Ethereum marks three years since The Merge

Since the hard fork, the cryptocurrency’s price has risen by more than 90%

Exactly three years ago, Ethereum developers activated the landmark The Merge upgrade. The key change was the shift of the second-largest cryptocurrency to the Proof-of-Stake (PoS) algorithm.

The impact of staking

The mainnet merged with a new consensus layer—the Beacon Chain. Staking replaced mining: instead of computing power, validators now lock up ETH to confirm transactions. This cut energy consumption by ~99.95%—Ethereum’s energy use is comparable to that of a single Web2 data centre.

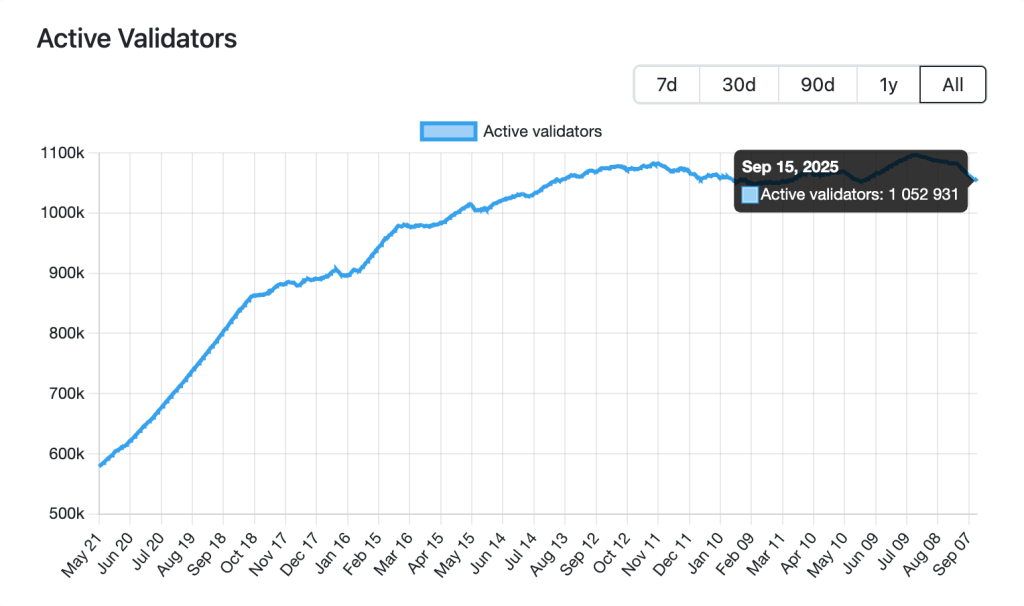

The move to PoS also broadened decentralisation by lowering barriers to entry. At the time of writing, Ethereum has more than 1 million active validators.

The new consensus algorithm minimised the risk of a 51% attack. To gain control of the chain would require 50% of the assets in staking plus 1 ETH. According to core developer Justin Drake, this is difficult and costly, but theoretically possible only for a wealthy state.

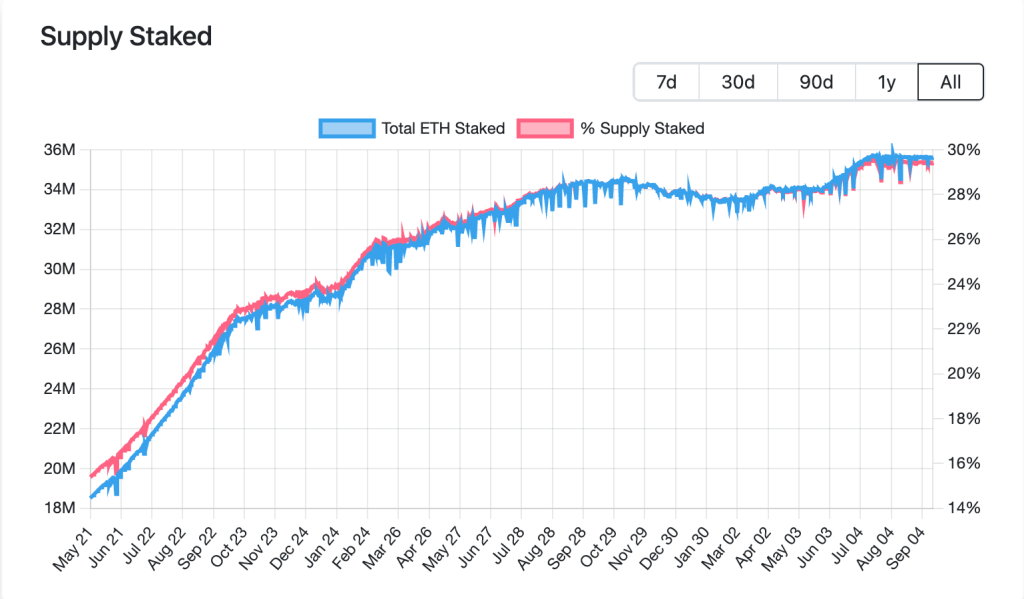

The volume of locked coins on the network of the second-largest cryptocurrency exceeds 3.6 million ETH worth $162.4bn—almost 30% of Ethereum’s total supply.

The fate of Ethereum PoW

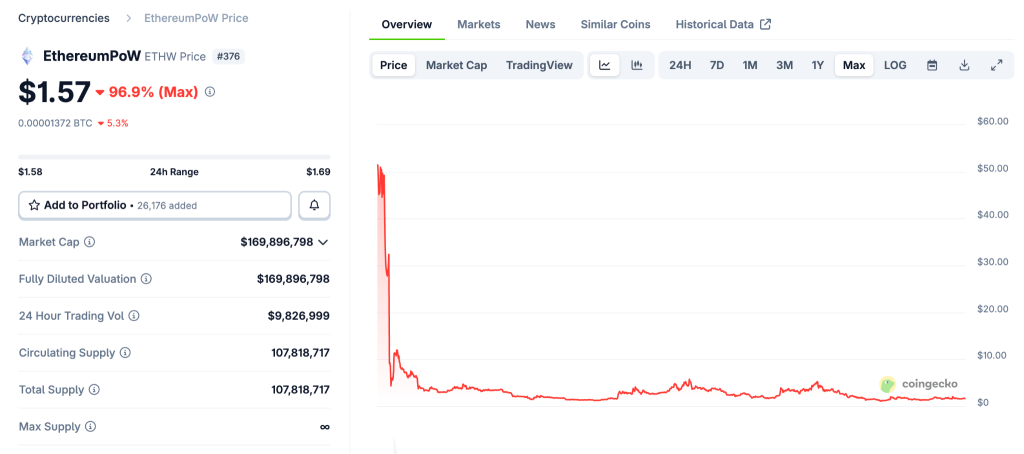

After The Merge, miners launched a fork of Ethereum called ETHW to continue operating on the Proof-of-Work (PoW) algorithm. The idea did not succeed.

Since launch, the project’s token has lost nearly 100% of its value.

Ethereum PoW also faced technical difficulties: in September 2022 hackers breached the Omni bridge and stole 200 ETHW. Within a year the community began calling it a “dead fork”, as developers stopped updating the code.

ETHW — born from refusing the merge, now just another ghost chain no one asked for.

At least it’s proof you can fork the code, but not the community. ⛏️ #FUDClub pic.twitter.com/D9Mj57Jcm0

— 🍊Bullish0xCrypto👑🇩🇴 (@Bullish0xCrypto) August 13, 2025

After The Merge

Since The Merge, Ethereum’s price has risen by more than 90%—from $1,635 to $4,523. Capitalisation has grown from $180bn to $536bn.

In August the cryptocurrency set a new record at $4,946.

Over three years Ethereum has evolved through a series of upgrades. In April 2023 the Shapella implementation enabled withdrawals of staked ETH, encouraging participation without the risk of permanent lock-up.

The Dencun upgrade in March 2024 introduced EIP-4844 with data “blobs”, sharply reducing fees on L2 networks by an average of 90%.

In May this year the flagship Pectra upgrade—the largest since The Merge, including 11 EIP—improved the usability and efficiency of the second-largest crypto network. A key novelty was adding smart-contract functionality to wallets.

The next major update, Fusaka, will be rolled out in early November. During the hard fork, developers will implement a further 11 EIPs aimed at improving the network’s scalability and resilience.

On 30 July 2025, Ethereum’s mainnet turned ten.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!