Economist warns bitcoin could fall to $60,000 as US–EU trade war escalates

Gromen sees risk of a drop to $60,000 as US–EU trade tensions escalate.

The price of digital gold could correct to $60,000 amid an escalating trade war between the US and EU, according to macroeconomist Luke Gromen.

He added that international isolation of the United States and a recession could also trigger heavy selling and institutional outflows.

Gromen argued that institutions are unlikely to drive the first cryptocurrency to a new high this year without a “powerful fundamental catalyst”.

“If you are counting on institutional investors to lift the price from $90,000 to $150,000, without a serious catalyst that is unlikely to happen. That is not how institutional investors operate. They will wait,” he said.

Such a move would require more than a 65% gain from around $89,800.

He cited passage of the Clarity Act in the US and potential new quantitative easing by the Federal Reserve as key upside drivers.

Institutional demand remains strong

CryptoQuant chief executive Ki Young Ju noted that “institutional demand for bitcoin remains strong”.

Institutional demand for Bitcoin remains strong.

US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.

577K BTC ($53B) added over the past year, and still flowing in. pic.twitter.com/kG1c8dTvlq

— Ki Young Ju (@ki_young_ju) January 19, 2026

“US custody wallets typically hold 100–1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included,” he wrote.

Over the past year, large investors added 577,000 BTC worth $53 billion, he said. Inflows continue, Ju noted.

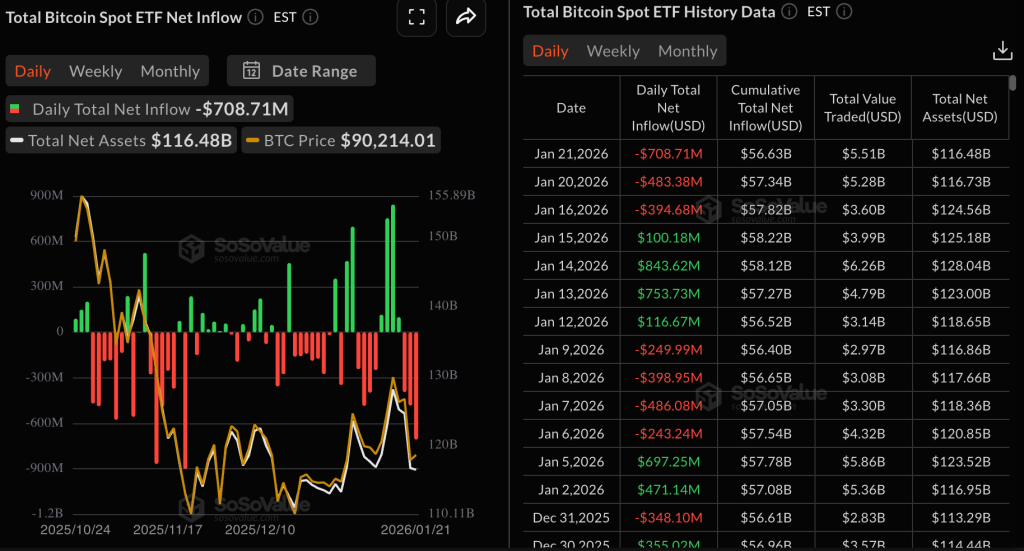

ETFs see outflows

In the latest trading session, US spot bitcoin ETFs shed $708.7 million, the biggest daily outflow in two months.

BlackRock’s IBIT saw the largest redemptions at $356.6 million, followed by Fidelity’s FBTC at $287.7 million.

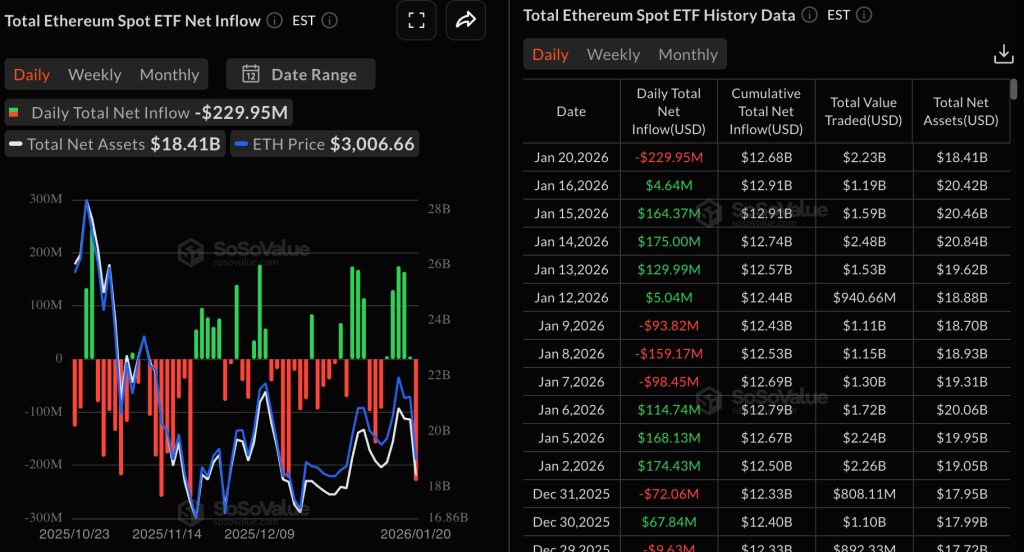

Ethereum ETFs saw $286.9 million in outflows, led by BlackRock’s ETHA at $250.3 million.

BTC Markets analyst Rachael Lucas argued the negative trend is not due to structural weakness — rather, the outflows reflect “classic de-risking”.

“When macro conditions deteriorate — rates rise, geopolitics flare or sudden volatility hits — institutions typically pull funds first from high-beta assets,” she commented.

On January 21, bitcoin fell below $88,000 as stock markets slumped amid tensions between the US and EU.

Prices soon steadied after US President Donald Trump said an agreement had been reached on Greenland. He also opted not to impose tariffs on imports from European countries in February.

“Despite the challenging macro backdrop, the crypto market is showing relative resilience as positions normalize,” said Vincent Liu, chief investment officer at Kronos Research.

Earlier, ARK Invest founder Cathie Wood predicted bitcoin would reach $761,900 by 2030.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!