ForkLog’s Person of the Year 2020 — It’s Time to Vote!

The Bitcoin industry is built by people. Some become role models, while others are anti-heroes.

ForkLog invites readers to choose the brightest and most influential figure in eight categories:

- Bitcoin (Development);

- Breakthrough Technologies;

- Most Influential Exchange CEO;

- Investor of the Year;

- Most Influential DeFi Figure;

- Most Influential Analyst;

- Thought Leader;

- Antagonist of the Year.

You can vote for and against multiple people within a single category.

In the Antagonist of the Year category, a “for” vote goes to the person who, in your view, has caused the most harm to the industry and its community.

We will tally the results together at the end of 2020. Onwards!

Bitcoin (Development):

Âdam Bæk

Blockstream / Liquid Network

Adam Back, head of the leading infrastructure company Blockstream, is one of the creators of the Liquid sidechain—a solution aimed at accelerating movement of funds between exchanges and issuing digital assets based on Bitcoin.

Five years after the launch of the first commercial application based on this technology, Liquid has become a truly in-demand product, bringing together more than 50 participants in its network. Among them are industry names such as Bitfinex, Ledger and CoinShares, and the total amount of Bitcoin locked in the sidechain is now more than double the Lightning Network’s figure.

Piter Velle

Blockstream / Chaincode Labs

Proposals to improve Bitcoin—Schnorr signatures and Taproot—will be among the most important updates in the history of the first cryptocurrency. In addition to boosting scalability and privacy, Schnorr/Taproot are also aimed at improving the network’s overall functionality and coin fungibility.

Also known as the author of the Segregated Witness (SegWit) protocol, another key Bitcoin upgrade, at the start of the year Piter Velle filed requests to include them in the Bitcoin Core codebase. In October, developers implemented updates in the Bitcoin Core source code, but activation timelines remain uncertain.

Jack Mallers

Zap

Led by Mallers, the American startup Zap is developing its eponymous wallet on the Lightning Network protocol. In 2020, Zap Wallet developers presented a product named Strike, which enables paying Lightning invoices using bank cards alone, without wallets and other LN staples. Public beta testing of Strike, under Visa’s Fintech Fast Track program, began in July.

The project’s immediate goal is to launch the Strike card for consumer app users and integrate Visa Direct fast-payment services. Investors, including Morgan Creek Digital and Green Oaks Capital, funded the startup with $3.5 million.

Nikolas Dorier

BTCPay Server

The BTCPay Server processing service enjoys deserved popularity among Bitcoin users who defend financial sovereignty, allowing them to create their own payment gateways and accept cryptocurrency without intermediaries.

Recognition for the product, created by Nikola Dorier’s team, is reflected by a grant from Square Crypto by Jack Dorsey.

In 2020 BTCPay Server leveraged Human Rights Foundation for donations, and the solution now supports assets issued in the Liquid sidechain. Moreover, developers unveiled Vault, a new app enabling connecting any hardware wallets to the processing, significantly advancing online commerce with Bitcoin.

Piter Chapek

Braiins / Slush Pool

This year, Braiins CEO Piter Chapek led the release of a new version of Braiins OS, including BOSminer and a working implementation of Stratum V2, a protocol designed to improve cooperation among miners and pools and to decentralize Bitcoin mining while boosting network security.

The Braiins OS and Stratum V2 development was the result of a team effort, including Peter Todd of OpenTimestamps and Matt Corallo of Square Crypto, but the project’s godfather and the originator of the idea is Braiins’ head, Piter Chapek.

Breakthrough Technologies:

Denny Ryan

Ethereum 2.0

Leading Ethereum Foundation developer Denny Ryan, though often operating in Vitalik Buterin’s shadow, is one of the key figures in Ethereum 2.0 development.

In September he published an official proposal (EIP-2982) proposing the launch of Serenity’s zero phase and the migration of Ethereum to Proof-of-Stake.

Charles Hoskinson

Cardano

This year, led by Charles Hoskinson, activated one of the main upgrades on Cardano’s road map—Shelley, and its native token ADA has broken into the top ten by market capitalization. Cardano is pressing on Ethereum’s heels, which is also evidenced by a possible transition to the blockchain of the SingularityNET project.

Gavin Wood

Polkadot

Gavin Wood, who helped launch Ethereum, now heads Parity Technologies, the company behind Polkadot—a protocol intended to interconnect different blockchains. Polkadot is hailed as one of the most promising next‑gen blockchains and a cornerstone of the Web3 ecosystem.

The Polkadot mainnet launched in May 2020, and its native token DOT has since entered the top tier by market capitalization.

Emin Günde Sirer

Avalanche

Prof. Emin Gün Sirer’s Avalanche protocol is offered as the first smart-contract platform with full support for the Ethereum Virtual Machine and a claimed 4,500 TPS, surpassing all existing blockchains.

According to the creator, the novelty lies in a scientifically grounded consensus protocol that makes the network as decentralized as Bitcoin.

Jae Kwon

Tendermint / Cosmos

When Cosmos Hub—the first in a line of Proof-of-Stake blockchains that will become part of the Cosmos ecosystem—was announced in 2019, Tendermint’s team led by Jae Kwon made clear a long-term plan. Today Cosmos is among the most popular DeFi platforms for building decentralized apps, and investor confidence in its native token ATOM is reinforced by support for staking on Coinbase. A key product—Inter-Blockchain Communication (IBC)—is on the horizon.

Huan Benet

Protocol Labs / Filecoin

Huan Benet leads California’s Protocol Labs, the developer of the decentralized storage platformFilecoin. Work on the project began in 2014, and the ICO in 2017 set a record for its time, raising $257 million. The Filecoin mainnet launched on 15 October 2020.

Aleksandr Skidanov

NEAR Protocol

Co-founder of NEAR Protocol, Aleksandr Skidanov, envisions the mission of the project as building an Open Web—the internet of the future. The protocol runs on a native Proof-of-Stake algorithm and aims to solve scalability to support resource-intensive decentralized applications (dapps). In May, NEAR raised $21.6 million from major VC firms, including Andreessen Horowitz. The mainnet launch took place in October.

Aнатолий Яковенко

Solana

Under Anatoly Yakovenko, the Solana project is developing a scalable blockchain protocol for building decentralized applications based on the Proof of History (PoH) algorithm. It rejects the Ethereum approach to sharding, instead betting on Turbine and Gulfstream transaction-propagation protocols and distributed data storage. With an average throughput of around 60,000 TPS in tests, the figure reached 191,000 TPS.

In the summer, decentralized exchange on Solana was announced by FTX, citing speed and cheap transactions as reasons. Additionally, Tether использовала the protocol to launch the USDT stablecoin.

Aleksandr Filatov

Free TON / TON Labs

In May 2020, the Telegram Open Network (TON) team, major PoS validators and the community launched the Free TON mainnet with the native TON token. The original protocol was developed by Nikolai Durov and the Telegram team, who could not complete the launch due to legal proceedings with U.S. authorities.

As Aleksandr Filatov, co-founder of TON Labs, notes, a key feature of Free TON’s business model is the distribution of 85% of total token supply to partners who contribute valuable content and active users to the ecosystem.

Chen Yulu

People’s Bank of China

The People’s Bank of China intends to be ahead of others and issue its own digital currency (CBDC). The digital yuan testing aimed at supporting the country’s new growth strategy is already underway, and China’s advances have spurred similar work in other countries.

Most Influential Exchange CEO:

Changpeng Zhao

Binance

Binance has long held a position as one of the largest exchanges by trading volume and continues to expand its services. Under Zhao’s leadership, Binance pursues aggressive expansion and participates in charitable initiatives, for example, in the fight against the coronavirus pandemic, and funds developers of projects.

Jean-Louie van der Velden

Bitfinex

The Bitfinex veteran, while no longer the top-liquidity provider, remains a key player in the market, supplying significant liquidity. This year the platform rolled out a solution to streamline liquidity transfers between centralized exchanges and DEXs, launched a custodial service for institutional clients, and contributed to the Lightning Network’s development. The strong ties between Bitfinex and Tether (USDT) remain a defining factor for traders.

Jess Powell

Kraken

Jess Powell continues to pursue the long-term vision of transforming Kraken into one of the world’s largest players in the market. This year the California exchange expanded its geographic footprint, participated in mergers and acquisitions, rolled out a range of new services, and strengthened its roster with prominent industry figures, including former Blockchain president Marco Santori.

In September, Kraken became the first U.S. crypto custodian to obtain SPDI status, granting it the functions of a traditional bank.

Brian Armstrong

Coinbase

Despite the momentum of rivals, Coinbase — the largest U.S. cryptocurrency exchange — shows no signs of ceding ground. Some of Coinbase’s moves and CEO Brian Armstrong’s views, not everyone agrees with, but the company continues expanding its offerings and assets, while increasing investments in infrastructure projects, including DeFi.

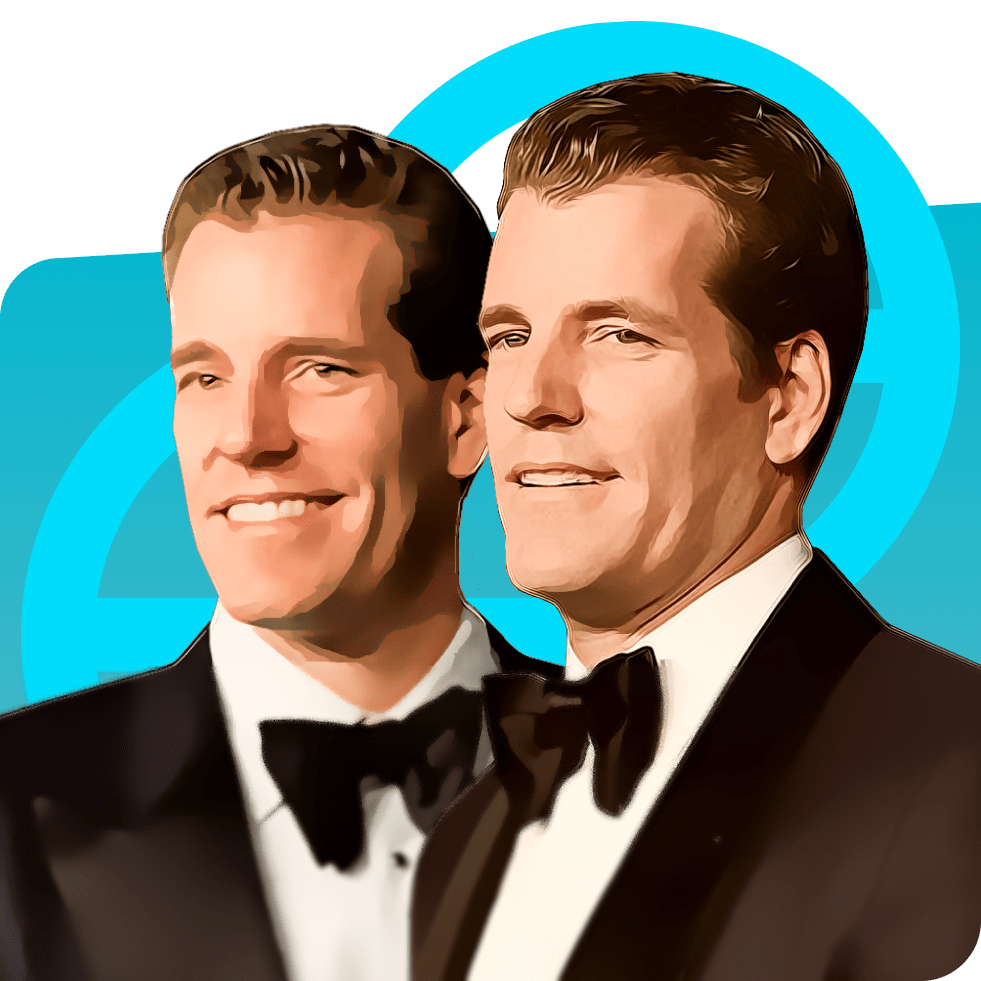

Winklevoss Twins

Gemini

Having failed to launch a Bitcoin ETF, the Winklevoss twins intensified their efforts in other areas, including strengthening trading infrastructure and security. Gemini topped CryptoCompare’s exchange ranking this summer and received accreditation from Britain’s financially strict regulator.

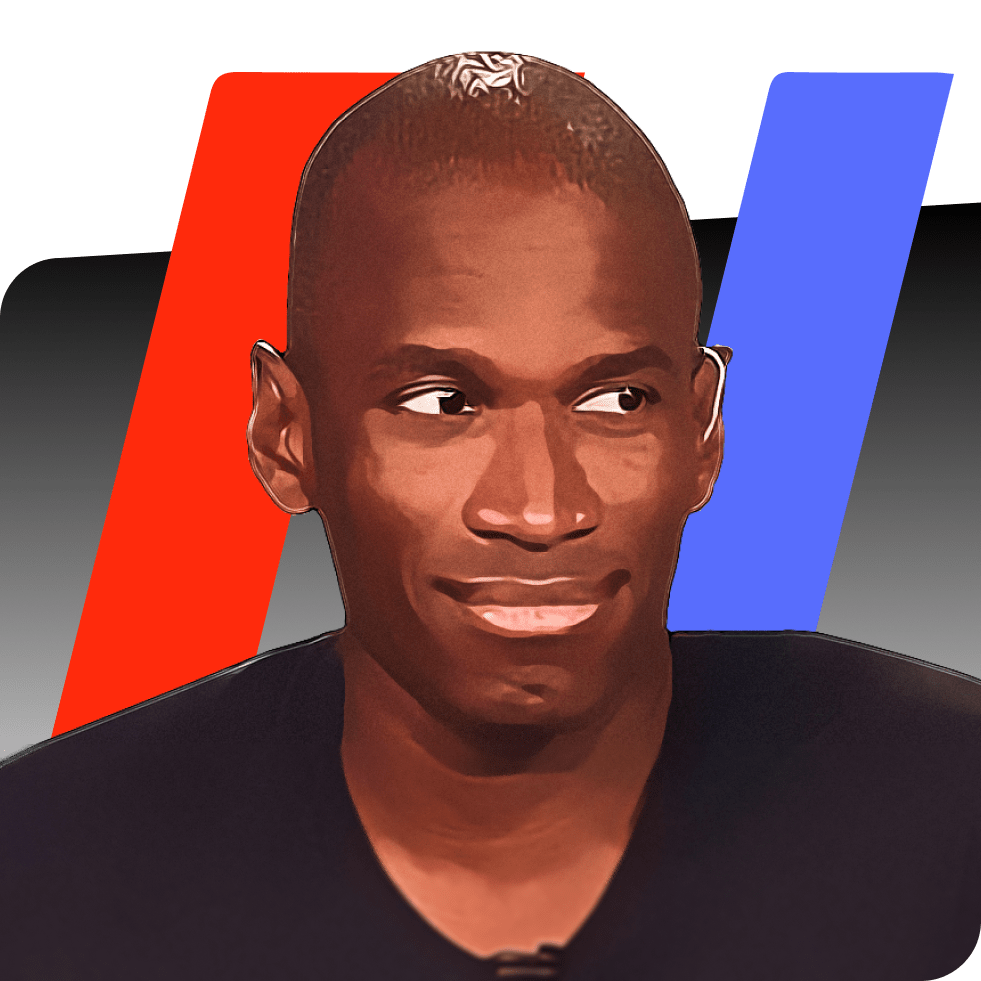

Artur Hayes

BitMEX

Despite regulatory troubles in the U.S. and accusations of market manipulation, BitMEX continues to contribute to the industry by funding developer grants.

Investor of the Year:

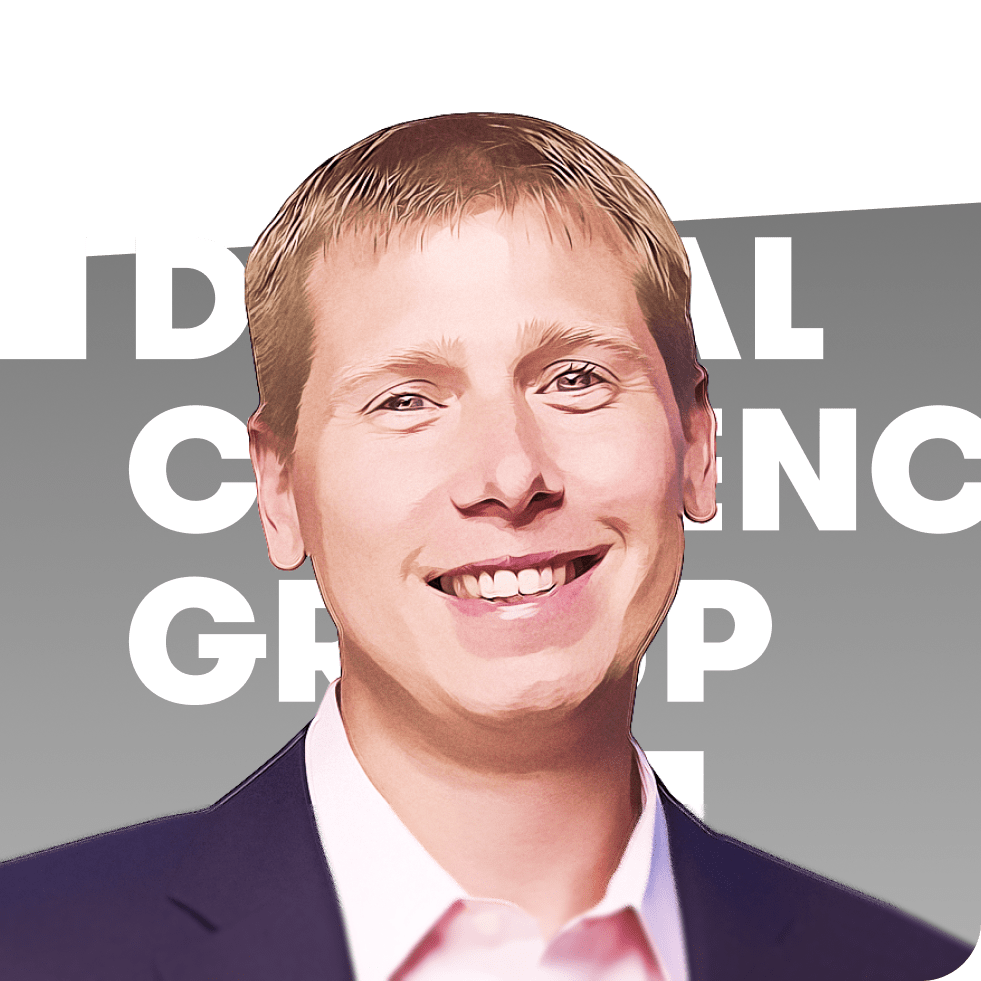

Barry Silbert

Digital Currency Group / Grayscale Investments

Barry Silbert is the gray eminence of the industry. One might say that he is the head of the Digital Currency Group (DCG), which includes Grayscale Investments.

As of the end of September, Grayscale’s Bitcoin Trust (GBTC) alone held about 450,000 BTC, or 2.4% of the supply at the time. DCG continues to invest in a variety of crypto ventures (Luno being a notable example) and this year ventured into bitcoin mining. And that is not counting the growing set of offerings for institutional investors.

Dan Morhed

Pantera Capital

Pantera Capital, a prominent crypto hedge fund, remains a key player. A July report shows Pantera Bitcoin Fund delivering over 15,000% in seven years; Pantera Digital Asset Fund with DeFi positions is up about 86% year‑to‑date.

The company’s portfolio includes familiar names and projects, such as Abra, Bakkt, Bitstamp, The Block, Brave, Circle, Coinbase, ErisX, NEAR, Ripple, ShapeShift, Tagomi and Zcash. CEO Dan Moreh4d is convinced that Bitcoin will exceed $100,000 by summer 2021.

Marc Andreessen

Andreessen Horowitz

In April 2020, the leading Silicon Valley venture firm Andreessen Horowitz (a16z) raised $515 million for its second crypto-focused fund, and subsequently led NEAR’s $21.6 million round. In September, Marc Andreessen joined Coinbase’s board as an observer, a firm in which a16z had previously invested.

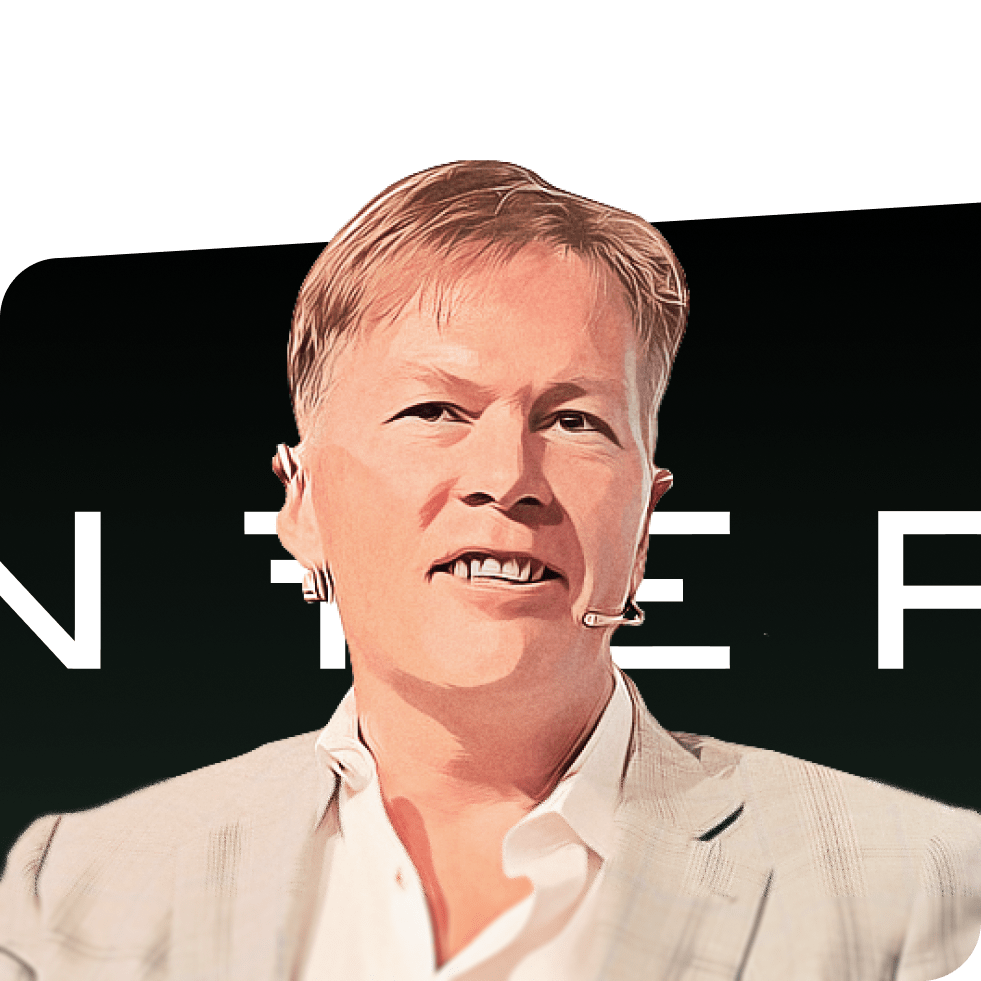

Mike Novogratz

Galaxy Digital

Galaxy Digital’s recent multi‑million losses have not cooled Mike Novogratz’s enthusiasm. In 2020 the firm partnered with Bakkt to build trading and custody solutions for institutional investors, co‑led a private token sale for AVA Labs with Bitmain, joined ParaFi Capital’s DeFi fund, and announced plans for a “one‑stop shop” for Bitcoin miners.

Mike Saylor

MicroStrategy

Mike Saylor, who runs MicroStrategy, a Nasdaq-listed provider of analytics software, became the first public company to invest a portion of its capital (about $425 million) into Bitcoin. Saylor is convinced that Bitcoin is a store of value and a digital alternative to gold, a view he expresses repeatedly; he has shifted about 80% of his assets into BTC.

Pol Tudor Jones

Tudor Investment

Hedge fund founder Paul Tudor Jones, whose wealth is estimated at $5.1 billion, keeps 1–2% of his assets in Bitcoin. He has recommended his clients include Bitcoin futures in their portfolios, calling the cryptocurrency not only the “fastest horse” but also a hedge against central bank policy.

Most Influential DeFi / CeFi Figure:

Hayden Adams

Uniswap

Despite skepticism about decentralization, the Uniswap protocol rose to the top of the DeFi sector and leads the Defi Pulse ranking by total value locked. This was helped by the release of Uniswap v2, the $11 million in investments received, and, of course, the launch of its governance token UNI UNI. In August, daily volume on Uniswap first exceeded that of Coinbase, the largest U.S. exchange.

Stani Kulechov

Aave

Lead platform Aave remains a major DeFi player and sits among the top five by value locked. In October Aave received $25 million in investments from Blockchain Capital, Standard Crypto and Blockchain.com to develop institutional lending. Earlier, the project raised $3 million via token sales of LEND to Framework Ventures and Three Arrows Capital.

Sergey Nazarov

Chainlink

Under Sergey Nazarov, Chainlink has become a central component of the DeFi sector. Its price oracles are extensively used and have become an industry standard. The project occupies a niche with little competition, effectively creating a monopoly in this space.

Aleks Mashinsky

Celsius Network

Aleksandr Mashinsky is known for pioneering protocols and algorithms for IP-based voice communications, now immersing himself in crypto and leading Celsius.Network—a lending platform aiming to provide financial services to the public. He argues that fully decentralised solutions cannot meet all needs, and Celsius should bridge the centralized and decentralized worlds.

In the summer, Celsius Network conducted a crowd-funding drive, raising more than $20 million.

Robert Leshner

Compound

Led by Robert Leshner, the lending platform Compound rose to become a leader in the DeFi sector this year. The company Robot Ventures raised $4 million for its second fund, aimed at developing DeFi projects.

André Cronye

Yearn Finance

Yearn Finance, focused on yield farming, burst onto the DeFi scene in July. In just a week after launch, the YFI token surged from $34 to $4,500 and later peaked at $43,678 in September after a rollercoaster ride. Opinions vary on yield farming and the issuance of “useless” tokens, but Crony certainly left a mark on DeFi history.

Anton Bukov

1inch.exchange

Anton Bukov advances the popular DEX aggregator 1inch. He has been developing software since 2002 and is a MakerDAO, Set Protocol and Kyber Network hackathon medalist.

Most Influential Analyst:

Plan B

author of the Stock-to-Flow model

Under the pseudonym Plan B, a member of an institutional investors team with assets under management of about $100 billion, who holds a doctorate in financial mathematics and endured the 2008 crisis, began exploring non-correlated assets (a kind of “Plan B”). Since 2015 he has gravitated toward investing in Bitcoin.

Plan B has repeatedly stated that his Stock-to-Flow model—used by gold investors—will prove correct, with predictions that Bitcoin will rise to $100,000 by the end of 2021. The concept has drawn criticism, but Plan B has revised his forecast upward: a rise to about $288,000 with a $5.5 trillion market cap.

Nik Carter

Coin Metrics

In 2018, Castle Island Ventures partner and Coin Metrics co‑founder Nik Carter argued that market capitalization is an irrational and inaccurate metric for bitcoin’s capital that is locked up in the market. He proposed an alternative: realized capitalization, based on aggregating UTXOs with value calculated at their last activity.

This year Coin Metrics proposed new methods for measuring Bitcoin’s hash rate—CMBI Bitcoin Hash Rate Index and the Observed Work metrics—providing a more current, accurate, and manipulation‑resistant picture than traditional methods. These metrics have underpinned futures contracts based on Bitcoin’s hash rate, letting traders profit from network growth rather than price fluctuations.

Mike McGloun

Bloomberg Intelligence

Bloomberg Intelligence commodity strategist Mike McGlone specializes in macro factors capable of catalyzing growth or triggering price drawdowns for the world’s most popular crypto assets, including Bitcoin. Among his forecasts is a Bitcoin price above $20,000 by year‑end. He calls Bitcoin a leader in the “shift toward digital money and a store of value” and sees a low probability of competing scenarios.

Ryan Selkis / Ryan Watkins

Messari

Messari, a research and data platform, has established itself as a key source for up-to-date market data. Its analytics, metrics and research reports are the result of a painstaking effort by the Messari team, with Ryan Selkis at the helm and Ryan Watkins serving as head of research at the company.

Larry Chermak

The Block

The head of The Block’s research department, Larry Chermak, is another respected voice in the crypto world. His regular analytical reports help assess both the industry’s broader state and its narrower aspects, including on‑chain metrics and exchange dynamics.

Mike Grenager

Chainalysis

Chainalysis is known not only for its tools to trace the origin of crypto transactions but also for its insightful research. Among its outputs are the Global Crypto Adoption Index, published in September, which ranks Russia and Ukraine among the most active crypto-using populations, and Geography of Cryptocurrency Report, naming Eastern Europe as a region with high dark web activity.

Isaac Schwartz

Goldfoundinshit TM

Isaac Schwartz is the creator of the analytical Telegram channel Goldfoundinshit.

Before entering the crypto industry he worked as a communications engineer and technical specialist at a mobile operator’s affiliate.

Leader of Opinion:

Jack Dorsey

Twitter / Square

CEO of Twitter and payments company Square, Jack Dorsey, has long expressed his love for Bitcoin, seeing it as the internet’s native currency. He backs his words with action: Square invested roughly 1% of its capital (about $50 million at the time) in Bitcoin, and its crypto division funds developers through grants. Twitter also became the first social network to add the Bitcoin emoji.

Pavel Durov

Telegram

The creator of the popular messaging app experienced a setback with the Telegram Open Network blockchain platform but pressed on with his clash against Roskomnadzor, which ultimately rejected attempts to shutter the resource.

Nevertheless, he remains convinced that the Digital Resistance movement continues, and having criticized Apple for blocking certain channels (Apple disputed Durov’s claims), he urged developers to fight censorship abroad. Telegram has demonstrated anti-censorship tools for users in Belarus.

Anthony Pompliano

Morgan Creek Digital

Co‑founder of Morgan Creek Digital Anthony Pompliano is a staunch Bitcoin advocate, arguing its superiority to gold. He believes Bitcoin’s market cap will surpass that of gold by 2030, and claims to have allocated about 80% of his assets to the first cryptocurrency.

Ton Veis

Analyst, Trader

ForkLog Live’s resident Ton Veis does not hide his faith in Bitcoin’s supremacy over other cryptocurrencies and counts himself among the “shitcoin minimalists.” In his view, the absence of a top dog should anger people enough to sell Bitcoin—this may become the trigger for its rapid ascent in the future. He regards popular DeFi projects as Ponzi schemes.

Aleksei Kirienko

Managing Partner, Exante

Aleksei Kirienko is a sharp critic of global regulatory actions and convinced that the cryptocurrency money-laundering theory is flawed. Bitcoin, he says, is not used for money laundering in the classic sense; such activities pertain to the banking sector. He has previously argued that Bitcoin is among the safest assets and should have a place in every investor’s portfolio.

Steve Forbes

Editor‑in‑Chief, Forbes

Forbes editor‑in‑chief, a member of the Forbes family, has joined the ranks of Bitcoin supporters. He calls cryptocurrencies a hedge against unstable government policy and a technologically advanced cry for help. Bitcoin gains special relevance when governments resort to free credit and quantitative easing to revive economies.

Artом Kozliuk

RospolnSoveta

Artem Kozliuk heads the public organization RosKomSvoboda and is a staunch advocate for privacy rights, including online privacy.

According to him, digital rights are increasingly violated under the pretext of fighting the coronavirus, and the range of technologies used to monitor behaviour continues to expand. RosKomSvoboda campaigns include BanCam (against facial recognition systems), Pandemic Big Brother (monitoring digital rights during the pandemic), and LegalBitcoin (lobbying for legalization of cryptocurrencies).

Mikhail Chobanyan

Kuna

Founder of the Kuna cryptocurrency exchange, Mikhail Chobanyan is not only a participant in discussions about the industry’s future in Ukraine but also takes an active civic stance. In September Kuna rejected a request by the Belarusian Financial Investigations Department asking for information about the “Belarusian Solidarity Fund,” which pays compensation in Bitcoin.

Antagonist of the Year:

Kraig Rayt

Bitcoin SV / nChain

The Australian Craig Wright, who proclaims himself the creator of Bitcoin, has failed to win over the community, yet presses on with the Bitcoin SV project and is linked to numerous scandals, including the Kliment v. Wright lawsuit.

Jihan Wu and Micri Zhang

Bitmain

Co-founders Jihan Wu and Micree Zhan of Bitmain have waged an internal corporate war for control of the world’s largest producer of ASIC miners.

Justin Sun

Tron Foundation

Justin Sun’s year has been marked by scandals. His well-intentioned attempts to win Warren Buffett over to crypto were overshadowed by a Steem controversy, the US government’s grant of $2 million to Steem community support during the pandemic, and a refusal to pay the promised $1 million reward for information about Twitter’s hack.

In The Verge’s investigation, it says that in pursuit of profit, Justin Sun is willing to compromise morals; some critics call his business model a “brothel marketing” approach rather than technology-driven innovation.

John McAfee

Entrepreneur John McAfee is remembered for his famous promise to eat his own penis if Bitcoin does not rise to $500,000 in 2020.

McAfee’s life has been a string of incidents and scandals, culminating in his arrest in October after the U.S. SEC brought charges for promoting ICOs on Twitter, along with allegations from the DOJ of tax evasion.

Peter Schiff

Investing in Gold

One of the most famous Bitcoin critics, Peter Schiff, began the year by claiming he lost access to his Blockchain wallet. It later emerged that he confused his PIN with his password, and he has no seed phrase backup.

Yet his frequent remarks that Bitcoin cannot be considered a safe haven continue to attract attention. He argues that only gold possesses such properties and even questions investors’ smarts. By the end of October, Bitcoin’s price had risen more than 80% since the start of the year, while gold was up about 26.3%.

Schiff was later accused of involvement in wrongdoing related to the Euro Pacific Bank and providing banking services to criminal syndicates and tax evaders.

Grem Clark

A Twitter hacker who breached the platform

One of the year’s most high-profile events was the Twitter hack. Forty-five high‑profile accounts were compromised.

The main suspect was 17‑year‑old Graham Clark from Florida. The teenager was charged with 30 counts, including organized fraud, improper access to computer systems and personal data theft. State authorities also say the breach involved the theft of Bitcoin worth about $120,000. If found guilty, he could face up to 200 years in prison.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!