Fireblocks: Institutional Embrace of Stablecoins Grows

Nine out of ten institutions are planning or already using stablecoins, primarily focusing on cross-border payments, according to Fireblocks.

Representatives of the digital asset platform surveyed 295 executives from banks, financial institutions, fintech companies, and payment services.

49% of respondents stated they have added support for stablecoins, 23% are conducting pilot tests, and another 18% are in the planning stage. Only one in ten has yet to decide on incorporating tokens into their business processes.

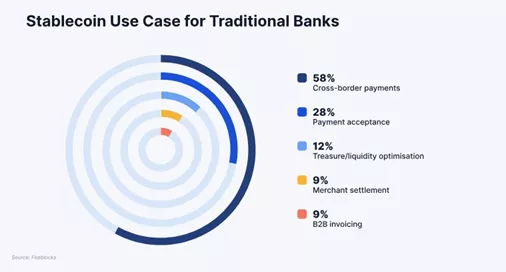

The study’s results indicated that banks have integrated stablecoins to restore cross-border volumes while maintaining existing infrastructure, whereas fintech companies and payment services aim to increase margins and profits.

Institutions view stablecoins as a tool for modernization. Given their peg to fiat currencies, tokens are easier to integrate into existing treasury processes. Additionally, stablecoins allow institutions to reclaim market share from fintech companies and reduce working capital needs.

“The stablecoin race has become a matter of keeping up with the times as customer demand grows and use cases mature,” the report states.

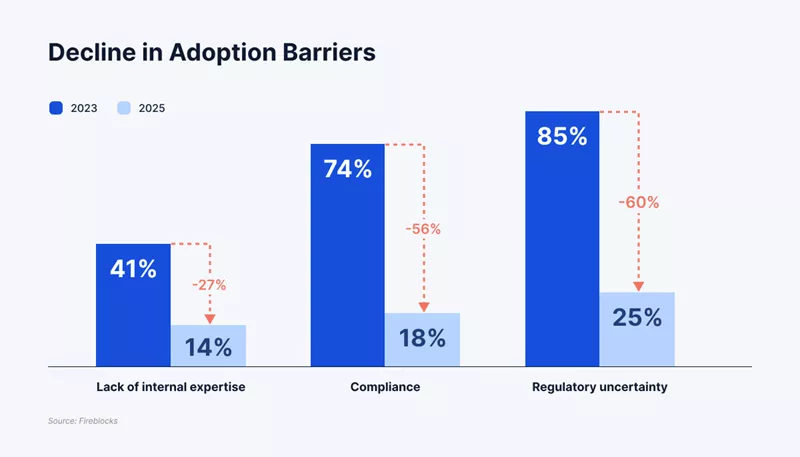

Trust in stablecoins is strengthening—not only due to progress but also because key barriers have receded. Only one in five respondents cited regulation or compliance as an obstacle, compared to 80% two years ago.

This shift reflects a wave of clear national policies, enhanced anti-money laundering tools, and the rise of international standards, analysts noted.

The document highlights the advantages of stablecoins in cross-border payments, especially for B2B solutions in developing countries, given the high costs and delays in TradFi systems.

Applications

Banks are integrating stablecoins to restore competitive positions, reduce “friction,” and meet customer expectations. In these aims, 58% of institutions employ the tool.

Other common use cases include:

- payment acceptance (28%);

- liquidity optimization (12%);

- merchant settlements (9%);

- invoicing in B2B (9%).

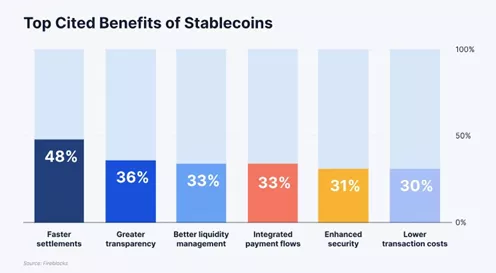

Among the benefits cited by respondents, accelerated settlements rank first (48%).

Following are:

- greater transparency (36%);

- improved liquidity (33%);

- integration with payment flows (33%);

- enhanced security (31%);

- reduced transaction costs (30%).

Earlier, Standard Chartered predicted the capitalization of stablecoins could grow to $2 trillion by 2028, with the US Treasury reporting similar expectations. Citi anticipates growth to $3.7 trillion in five years.

Back in January, a working group on digital asset markets formed by US President Donald Trump identified the development of a regulatory framework for stablecoins as a priority.

In May, a bill on stablecoins (GENIUS Act) failed in a key Senate vote.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!