Forbes points to Binance practices eerily similar to ‘FTX maneuvers’

In late 2022, Binance moved about $1.78 billion of collateral for USDC issued on the BNB Beacon Chain and BNB Smart Chain networks to Cumberland, Alameda, and other market makers ‘for undisclosed purposes’. This is reported by Forbes.

The exchange carried out this operation without informing its clients.

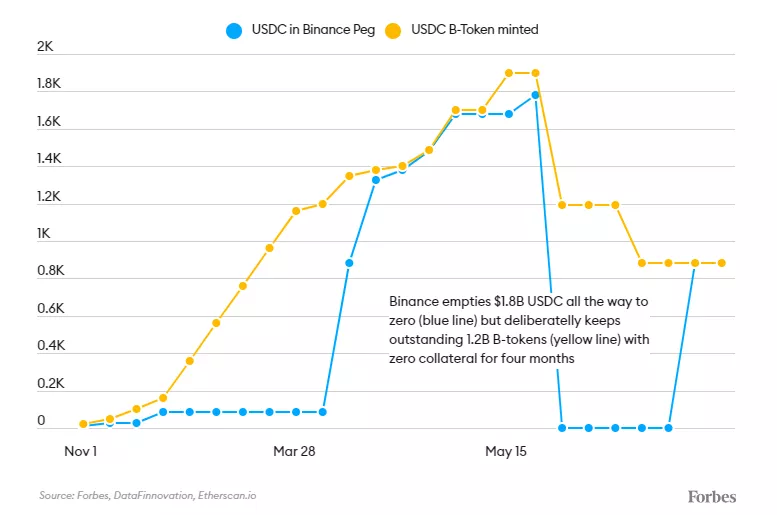

Journalists cited on-chain data showing that from August 17 to December 6, USDC holders on the BNB Beacon Chain and BNB Smart Chain networks totaling about $1.78 billion were left without collateral.

An illustration by Forbes shows that the exchange transferred about $3.63 billion of collateral from BUSD and USDC addresses on the BNB networks to a cold wallet. A week later, $1.85 billion in BUSD were returned.

Of the $1.78 billion in USDC, $1.025 billion went to Cumberland addresses, which could have helped the exchange convert the stablecoin into BUSD. Journalists allowed that the transactions might be tied to routine over-the-counter trading services the firm provides to third parties.

Other recipients included Amber Group, Alameda Research of Sam Bankman-Fried, and Tron founder Justin Sun.

According to Binance.US CEO Patrick Hillman, moving billions of value in digital assets between wallets is ‘normal business practice for the exchange’.

«No mixing occurred. There are wallets and an accounting ledger», — said a senior executive.

According to Hillman, the accounting ledger aggregates all funds — both those due to users and those arriving at wallets. The latter are simply ‘containers’. In other words, Binance maintains its own records to track assets.

Forbes suggested that the operations could cast a shadow over the Proof-of-Reserves procedureProof-of-Reserves.

«Having two sets of books means the company asks clients and regulators to trust its accounting, creating difficulties for independent verification of the liquidity it asserts», — Forbes explained.

Journalists drew parallels between Binance’s current backstage asset shuffle and FTX’s pre-bankruptcy moves, specifically the use of Alameda Research client funds in trading operations.

The publication recalled lawsuits against banks Signature and Silvergate with accusations of aiding Sam Bankman-Fried in his illegal activities.

Forbes also cited findings by ChainArgos founder Jonathan Reiter shortcomings in reserve management for BUSD. The expert identified a shortfall in the backing of the stablecoin on the BNB Beacon Chain and BNB Smart Chain networks and acknowledged its subsequent remediation.

According to the analysis, the divergence between BUSD issuance on the BNB networks and the reserves backing it on Ethereum was observed from 2020 to 2021. In three separate instances, this gap exceeded $1 billion.

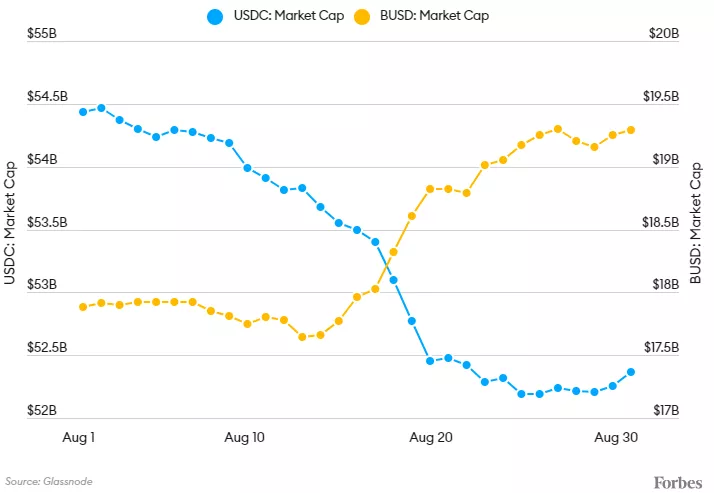

Forbes also mentioned a Fortune article, according to which Binance unlocked its USDC collateral and directed the proceeds toward the issuing of BUSD. To support the hypothesis, the publication included a chart showing the dynamics of the capitalization of the two stablecoins.

The noted decline in the collateral address balance by $3.6 billion since August 17 was offset only by December 6.

The journalists stressed that the withdrawal of $1.78 billion of USDC occurred without a corresponding reduction in the supply of its counterpart on Binance networks.

The collateral balance fell to zero, which could spell trouble for the exchange in the event of a bank run. The platform would not be able to satisfy redemption requests for tokens promptly.

In an interview with The Block, the exchange’s representatives disagreed with Forbes’s conclusions.

«Binance had previously acknowledged that wallet-management processes for stablecoin reserves on the BNB networks were not always flawless. This has never affected customer asset collateral. The governance processes have been corrected … this can be verified on-chain», — they explained.

On February 10, the New York Department of Financial Services (NYDFS) initiated an investigation into Paxos. Later the regulator ordered the firm to stop issuing the exchange-linked stablecoin.

The company said it would halt issuing the asset but would continue to support redemptions and conversions at least until February 2024. In NYDFS explained their actions as due to insufficient safeguarding of Binance USD.

Bloomberg previously wrote about Circle‘s complaint in 2022 with the NYDFS regarding the quality of BUSD reserve management. The co‑issuer of the competing USDC asset pointed to alleged insufficient backing.

In February 2023, Binance integrated zk-SNARK technology into the reserve-verification mechanism.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!