Grayscale Bitcoin Trust up 220% since January, outpacing Nvidia shares

Since the start of the year, Grayscale Investments’ GBTC has surged 220%, Nvidia, the leader in the S&P 500, up 198%. The stock-market indicator rose 9% over this period, according to CoinDesk.

Bitcoin doubled in price to $35,000, while traditional fixed-income instruments delivered losses to holders.

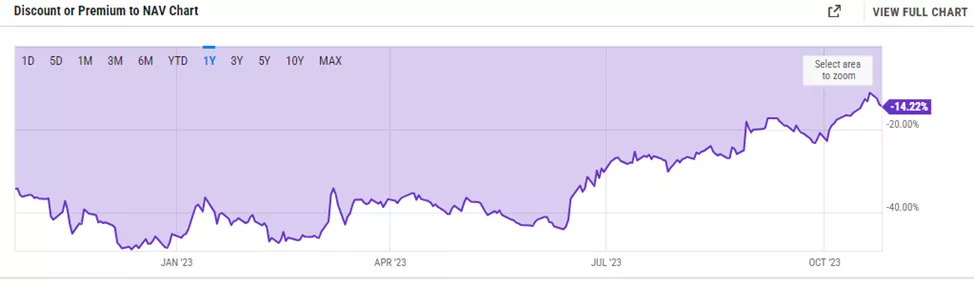

The GBTC discount to NAV narrowed to 14.22% amid expectations of launching ETF based on the first cryptocurrency. At the start of the year, the figure stood at 48.31%.

The situation was sharply changed by the filing in July by BlackRock for the launch of a Bitcoin ETF. After that, Grayscale Investments’ GBTC quotes rose by 57%, and the discount to NAV narrowed from 41.7% to 29.3%.

The continued momentum in recent days was aided by the SEC’s lack of an appeal against the decision in the Grayscale case.

At the end of August, a U.S. court granted the asset-management company’s in a suit against the regulator for refusing to convert GBTC into a digital-gold-based ETF.

The appellate court ordered the Commission to reconsider its decision.

In recent days, a U.S. court officially approved the verdict, according to which the SEC must reconsider Grayscale Investments’ application to convert the Bitcoin Trust into a spot ETF based on the first cryptocurrency.

“GBTC is a gift that keeps on giving. Congratulations to those who have managed to narrow the spread by trading against futures,” — said Marex Solutions’ co-head of digital assets Ilan Solot to the publication.

Alexander S. Blum, managing partner at Two Prime Digital Assets, pointed to positive prospects for Bitcoin thanks to the expected final realisation of arbitrage opportunities in the product.

“Since approval of converting GBTC to ETF seems increasingly likely, investors know that market makers will revert quotes to NAV […]. As a result, it seems likely that pressure on short positions in futures on digital gold will ease and support upside pressure on its spot price,” — explained him.

In October, JPMorgan projected a reduction in Grayscale’s management fee for the product and the neutralisation of its discount to NAV after its conversion to an ETF.

Earlier, Matrixport analysts forecast growth in digital gold as a result of the instrument’s approval to $42,000–$56,000. CryptoQuant recorded values of $50,000–$73,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!