Is a New Bitcoin Hard Fork Really Possible?

Knots vs Core tensions flare as OP_RETURN limits spark fork rumors—and fears of censorship.

Since April 2025 a conflict among Bitcoin developers has split the community into two camps. One backs the alternative Knots client, which takes a hard line on protecting mining decentralisation and fighting spam on the blockchain of the first cryptocurrency. The other trusts Bitcoin Core and believes the network is heading in the right direction.

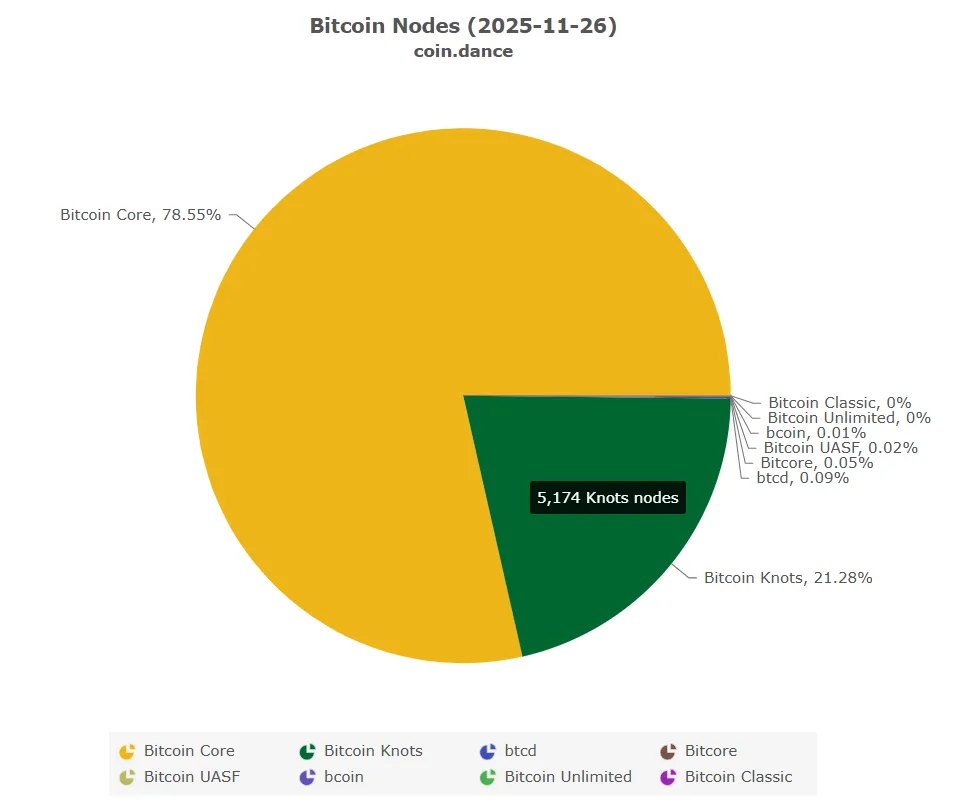

Tensions escalated after the ambiguous release of v30, which removed the limit on relaying data within a block. In November an unprecedented 21% of nodes backed the “filterers”.

Constant skirmishes on social media spawned rumours of a possible soft—or even hard fork—of Bitcoin. The last time the question felt this acute was in 2015–2017, during the “blocksize war”, which ultimately produced the separate Bitcoin Cash chain.

ForkLog has examined the arguments on both sides to assess how realistic a new fork of the first cryptocurrency might be.

A tireless sentinel

Luke Dashjr, the head of the Knots team, is known as one of the fiercest critics of Bitcoin Core. He began his campaign to safeguard Bitcoin’s values in 2019, when at the Magical Crypto Conference he warned the community about the problems that could arise if block sizes were allowed to grow unchecked.

Dashjr has often used the dramatic phrase “an attack on Bitcoin”. He has pointed directly to centralisation of decision-making and alleged disregard for community consensus. In 2021 his criticism focused on disagreements over node synchronisation during the upgrade to software supporting Taproot.

His criticism intensified in 2023 as “inscriptions” took off, laying the groundwork for the Ordinals protocol. The sticking point became what he saw as non-purpose use of Bitcoin and the risk of “cluttering” it with NFT spam. The community in turn accused him of trying to censor the blockchain.

Dashjr was also for a long time the sole editor of Bitcoin Improvement Proposals (BIPs), a role he earned thanks to his large contribution to building the ecosystem of the first cryptocurrency.

However, in April 2024, at the initiative of Bitcoin Core lead developer Ava Chow, a replacement from a group of contributors was proposed. According to her, the responsibility and workload were too great to rest on one person’s shoulders.

“One of the big frustrations was that Luke would leave a comment like: ‘Hey, you need to fix this thing,’ and the author would literally fix it within a few hours. But then we wouldn’t see Luke again on that Pull Request for another month or two,” — explained Chow in 2023.

Her remarks suggested strained relations within the team, and that Dashjr’s criticism was likely slowing the implementation of complex smart contracts and the development of, for example, L2 and BTCFi.

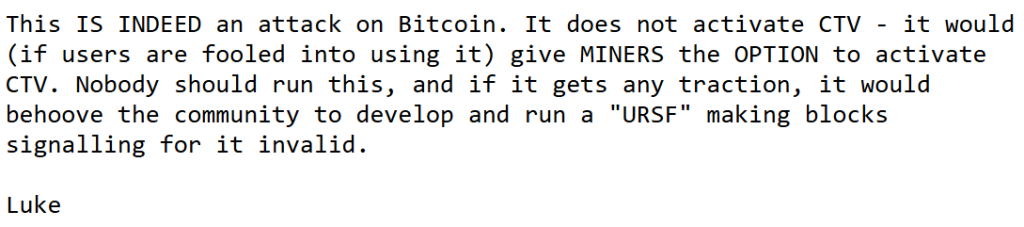

Thus, in 2023, responding to Jeremy Rubin’s proposal to use covenants to create programmable transactions Check Template Verify (CTV), he again declared a deliberate threat to the digital-gold network.

As a countermeasure, Dashjr proposed responding with a user-requested soft fork, under which nodes could publicly reject blocks that support CTV.

The temperature rose again in spring 2025, when discussion began on increasing the data-relay limit in OP_RETURN outputs from 80 to 100,000 bytes.

On 27 April Peter Todd submitted Pull Request (PR) #32359 to Bitcoin Core. The proposal scrapped all limits on OP_RETURN output sizes and formalised an initiative by Antoine Poinsot of Chaincode Labs.

Both programmers saw little point in limits, arguing that users had long found many workarounds. And constraints were hampering the development of new functionality in the first cryptocurrency.

Although Todd’s proposal was closed on 12 May, it made its way into the October Bitcoin Core v30 release.

Knots at the ready

In response, Dashjr urged preserving the limits and either staying on older Core versions or switching to his Bitcoin Knots client, which enforces a strict OP_RETURN cap of 42 bytes.

Knots, like other forks of the main software, does not violate consensus rules and remains fully compatible with today’s Bitcoin network. Such forks adapt the code to developers’ views and preferred use-cases for the first cryptocurrency.

Bitcoin Knots, previously known as Bitcoin LJR, was launched by Dashjr in 2011. He likely borrowed the name from the biblical episode in which Jesus Christ chased merchants from the temple with a whip of knots (a shepherd’s scourge). This theory was put forward by Bitcoin Magazine’s editor-in-chief, Aaron van Wirdum. As a Catholic, the programmer was hinting, he said, at unifying code as well as protecting the community from bad actors.

Before being renamed Bitcoin Knots, the software partly served as a testbed. Dashjr often introduced optimisations that later landed in Core. Since 2011 the target audience for the custom code has broadened and the rules have become more conservative. Only improvements deemed “safe enough” make the cut.

Knots offers more options for node operators and miners. They get a host of extra settings for censoring transactions and combating spam.

The burgeoning confrontation has not helped Core. In May Knots-powered nodes were around 10%; at the time of writing, their share has exceeded 21% and continues to grow.

Activity by individual programmers has also tilted the scales further towards Knots.

In late October a Bitcoin developer under the nickname dathonohm proposed BIP-444, which would temporarily restrict the ability to add arbitrary data to the blockchain to reduce the risk of illegal content. Implementing it would trigger a soft fork, making previously valid transactions invalid for one year.

Dashjr supported the initiative as a temporary measure, saying it “aligns with the strategic course and has no technical obstacles”. The cypherpunk Nick Szabo, whose work helped inspire Bitcoin, also sided with Knots.

The split persisted: many participants still saw no point in the “improvements”.

Underhand tactics or necessary measures?

Beyond curbing uncontrolled spam, Knots supporters raised the spectre of illegal and otherwise sensitive content that could be embedded forever in the blockchain, exposing archival node operators to risk. On social media, fears coalesced around the possible inclusion of undeletable CSAM.

On 6 October Dashjr accused the largest mining pool, F2Pool, of actively attacking the Bitcoin network and urged the community to act. The allegation centred on the intentional spread of CSAM on Bitcoin to tarnish its reputation.

“If miners are in a malicious pool—change pool, switch to Foundry or Antpool or even mine your own blocks, because if content like CSAM gets into the network, the consequences will be irreversible,” said Dashjr.

In his view, the only way out was a soft fork.

Core supporters on social media argued that even if such content does not exist, publicising it would all but ensure it appears.

Another lever for Knots is the Ocean mining pool, where Dashjr is CTO and co-founder alongside Twitter’s creator Jack Dorsey. The platform incentivises miners to ignore non-financial transactions by charging fees.

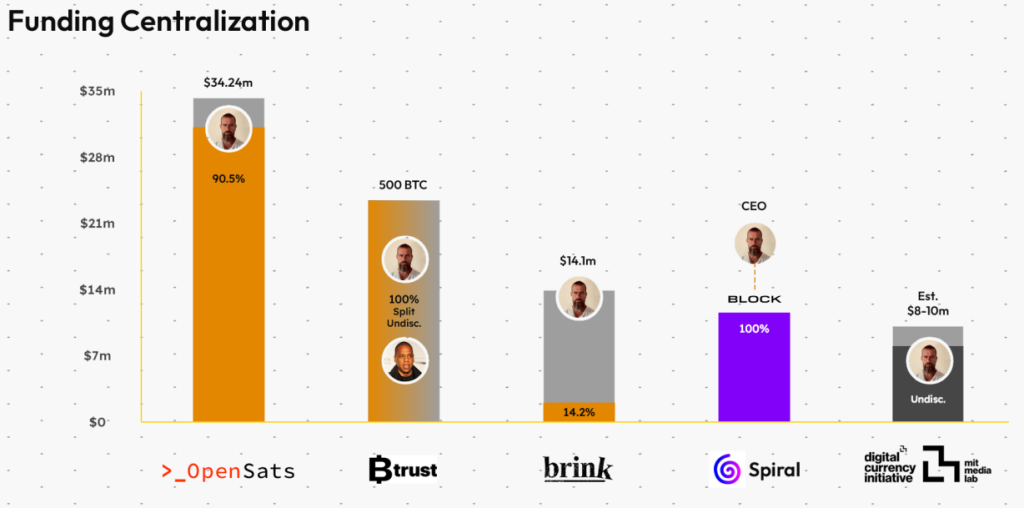

Despite his involvement with Knots, Dorsey appears neutral. Evidence includes a report by the research group 1A1z. According to its analysts, through subsidiaries he supports most Bitcoin developers. Brink alone employs three key maintainers of the first cryptocurrency.

At Brink’s instigation, from May to September Core underwent its first independent technical audit. Analysts from Quarklab and the Open Source Technology Improvement Fund were assisted by Bitcoin developer Niklas Gögge and Antoine Poinsot, the proponent of higher OP_RETURN limits.

The findings bolstered the team’s standing at a difficult time. The report concluded that improvements in recent years to security policy, testing and the review process have indeed enhanced the reliability and quality of Bitcoin Core.

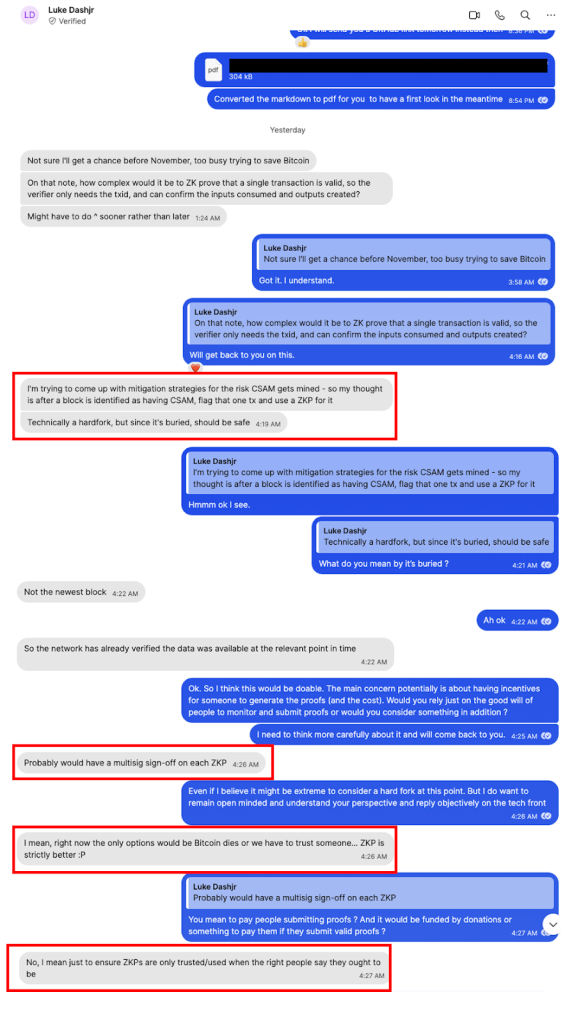

How else to turn up the heat in crypto circles? An answer appeared in late September with an article by an independent journalist under the pseudonym L0la L33tz. It included screenshots of leaked messages showing Dashjr purportedly planning a hard fork of the Bitcoin network.

It is important to understand that changing the OP_RETURN limit is a client policy change, not a change to consensus rules. A hard fork in this case is therefore virtually excluded.

In the correspondence, Dashjr calls mempool filtering insufficient to prevent CSAM being stored on-chain. Instead, he proposes creating a committee with a multisig and empowering it to retroactively alter data on the network.

Under the idea, a trusted group would verify transactions and replace CSAM data with a zero-knowledge proof (ZKP). Node operators could then delete the information from their local copy of the blockchain while retaining the ability to provably validate the transaction.

“Right now the only options are either Bitcoin dies, or we will have to trust someone,” — wrote, if the screenshots are accurate, Dashjr.

Implementing such an idea would require changing consensus and, accordingly, a hard fork of the first cryptocurrency.

Dashjr then said third parties were preparing open letters urging permission to delete illegal content. On advice from Ocean’s lawyer, the Knots team decided that “it’s better if the letter is not perceived as coming from them”.

“Are you writing an article that is entirely based on lies?” — asked Dashjr in a comment to The Rage, refusing further dialogue.

If such a committee could delete CSAM, it could also censor any other data it deems undesirable, L0la L33tz’s article argued.

Logical knots

Rumours of a hard fork became the emotional peak of the conflict. Dashjr’s opponents felt vindicated in their fears. His supporters, meanwhile, were plainly rattled by what they saw as a smear attempt.

An unexpected twist came from Udi Wertheimer, co-founder of the Taproot Wizardas project.

“I am obviously not on Luke’s side, but… this is just a sloppy, low-quality propaganda piece,” the programmer wrote.

What led a supporter of the opposite attitude to Bitcoin “inscriptions” to publicly defend Dashjr? Wertheimer explained that the leaked messages were a hypothetical discussion about using ZKPs so that Knots nodes could avoid loading “spam”.

The cypherpunk and Blockstream founder Adam Back sought to explain the absurdity of the conflict and its possible consequences, and reminded readers that the latest release contains more than a higher OP_RETURN limit:

“If we as a community lose the ability to accept rational changes, Bitcoin will face far bigger problems. Social attacks, calls to reject security and reliability improvements from 200 of the most qualified specialists on the planet are attacks on the first cryptocurrency in their own right. Version v30 contains fixes that improve security.”

The Core team likely hopes the problem resolves itself — the easiest way out of a logical stalemate.

In theory, one could endlessly block every possible method of embedding data in Bitcoin’s blockchain. But most Core developers believe this would become an infinite game of finding new loopholes. It could also incentivise disguising data as ordinary monetary transactions, blurring the line between funds and arbitrary information on-chain.

The only way out in such a scenario is to grant a person or group the power of a censor — a role Core is not seeking. Such a position would invite intolerable pressure from regulators and the community.

Rising popularity of data in OP_RETURN could indeed unbalance Bitcoin’s economics by crowding scarce block space. If the average block size now runs at 1.5 MB, in theory it could reach 4 MB, pushing up fees. On the other hand, on-chain activity in digital gold has been so low over the past six months that Runes and Ordinals at least sustained some economic viability for miners and node operators.

Designing complex systems for integrity always forces trade-offs between stability, progress and security. The most important consensus developers must reach is social; without it, no innovation can become a pillar and deliver benefits.

Podcaster and investor Stephan Livera put it at length, but accurately.

“Do not underestimate how many real people are involved and irritated by the situation (by my estimate, at least a few thousand — very loud and emotionally charged). But the problem, in my view, is that under current conditions — low demand for monetary transactions on-chain and the existence of things like LibreRelay — there’s little that can realistically be done.”

Livera considers “filtering” unlikely to pay off, because it is financially impractical:

“Let’s be honest — in mining in 2025, what is the probability that a significant share of hashrate agrees with your definition of spam and starts filtering it? In my view, extremely low.”

In his words, the fundamental problem is insufficient use of Bitcoin for moving money:

“Increase demand for monetary transactions on Bitcoin. That is far more productive than what I consider a lot of unnecessary friendly fire.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!