Glassnode assesses scale of on-chain flows tied to FTX, Alameda Research and Binance

In the wake of the events surrounding FTX, Glassnode analysts conducted a study of the scale and interconnections of on-chain flows over the last year, tied to FTX, Alameda Research and Binance.

With the recent collapse of the #FTX exchange, we have undertaken studies to assess the scale and relationship of on-chain flows over the last 1yr.

The following thread covers 🧵

— Fund flows between #FTX, #Alameda, #Binance

— The complete decline of #FTX exchange reserves— glassnode (@glassnode) November 9, 2022

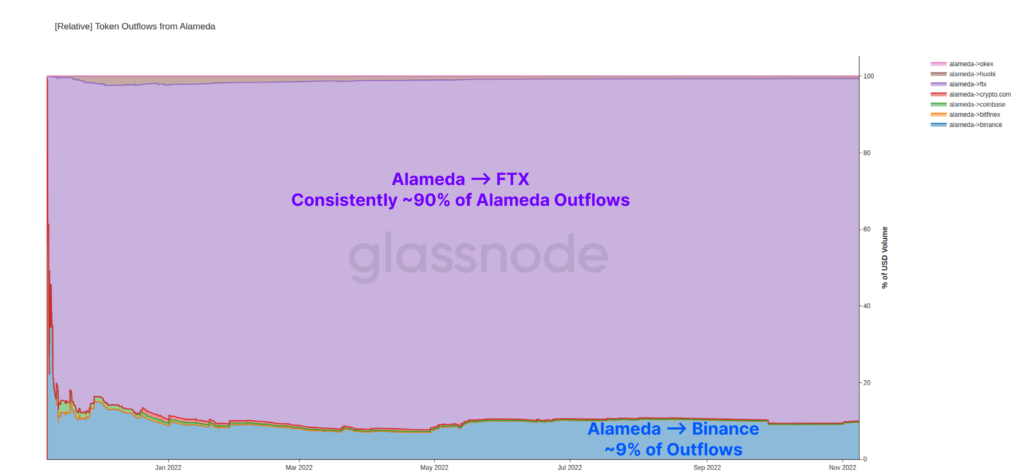

Over the analysed period, Alameda Research’s Ethereum wallets interacted predominantly with FTX (~90% by weighted volume) and Binance (~9%).

In examining deposits to FTX, Sam Bankman-Fried’s trading firm proved the largest among all entities. Since November 8, 2021, Alameda Research had deposited onto the exchange’s addresses digital assets valued at more than $49 billion.

Typically, inflows stood at around $200 million. They were often stablecoins (USDC, DAI, USDT and HUSD), Ethereum and WBTC.

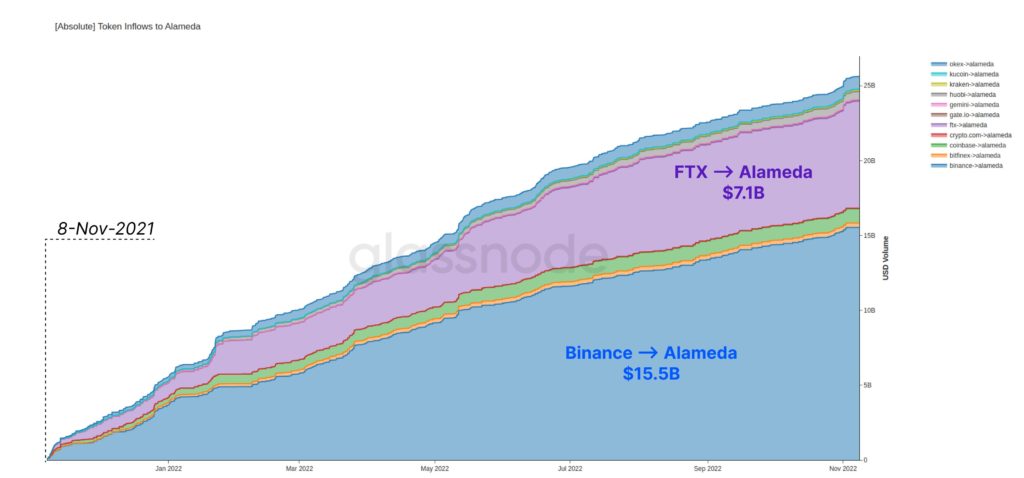

When considering deposits to Alameda Research, analysts detected a shift in activity toward Bankman-Fried’s exchange. From its wallets, $7.1 billion flowed in. $15.5 billion went to Binance.

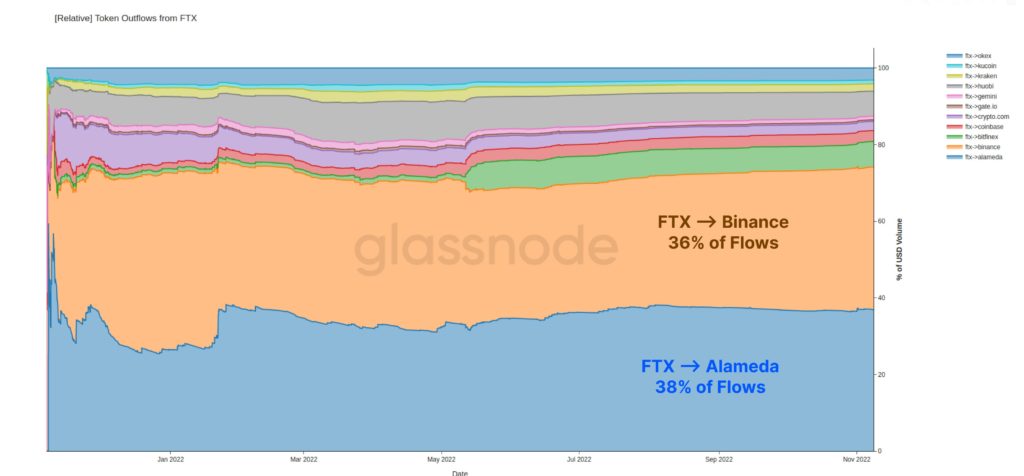

Experts also assessed the dominance of Alameda Research and Binance in terms of funds flowing from FTX to other exchange platforms. Their shares stood at 38% and 36%, respectively.

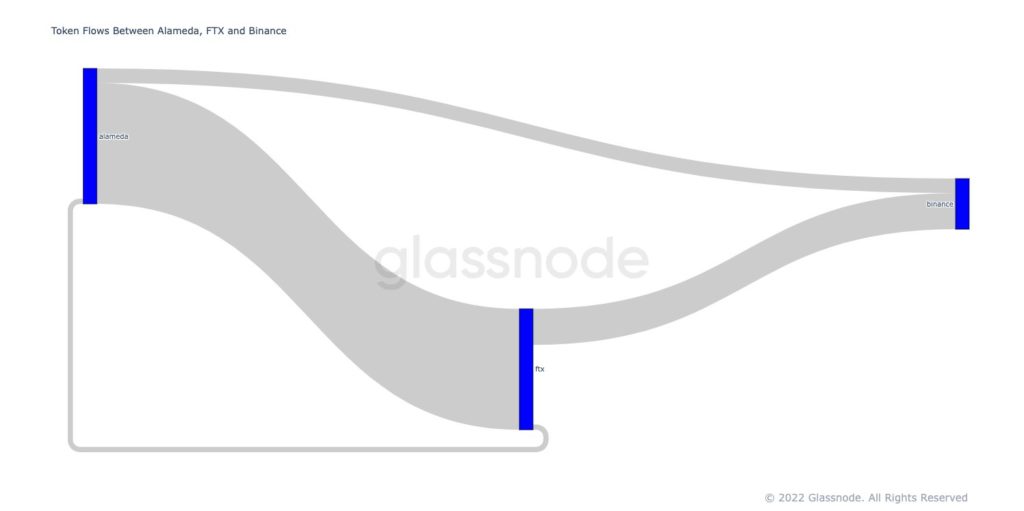

Experts suggested that Alameda Research acted as an intermediary in transfers between Binance and FTX. The platforms served as the firm’s main trading venues.

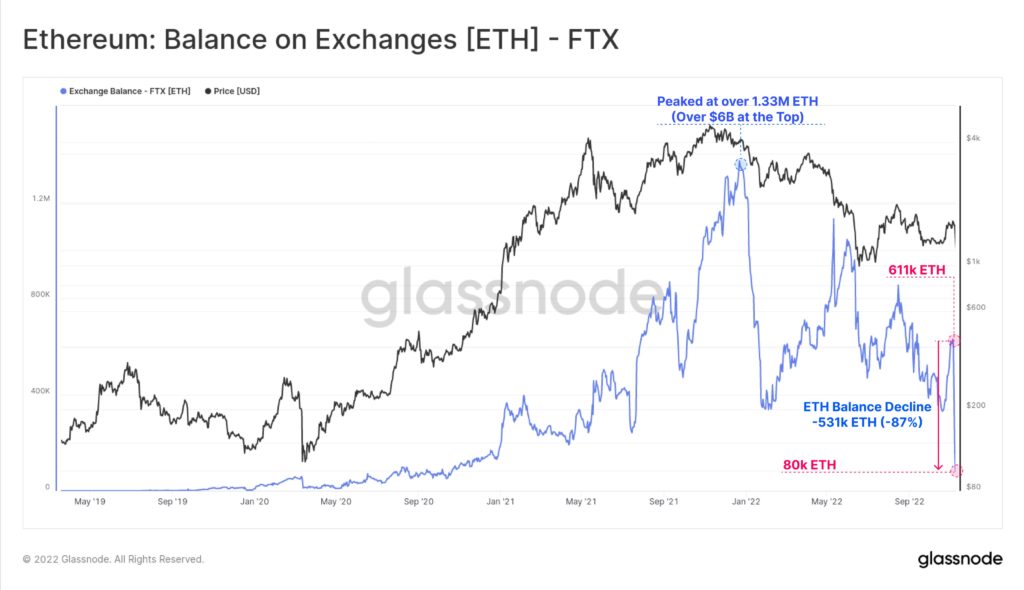

Within two days of the study, FTX’s reserves in Ethereum nearly dwindled to zero. The balance fell from more than 611,000 ETH to 80,000 ETH.

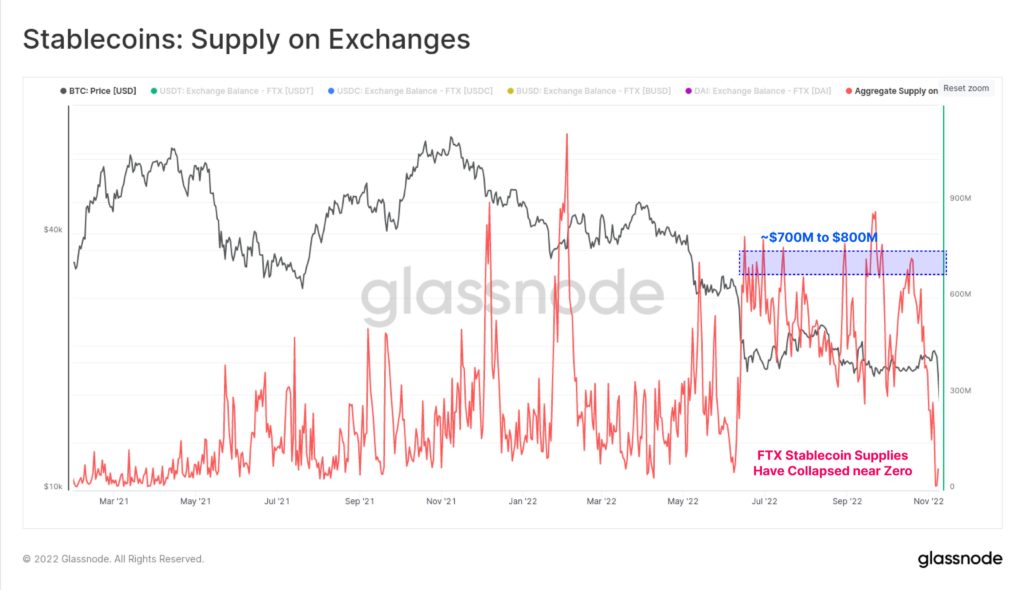

For stablecoins, the metric also collapsed to zero from around $700-800 million observed in mid-October.

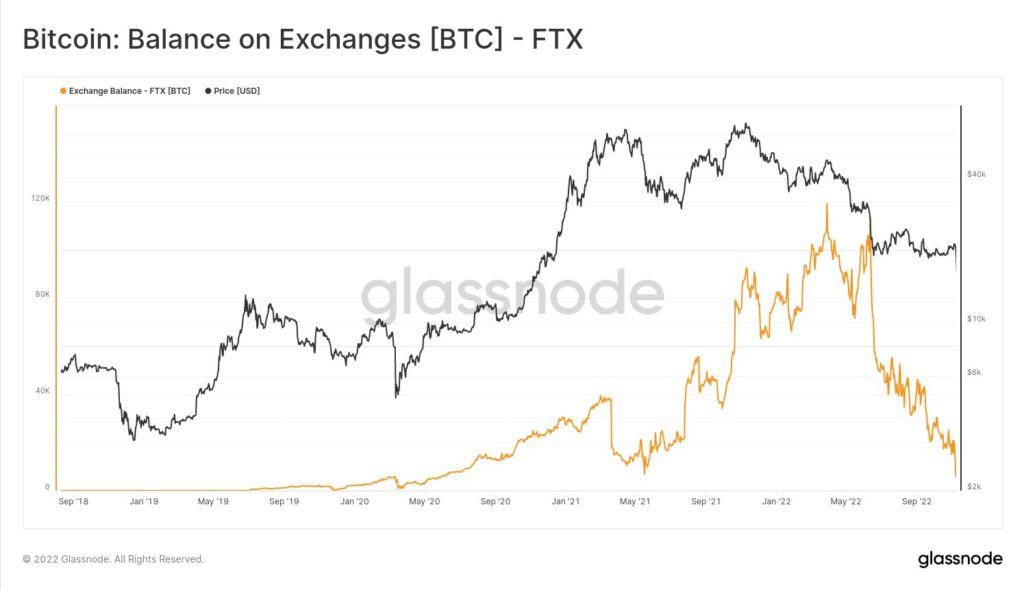

The reserves of the leading cryptocurrency also showed a similar dynamic — from 108,000 BTC at the end of March, the balance fell almost to zero. The trend formed immediately after Terra ecosystem collapse.

“The problems surrounding FTX have been an extremely complex event for the market, with hits to prices, investor confidence and consequences yet to be assessed”, the specialists concluded.

Earlier, Coin Metrics suggested that a possible reason for FTX’s collapse could have been a large financial aid, which the company extended to Alameda Research in Q2 2022.

Recall that on 10 November Binance disclosed information about the exchange’s cryptocurrency reserves without a broad announcement.

Against the backdrop of FTX’s insolvency-driven turbulence, Binance raised its SAFU fund to around $1 billion.

Read ForkLog’s Bitcoin news in our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!