September 2024 and 63.6% below the peak in December.

Volumes on decentralized platforms rose to $393 billion. The ratio of DEX to CEX spot volumes set a new record, reaching 29%.

Presto Research analyst Min Jung explained that activity on DEX is fueled by platforms like Hyperliquid and traders chasing airdrops and points.

According to CIO of Kronos Research Vincent Liu, traders are shifting to DEX due to declining trust in CEX and lower fees. He added that decentralized platforms offer real benefits: trading freedom, self-custody of assets, and early access to tokens.

In May, DEX turnover amounted to $410.2 billion, more than a quarter of the equivalent CEX figure.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!