First Bitcoin ETF in North America attracts $421m in two days

The bitcoin-based exchange-traded fund (ETF) managed by Canadian company Purpose Investments drew $421 million in the first two days after launch, according to Bloomberg Intelligence analyst Eric Balchunas.

STUNNING: The Canada Bitcoin ETF $BTCC already has collected $421m in assets first two days (crushing our estimate). Proportionally speaking it is the equiv of a US ETF taking $8b in first two days. If it were to keep up this pace it will be the biggest ETF in Canada in 20 days. pic.twitter.com/ESIMIiy7qy

— Eric Balchunas (@EricBalchunas) February 20, 2021

The expert noted that for the U.S. market the figure is equivalent to about $8 billion.

If the Purpose Bitcoin ETF maintains the pace, it will become the largest ETF in Canada within 20 days, Balchunas added.

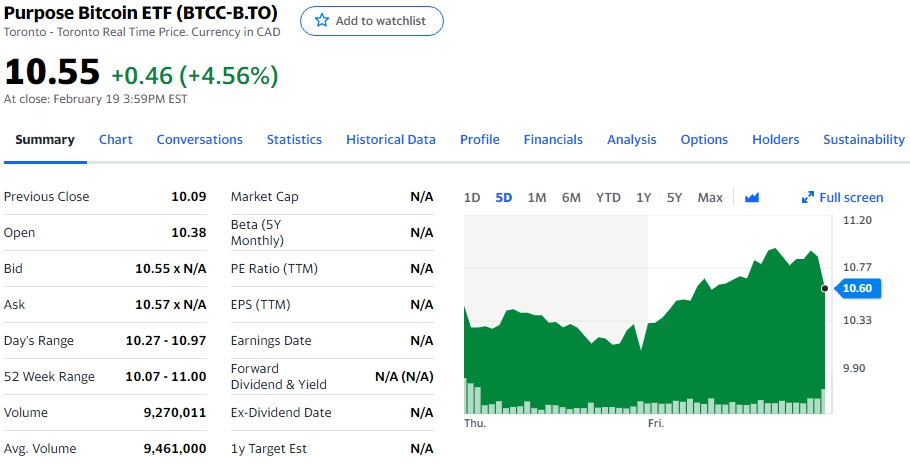

The regulator approved the company’s application on February 11, 2021. The fund became the first bitcoin ETF registered in North America. Trading of its shares under the ticker BTCC on the Toronto Stock Exchange (TSX) began on Thursday, February 18.

Data: Yahoo! Finance.

Regulatory approval for launching a similar product was granted to another Canadian company — Evolve Funds Group. Trading of the fund’s shares on the TSX began February 19, and its volume was 26 times smaller than that of the Purpose Bitcoin ETF, the analyst noted.

Crazy, the Purpose Bitcoin ETF (BTCC) is trading 26x more than Evolve Bitcoin ETF (EBIT), which launched only 24hrs later. That’s how big a deal being first-to-market is and why issuers are spending millions in US to get first approval. Really is like the Cannonball Run.

— Eric Balchunas (@EricBalchunas) February 19, 2021

Here is how important it is to be a pioneer in the market and why issuers are spending millions in the US to get approval first. It really is like the Cannonball Run, the expert noted.

On the US SEC, applications to register bitcoin ETFs have been submitted by Bitwise, VanEck, and Valkyrie Digital Assets. At the time of writing, the regulator had not approved any of them.

Earlier, SEC commissioner Hester Peirce said that US capital markets are ready for the launch of exchange-traded products based on the first cryptocurrency.

In October, trading of shares of the 3iQ index Bitcoin fund began on the TSX.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!