Uniswap, the largest non-custodial exchange, raised $11 million in investment

Uniswap, the largest non-custodial exchange, raised $11 million in investment. This follows from data in Формы D, filed with the U.S. Securities and Exchange Commission (SEC). The information citing the document was shared by Twitter user devops199fan.

.@UniswapProtocol sold $11MM in securities on 6/5/20, congrats @haydenzadams! 🕵️

info is publicly available in their SEC Form D filing 🧐

notice any other interesting EDGAR filings recently? 🤔

cc @Arthur_0x @DegenSpartan @Rewkang

full notice 👇https://t.co/j8ffLkTjCi pic.twitter.com/HAsGxfloSX

— devops199fan 🔪📜😅 (@devops199fan) August 6, 2020

Funds from 12 unnamed investors were raised by the company behind Uniswap on June 5. The influx of new investments came less than a month after the launch of the second version of the decentralized platform.

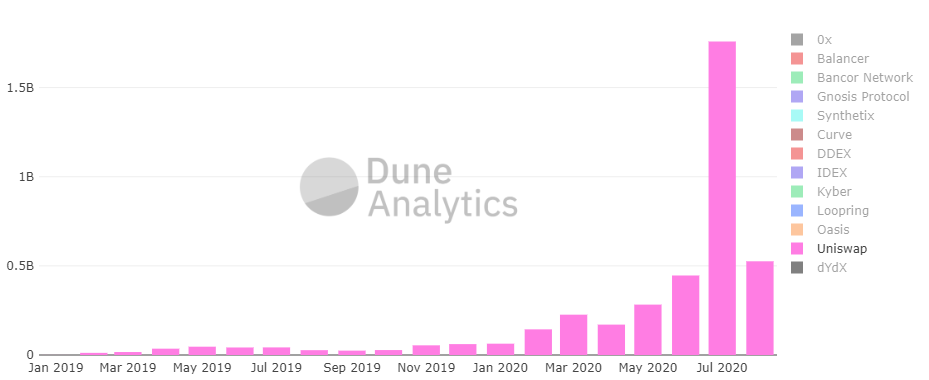

According to Dune Analytics, trading volume on Uniswap has been rising rapidly in recent months.

In July, Uniswap’s turnover exceeded $1.75 billion.

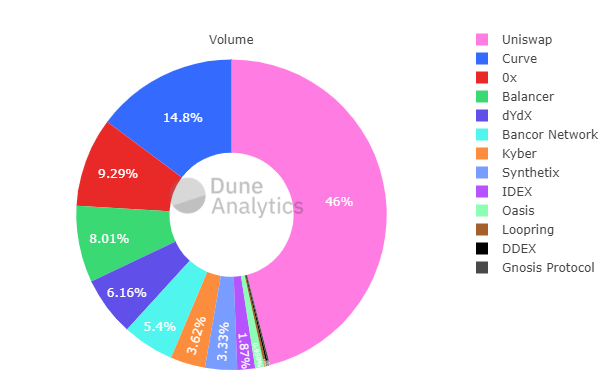

On the chart below you can see that Uniswap has the largest market share in the DEX segment.

Earlier, ForkLog reported that in the network появилось several fake clone sites of the Uniswap exchange, through which criminals steal cryptocurrencies.

Subscribe to the ForkLog channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!