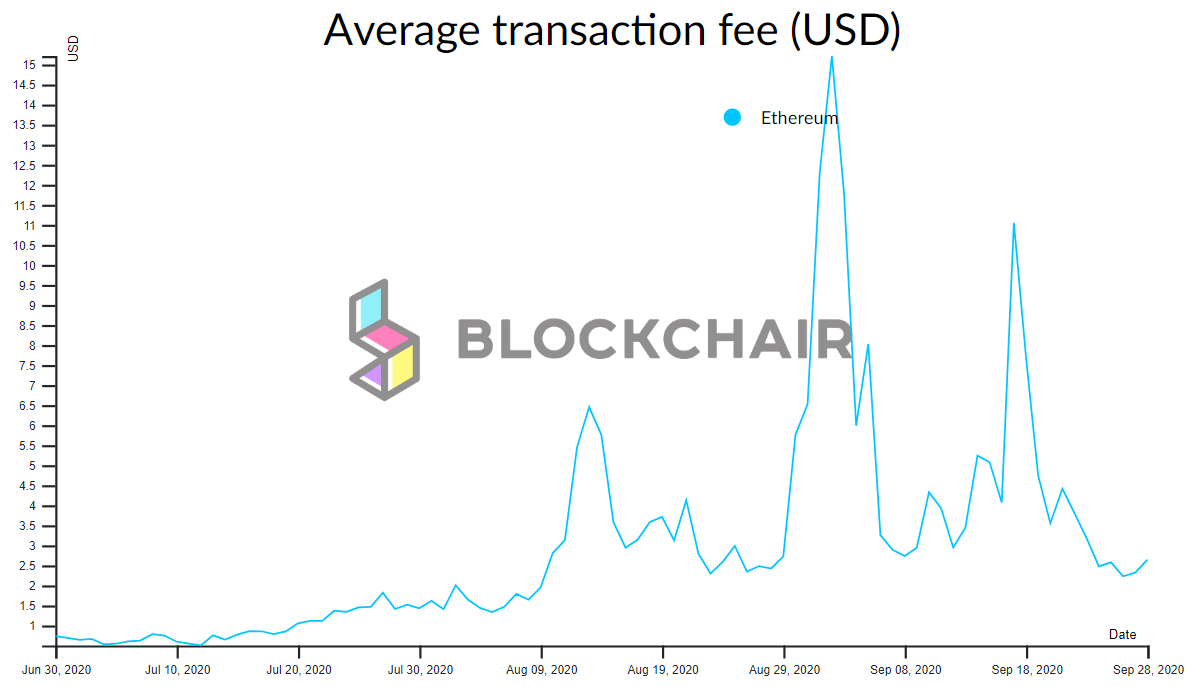

Ethereum network fees fall to their early-August low

On 26 September, the average transaction fee in the Ethereum network fell to $2.23. The last time such low levels were seen was 9 August this year.

Data: Blockchair.

On 2 September this metric surpassed the previous all-time high of $10, rising to $15.21. The surge in turnover spurred a frenzy around decentralized finance, in particular yield farming.

On 17 September there was another spike in transactional activity, driven by issuance and distribution of governance tokens for the Uniswap decentralized exchange. On that day, 138,693 participants submitted applications for the airdrop.

Also on 17 September a new daily record for transactions was set, amounting to 1.406 million transactions. The previous peak of 1.35 million transactions was set on 4 January 2018.

The vast majority of DeFi protocols are built on the Ethereum blockchain, whose throughput is limited to 14 transactions per second. This creates a backdrop for rising competition to speed up transaction inclusion in the blockchain.

The auction mechanism used in Ethereum ranks transactions by priority based on the fees paid. As a result, the fees exceed what is acceptable for many users.

Decreasing fees may indicate waning interest in DeFi protocols.

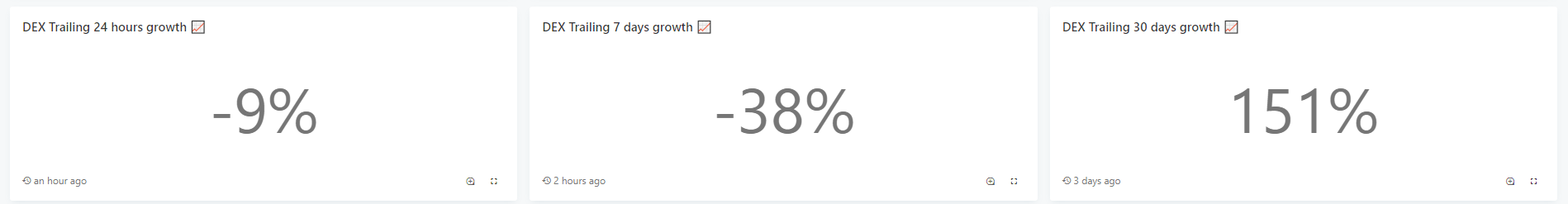

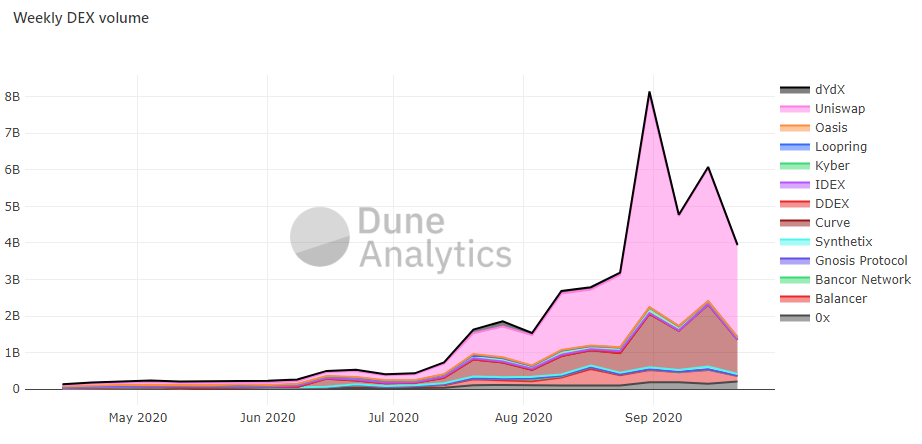

Despite the recent growth in locked assets to $11 billion, activity on decentralized exchanges continues to retreat from late-August peaks. According to Dune Analytics, trading volume over the last seven days fell by 38%, though it remains 151% above the level 30 days earlier.

Trading turnover on DEXs. Data: Dune Analytics.

Weekly trading turnover on DEXs. Data: Dune Analytics.

Token prices of DeFi protocols have also declined. According to CoinGecko, since 1 September the sector’s market capitalization fell by $4 billion, to $14.5 billion.

Earlier, Forklog published a piece in which the causes of the DeFi fever were examined.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!