Ethereum ETF Inflows Surpass $2.6 Billion in Eight Days

Net capital inflows into spot exchange-traded funds based on the second-largest cryptocurrency have reached $2.6 billion over the past eight days.

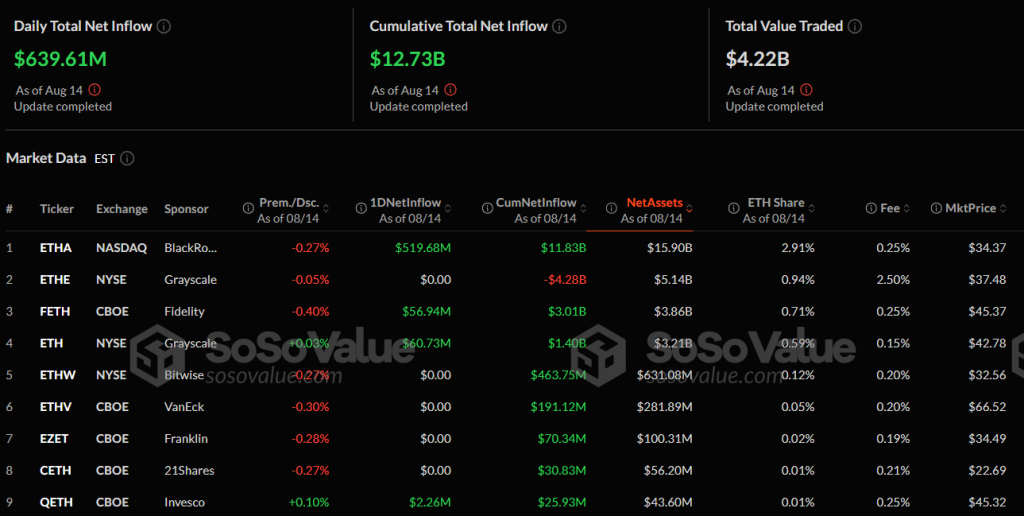

On August 14, net inflows into spot Ethereum ETFs in the United States amounted to $639.6 million.

The leading fund was BlackRock’s ETHA, with $519.7 million. Grayscale Ethereum Mini Trust attracted $60.7 million, while Fidelity’s FETH saw $56.9 million. A smaller inflow was also recorded by Invesco’s ETF ($2.26 million).

On August 11, inflows into exchange-traded funds based on the second-largest cryptocurrency set a record of $1.02 billion.

At the time of writing, Ethereum’s price had adjusted by 1.8% over the day to $4652, according to CoinGecko. Over the past week, the asset has risen by 18.7% and at one point traded near its all-time high.

ETH Reserves

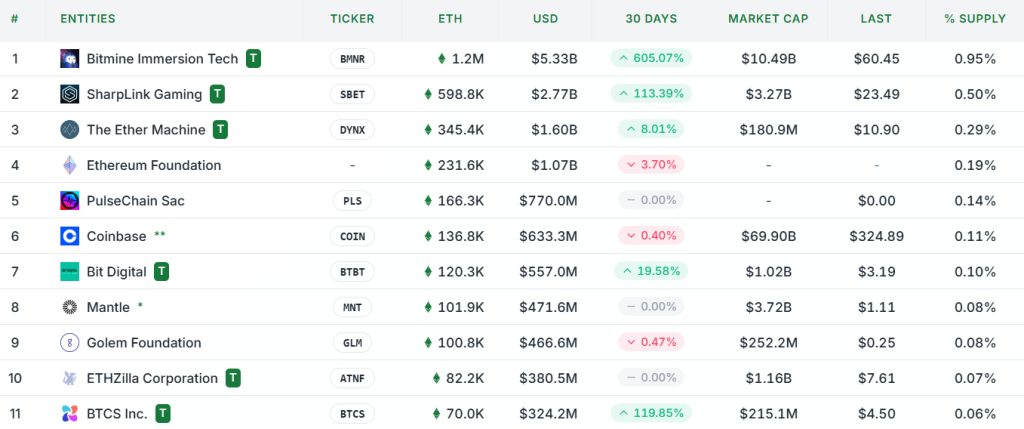

From July 1 to August 12, BTCS secured over $192 million in additional funding. The funds were obtained through DeFi loans on the Aave platform, backed by Ethereum, the issuance of convertible notes, and the sale of shares. This allowed reserves to increase to 70,140 ETH, valued at over $321 million.

Chief Financial Officer Michael Prevoznik noted that the growth of treasury in the second-largest cryptocurrency remains a fundamental part of BTCS’s strategy. According to him, this ensures both direct income and long-term participation in the growth of the Ethereum ecosystem.

At the time of writing, public companies manage 3.57 million ETH, valued at $16.5 billion. The largest holder is BitMine Immersion Technologies.

Previously, inflows into ETFs based on the second-largest cryptocurrency exceeded the issuance of new coins following The Merge.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!