Glassnode: Investors pull Bitcoin from centralized exchanges en masse

Against a backdrop of rising Bitcoin prices, investors continued moving the cryptocurrency into long-term storage. Over the past month, 270,000 BTC were withdrawn from liquid wallets. Data from analytics firm Glassnode.

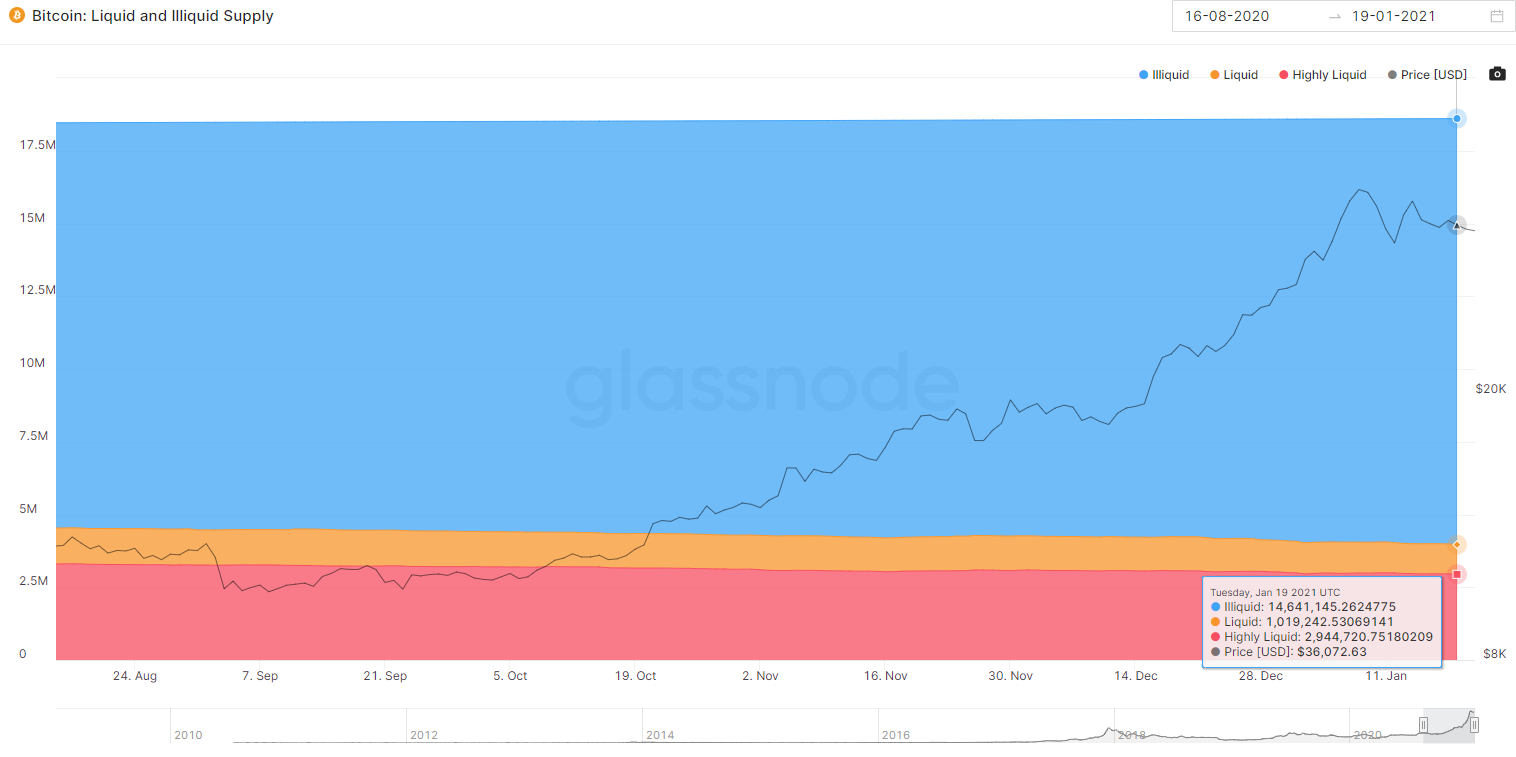

Experts noted that Bitcoin’s liquid supply has been steadily shrinking over the last nine months. At the time of writing, the indicator stands at 21.3% of the total coins in circulation. 78.7% of the 18.6 million BTC issued are in “illiquid” wallets.

This $BTC chart might be more important than the price chart: bitcoin supply is being withdrawn from exchanges at an all-time-high pace.

Historically, bull cycles have ended AFTER liquid supply change flips positive (🟡)

That flip has not happened yet.

h/t @glassnode pic.twitter.com/NYWzlCdHAY

— Luke Martin (@VentureCoinist) January 20, 2021

“This Bitcoin chart is more important than the price chart. Bitcoin is being withdrawn from exchanges at record pace. Historically, bull cycles ended with liquidity expansion. But this has not happened yet,” wrote analyst Luke Martin.

Glassnode defines a Bitcoin wallet as illiquid if, over its lifetime, less than 25% of its assets have been withdrawn. Accordingly, wallets that have preserved less than 25% of the coins deposited are considered highly liquid.

Dynamics of liquid and illiquid Bitcoin supply. Data: Glassnode.

Statistics from Glassnode show that 61% (2.38 million BTC) of the 3.9 million highly liquid BTC are held on centralized exchanges. The figure has been steadily falling — according to CryptoQuant, exchange balances have declined by 13.8% since July.

Institutional interest in the leading cryptocurrency is also rising. According to Bitcoin Treasuries, whales now hold more than 1.2 million BTC — 6.5% of all issued Bitcoin.

In the past year, institutional investors purchased more than 1 million BTC. Among them: Grayscale Investments (600,000 BTC), MicroStrategy (70,470 BTC), Ruffer Investments (45,000 BTC) and Square (4,709 BTC).

As noted in the Ruffer Investments overview, bitcoin is in the early stages of institutional adoption.

Earlier, JPMorgan analysts said that institutions have begun to view bitcoin as an alternative to gold.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!