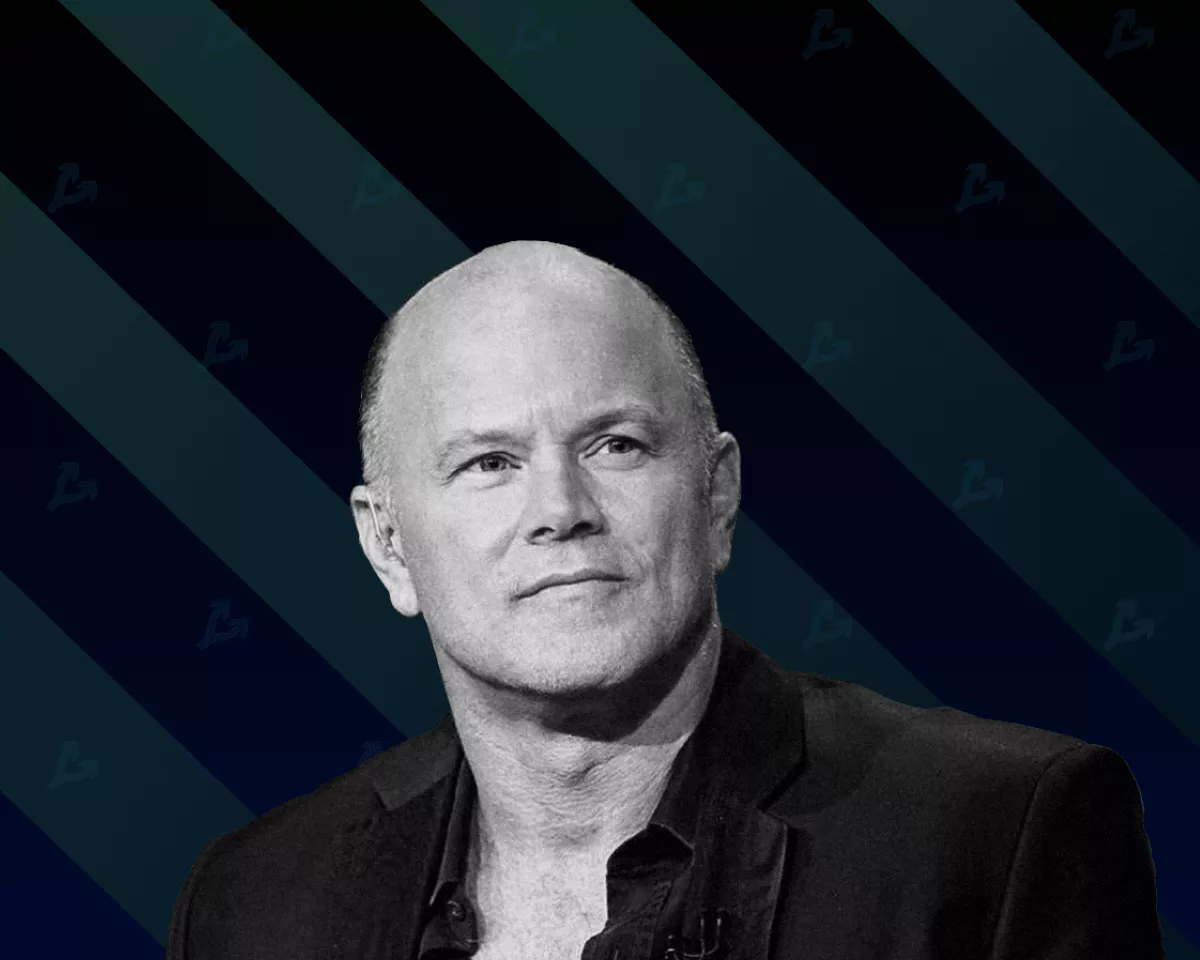

Galaxy Digital acquires DrawBridge Lending and Blue Fire Capital

Galaxy Digital, led by Mike Novogratz, acquired DrawBridge Lending and Blue Fire Capital. The acquisition will allow the crypto bank to broaden its trading solutions and strengthen its expertise in lending and derivatives, according to the press release.

DrawBridge Lending is positioned as an innovator in the areas of crypto lending and structured products. The company is registered with the Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA) and as a commodity pool operator (CPO).

Blue Fire Capital is a dealer on the cryptocurrency market and specializes in market-making functions.

According to Galaxy Digital representatives, the annual over-the-counter (OTC) volume of digital asset trading exceeded $4 billion. The bank’s clients number 200 companies.

“Over the past two and a half years, the Galaxy Digital Trading team has been working on implementing the roadmap. We have been able to enhance our capabilities in order execution, liquidity provision, and the range of services in the context of spot trading and derivatives. The acquisition of DrawBridge Lending and Blue Fire Capital is the next important milestone,” — said Peter Vishnevsky, co-head of Galaxy Digital Trading.

Galaxy Digital also reported financial results for the third quarter. Net total revenue for the period reached $44.6 million. The figure for January–September stood at $58.4 million.

Trading revenue of the bank’s trading division for July through September rose 75% year on year to a bank-record $1.4 billion. Growth was driven by deals with 30 new clients, the launch of an electronic trading platform, and increased activity in the crypto derivatives market.

Assets under management at Galaxy Digital Asset Management rose to $407.4 million by the end of the reporting period. At the start of the year, the figure stood at $90.5 million.

The assets under management of the passive Bitcoin fund and various index funds reached $82.4 million.

The return of the Bitcoin fund tied to the Bloomberg CFIX index was 17.3%. The Galaxy Crypto index fund linked to a basket of the most liquid cryptocurrencies rose 32.2%.

In October Galaxy Digital announced plans to provide financial services to Bitcoin miners.

In late September, Mike Novogratz’s merchant bank became a minority shareholder of ParaFi Capital. The partnership envisages joint investments in the DeFi sector.

Subscribe to ForkLog news on Telegram: ForkLog FEED — all the news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!