Mike Novogratz Warns of Risks for XRP and Cardano

Tokens like XRP and Cardano must prove their utility or risk losing to competitors, says Novogratz.

Tokens like XRP from Ripple and Cardano (ADA) must demonstrate their real utility, or they risk losing to more successful competitors, according to Galaxy Digital CEO Mike Novogratz.

In a conversation with Head of Research Alex Thorn, the company head noted that the crypto market is shifting from “narrative-based tokens” to those with a business foundation.

With each market cycle, investors have more options, making it harder to maintain community engagement. Tokens that survive solely due to a loyal user base will lose out to those that generate profit and provide measurable value, Novogratz emphasized.

In his view, likely winners will be Bitcoin, which has already established itself as money, and protocol coins that truly become platforms for building businesses.

“Charles Hoskinson, bless him, has maintained the Cardano community despite the blockchain not being widely used. They have a strong community, as does XRP. Can they maintain it as more and more options appear?” Novogratz pondered.

He cited the token Hyperliquid as an example of an asset with obvious value. The exchange directs 98% of profits to buy back and burn HYPE, which acts as an investment similar to stocks.

“I believe this is the future of tokens. You’ll see good coins trade successfully, just like quality real assets,” said the Galaxy co-founder.

Novogratz predicts that the industry will undergo a transformation over the next one to three years. During this period, crypto exchanges and wallets will evolve into neobanks offering stablecoins, tokenized stocks, and money market products.

In September, the entrepreneur admitted that he underestimated the resilience of XRP — he did not expect the token to survive the lawsuit by the U.S. Securities and Exchange Commission against Ripple. The litigation lasted more than four years.

However, questions regarding the real application of the token from the California fintech company in the industry are raised regularly.

In November, doubts about XRP’s utility were expressed by VanEck’s Head of Digital Asset Research Matthew Sigel and The Wolf Of All Streets podcast host Scott Melker. At that time, Ripple’s CTO David Schwartz confirmed that the token’s concept does not provide for passive income. XAO DAO co-founder Santiago Velez clarified that the asset’s primary function is to serve as a neutral intermediary currency for settlements.

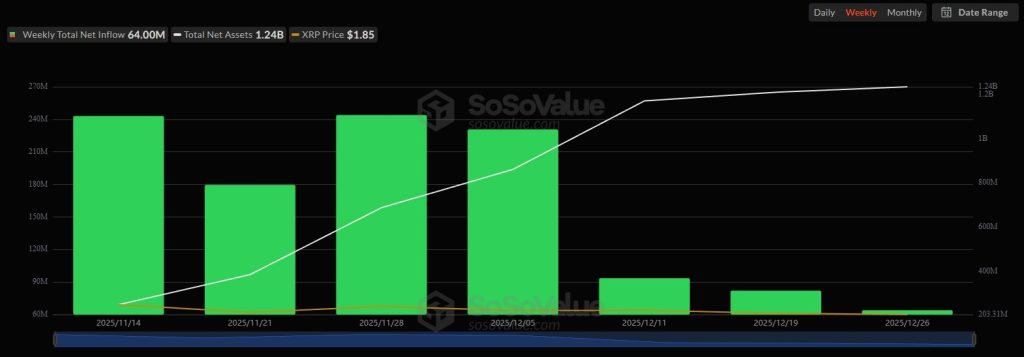

On November 13, the U.S. saw the launch of a spot ETF based on XRP from Canary Capital. The debut session’s turnover of $58 million was the best among all exchange-traded funds launched this year. After the launch, the products did not record a single week of fund outflows, unlike market leaders based on Bitcoin and Ethereum.

Analysts Do Not Bet on Rapid XRP Growth

Ripple’s token prices are expected to continue consolidating in the new year, with the strengthening of the upward trend depending on additional catalysts, according to experts surveyed by Cointelegraph.

“We still believe that the second half of 2026 will provide more favorable conditions for risk assets in general. In the short term, we see a bearish sentiment towards altcoins until BTC consolidates or forms a bottom,” said Nansen Senior Analyst Jake Kennis.

He refrained from predicting specific price levels for XRP but highlighted several positive factors for the coin:

- approval of spot ETFs;

- integration with global payment systems;

- increased efforts to transform the token into a “liquid intermediary asset.”

CEO of Posidonia21 Capital Partners Jesus Perez also suggested a sideways trend for XRP at the start of the year.

“Growth potential is likely to depend more on the resilience of the narrative and market sentiment than on fundamental transformations,” he added.

A potential driver could be the introduction of staking. However, discussion of the mechanism for additional income in XRP is still at an early stage, Perez noted.

Back in the day, on-chain sleuth ZachXBT compared the operational models of Ripple, Cardano, and Hedera to financial pyramids.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!