How to issue an NFT and sell a tweet: a beginner’s guide

Alongside yield farming in the DeFi space, one of the hottest trends in the crypto industry has become non-fungible tokens (NFTs).

Assets with rather subjective, and at times dubious, value trade on a number of platforms. Prices of some tokens run into millions of dollars. In February, meme GIF Nyan Cat sold for 300 ETH (~$568,000 at the rate at the time), and in March the token of the artist under the pseudonym Beeple was bought for almost $70 million.

The trend drew in many famous figures, among them Elon Musk. On March 15, the founder of Tesla and SpaceX posted a techno track about non-fungible tokens on his Twitter, saying he would put it up for sale. Beeple offered $69 million for Musk’s NFT.

Twitter founder Jack Dorsey put up for sale his first tweet. The bid for the NFT reached $2.5 million. Subsequently the tweet was sold for $2.91 million.

Experts’ opinions on NFTs are far from unanimous. Some are convinced of the short-term nature of the phenomenon, while others call the current hype “a game for the smart and wealthy”. In any case the phenomenon is highly interesting and has already made a splash well beyond the community.

We have worked out how to create, acquire and sell NFTs — and answered the fundamental questions.

- There are many services where you can buy and sell NFT. Some of the most popular are OpenSea, Rarible, SuperRare.

- Issuing your own non-fungible token is no more difficult than uploading a video to YouTube.

- Any user can sell their tweets as NFTs, speculate on tokens and earn passive income through royalties.

Key features of NFTs and a chronicle of the boom in the sector

NFTs are non-fungible tokens [non-fungible tokens]. These assets are a kind of digital certificates certifying the uniqueness of something.

Traditional artworks, antiques, historical exhibits are usually sold at auctions with documents confirming authenticity. NFTs are “blockchain-certified” unique images, textual documents, video and audio recordings and other files. In other words, this is a form of digital asset whose ownership is recorded on the blockchain.

NFTs, explained. pic.twitter.com/Dcale4cd2L

— Jack Butcher (@jackbutcher) March 22, 2021

Such tokens can be bought, collected, sold and even burned, much like physical objects. The blockchain provides transaction transparency, allows tracing the history of movement of an NFT’s movement from address to address and other information about the asset.

NFTs are issued on various blockchains, of which Ethereum is the most popular. The process of issuing a token is called minting. When creating NFTs, issuers can set fees on resale of the asset, typically ranging from 10-30%.

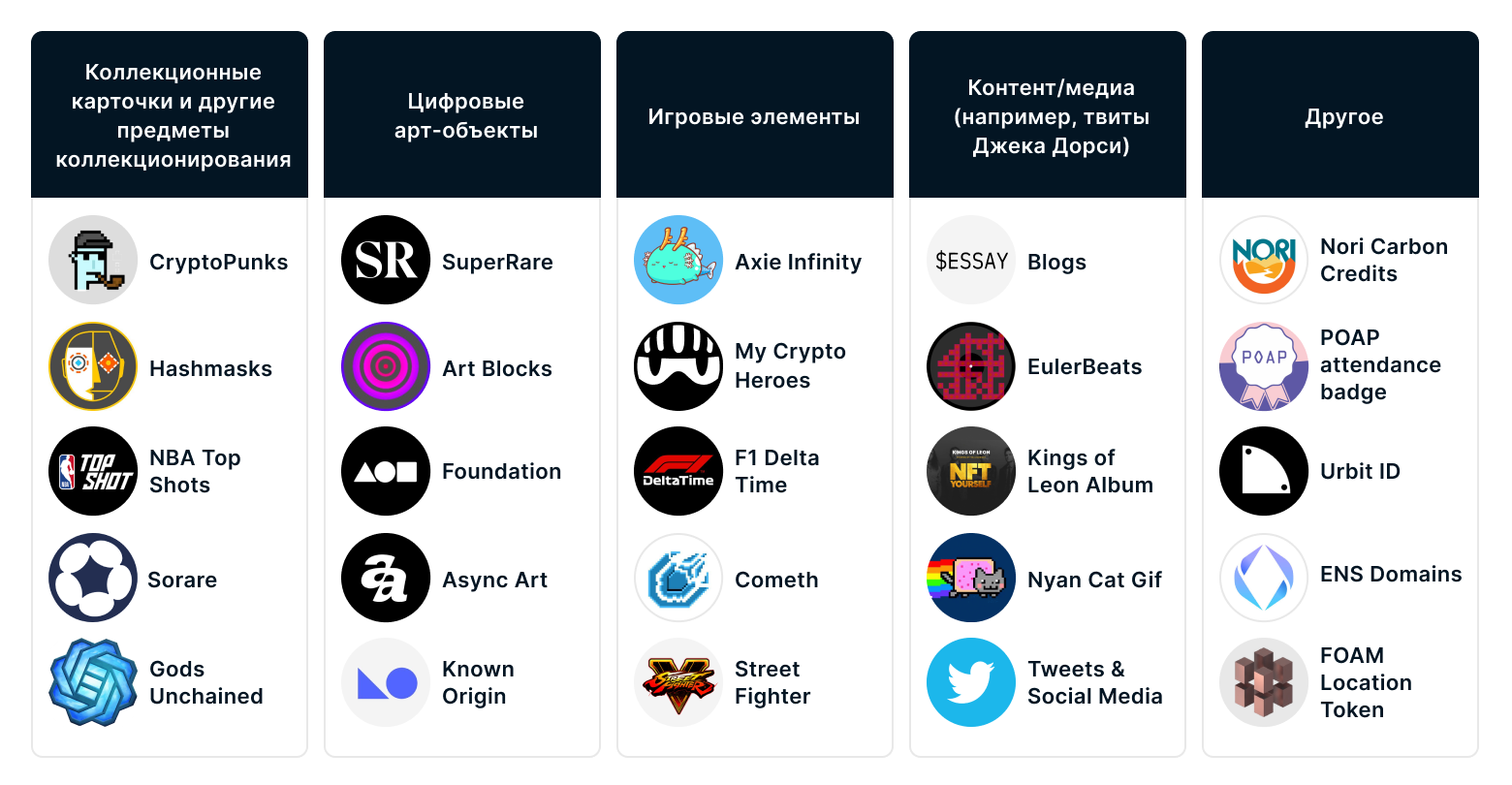

Non-fungible tokens can represent virtually any physical or intangible object. These include:

- art objects;

- virtual items in games, such as skins, weapons, avatars;

- music;

- collectible items (for example, digital trading cards);

- tokenised real-world assets — from real estate and cars to designer sneakers;

- video clips from iconic sports events.

On some marketplaces, recipes and even entire startups are presented as NFTs, hinting that there are virtually no limits to issuing such assets.

This phenomenon is not that new. The concept of the first non-fungible tokens — Colored Coins — appeared in 2012. It entailed tokenising assets on the Bitcoin blockchain.

One of the oldest projects in those early crypto days was — Rare Pepe Directory. Cartoon frog illustrations, adapted from a 2008 viral internet meme, were among the first examples of unique digital artworks linked to crypto tokens. Thanks to them the community developed the idea of building standards for non-fungible tokens — building blocks for many people to create their own NFT.

The first NFT hype — CryptoKitties, a project that allowed breeding NFT cats. In early September 2018, a two-week-old kitten named Dragon was bought for 600 ETH.

Shortly before CryptoKitties appeared, the CryptoPunks project from Larva Labs debuted. A total of 10,000 CryptoPunks were issued, initially distributed for free. In May 2020, lot #6487 was bought for 100 ETH. The average daily sale price of CryptoPunks in mid-October 2020 rose to 7 ETH.

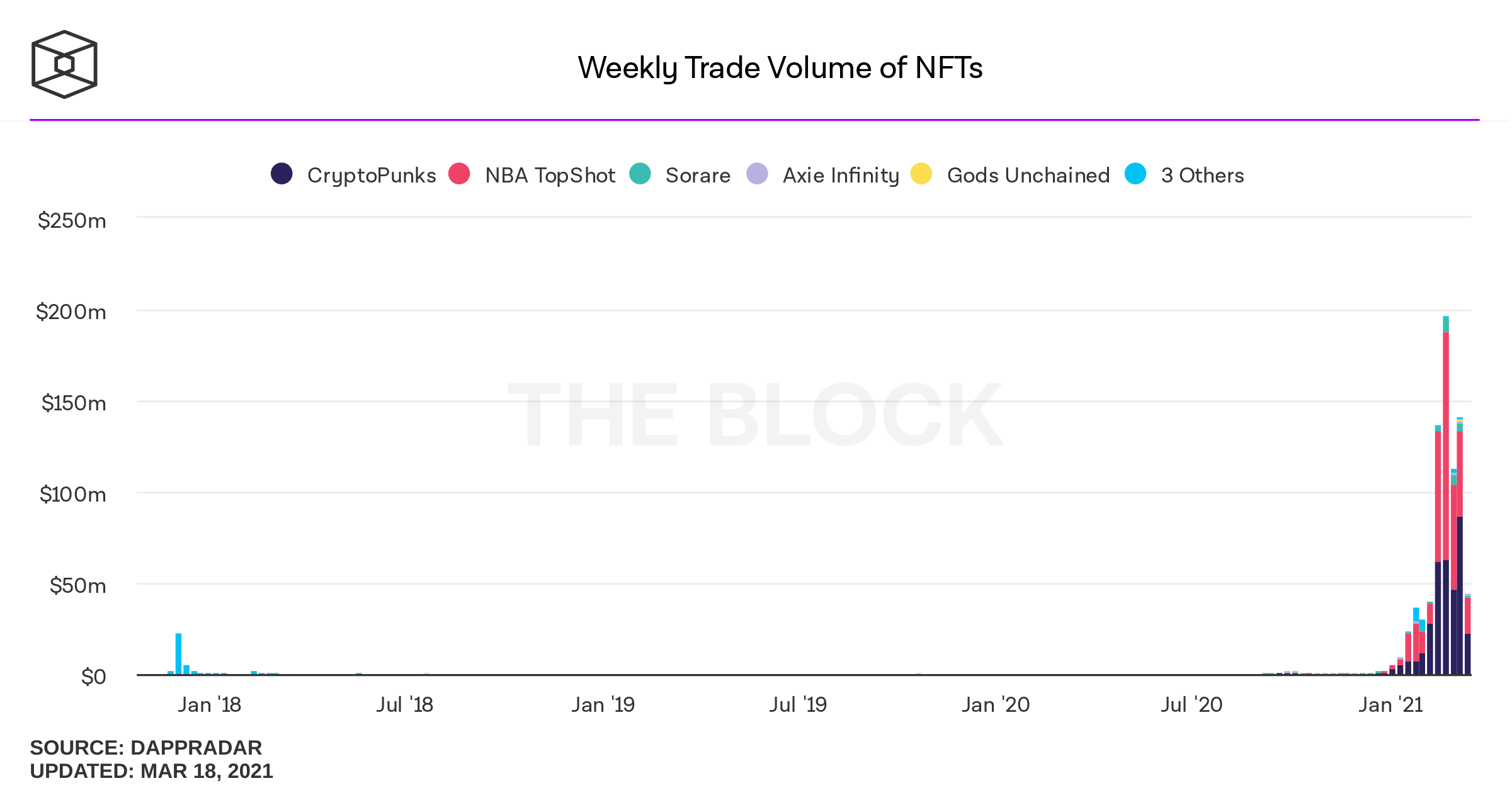

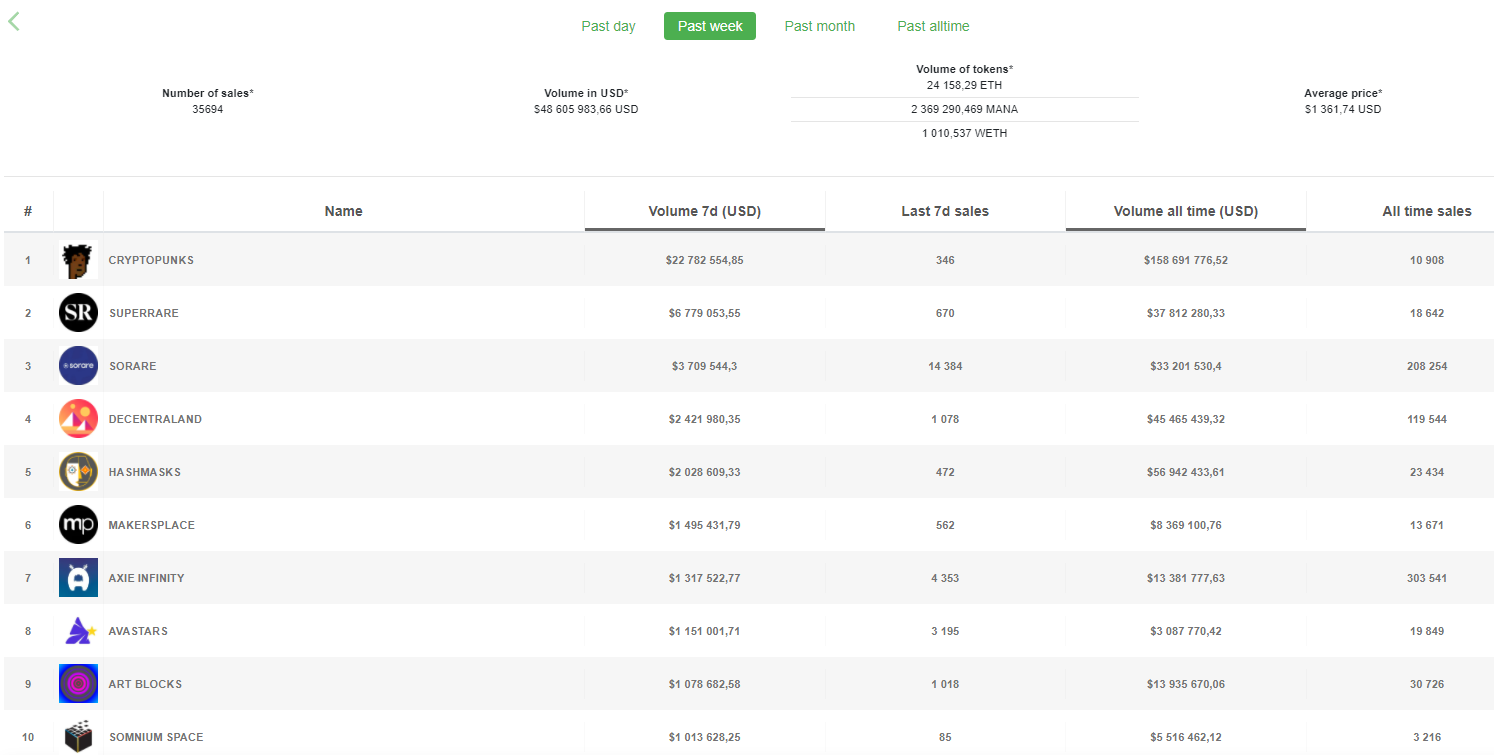

The second half of 2020 and the start of 2021 were marked by a renaissance in the NFT space. The graph below clearly shows a substantial surge in CryptoPunks, NBA TopShot and other NFT platforms’ turnover.

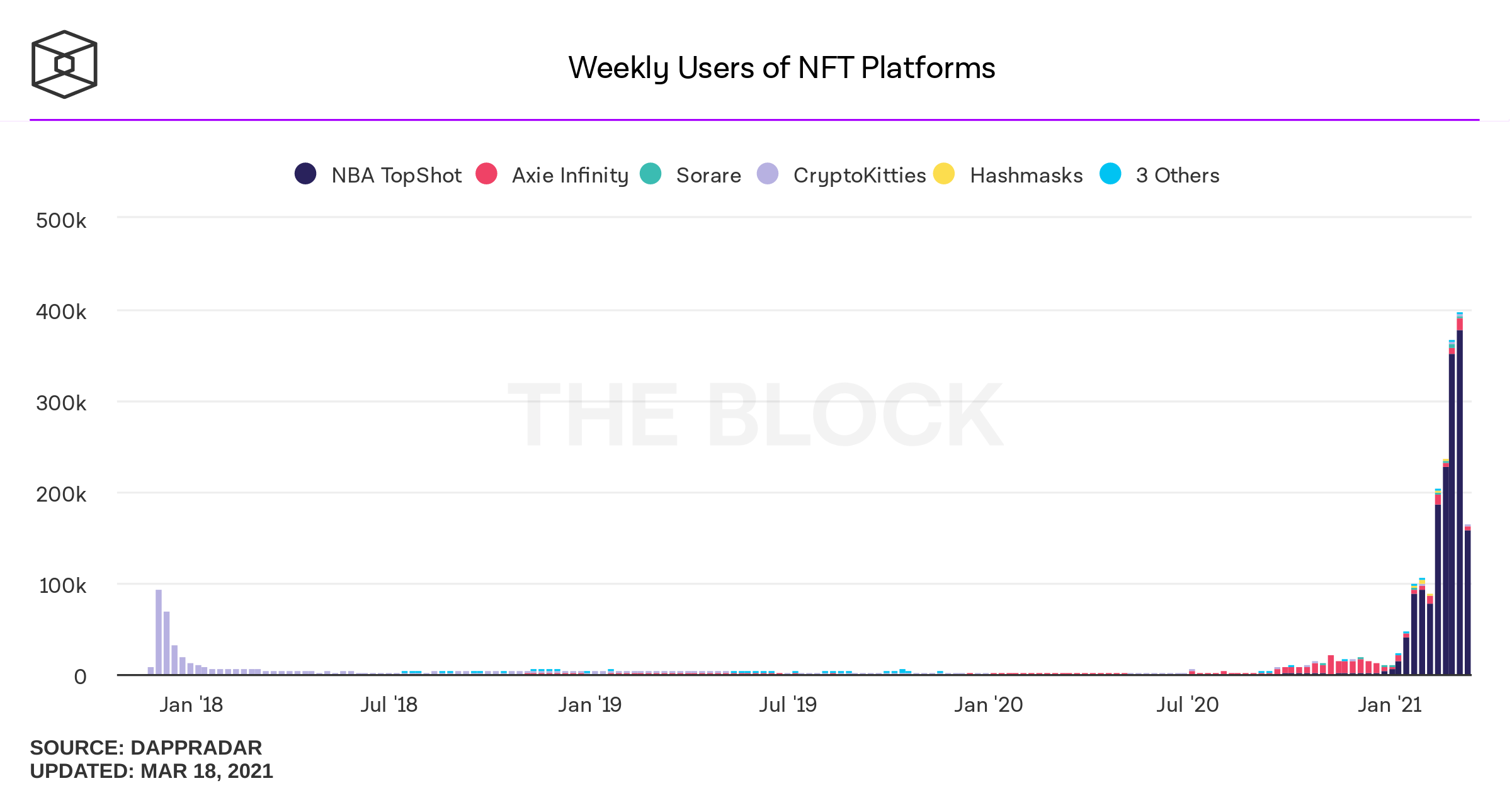

Trade volumes are closely correlated with the number of users.

Obviously, at the start of 2021 the number of NFT holders was far greater than during the CryptoKitties era that clogged the Ethereum network.

Below are the largest NFT projects by number of trades and by total sales value.

New assets are moving into the mainstream. Canadian singer Grimes, Elon Musk’s partner, sold at a Nifty Gateway auction a collection of NFTs with unreleased music for $6 million. In March, Sotheby’s announced the first-ever NFT auctions by the house for the digital artist Pak.

In late February, Beeple’s NFT with Trump resold for $6.6 million. A tokenised copy of Banksy’s burned painting, titled “Morons,” went for 228.69 ETH.

Such news comes daily and the hype is likely far from over. Now is the time to learn how and where to create, buy and sell NFTs.

How to create an NFT

The process of creating NFTs is relatively straightforward and does not require deep knowledge of cryptocurrencies and the underlying technologies.

First, you should decide which blockchain to use for issuing your own NFTs. Most NFTs are issued on Ethereum, but there are other noteworthy and gaining-popularity platforms, including:

- Binance Smart Chain (BSC);

- Flow by Dapper Labs, the creators of “CryptoKitties”;

- Tron;

- EOS;

- Polkadot;

- Tezos;

- Cosmos;

- WAX.

Each blockchain has its own NFT standards and the ability to interact with various wallets and marketplaces. For example, a token issued on Binance Smart Chain can be sold only on platforms that support BSC assets. The VIV3 marketplace on Flow or the Ethereum-based platform OpenSea won’t be suitable for that.

Let us consider the minting process in the context of Ethereum, still the largest NFT ecosystem. To begin you will need:

- An Ethereum wallet such as MetaMask, which supports ERC-721 and other NFT standards;

- A certain amount of ETH to pay transaction fees (given the current gas-price dynamics, you will need at least $50-$100).

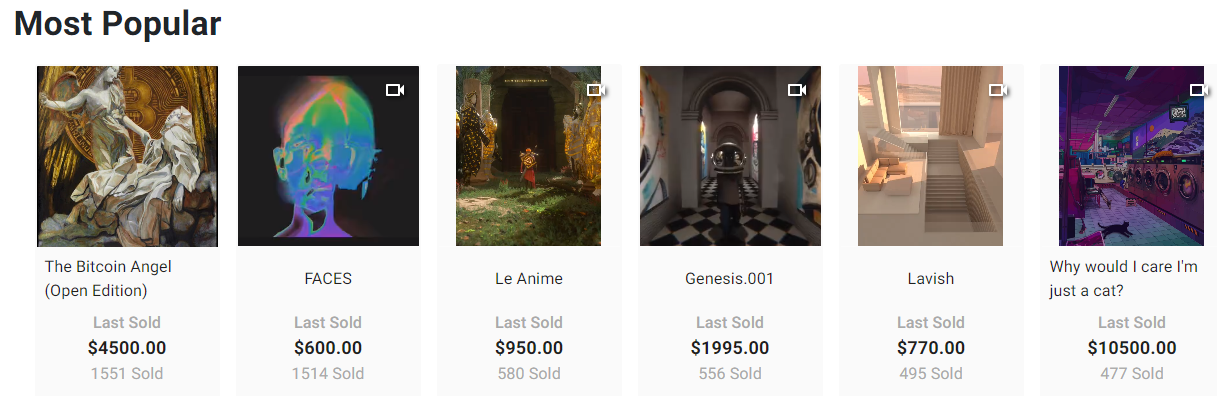

There are many marketplaces that allow you to connect a wallet and upload a file to turn it into an NFT. Some of the most popular platforms:

There are services like Makersplace, which require registration. On Nifty Gateway there is quite a strict vetting and moderation of participants. On this marketplace you can find NFTs by Grimes, actor Justin Roiland and other famous personalities.

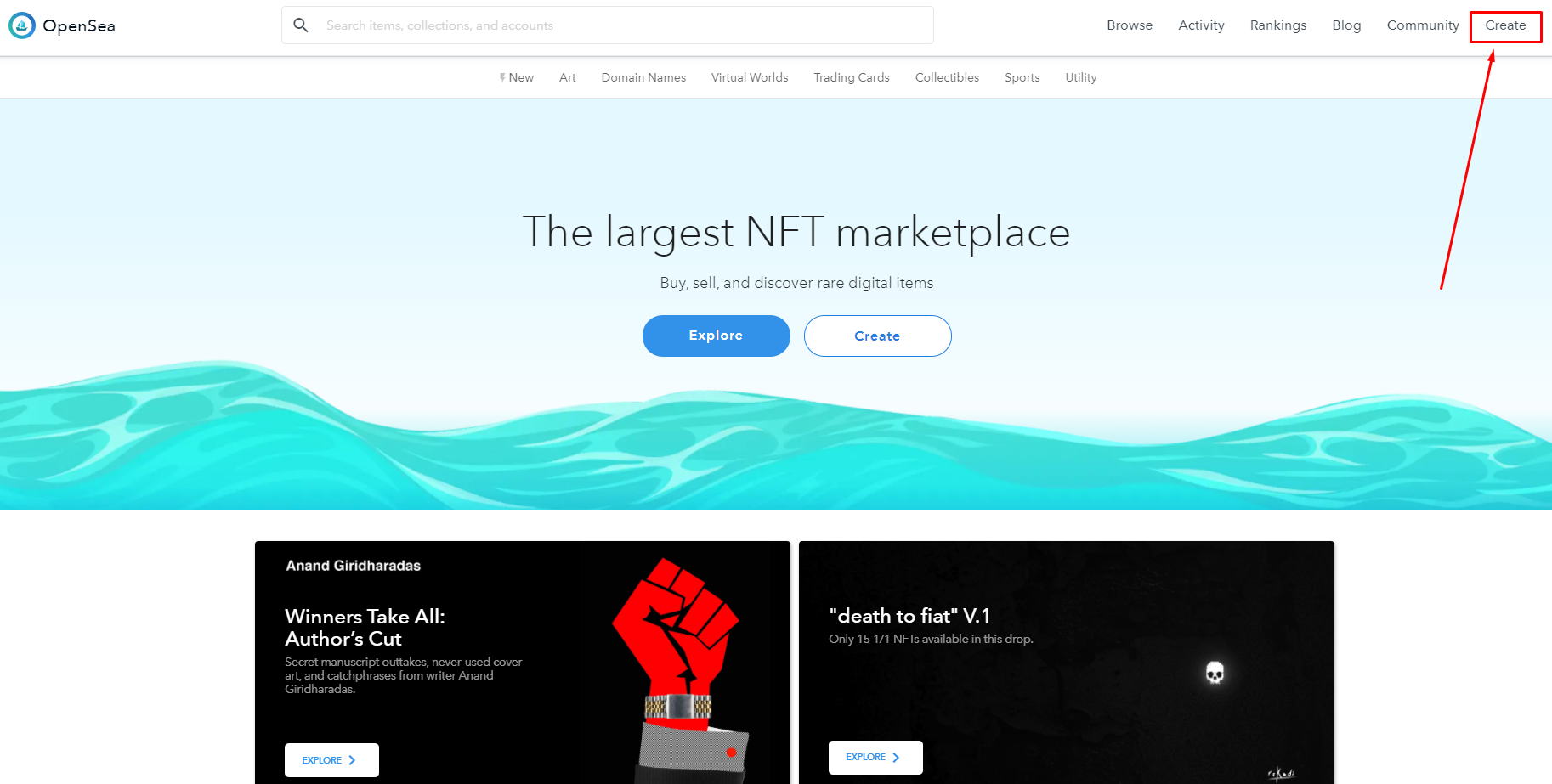

Consider the process of minting a token on OpenSea — the largest NFT marketplace.

After clicking Create you will need to connect an Ethereum wallet to the service.

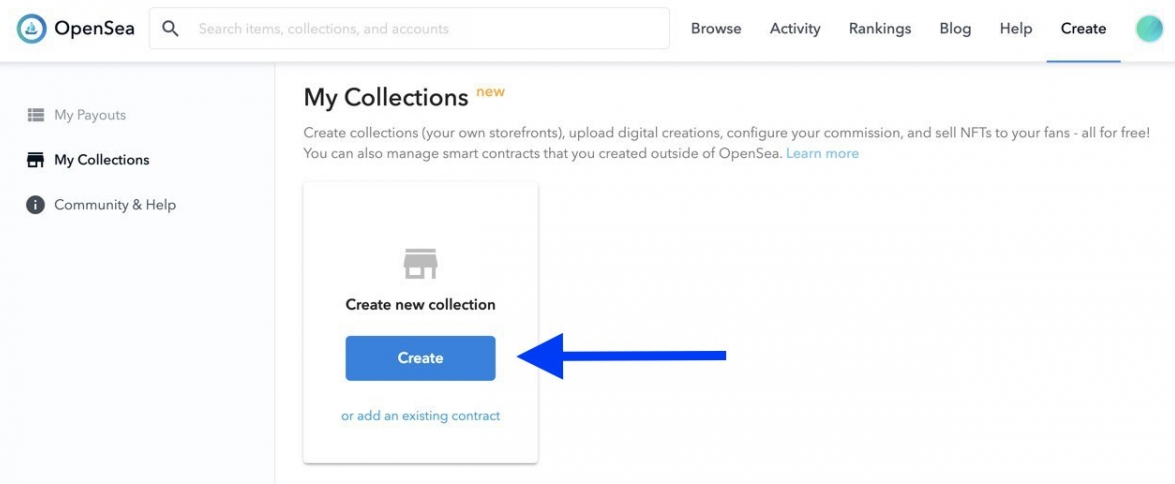

Next step: when you hover over Create, choose My Collections, and then press the blue Create button.

A window will appear allowing you to upload an image for the new collection, give it a name and a description. Essentially, at this stage you are simply creating a folder for your NFTs.

After that you can set a banner by clicking the pencil in the top-right corner.

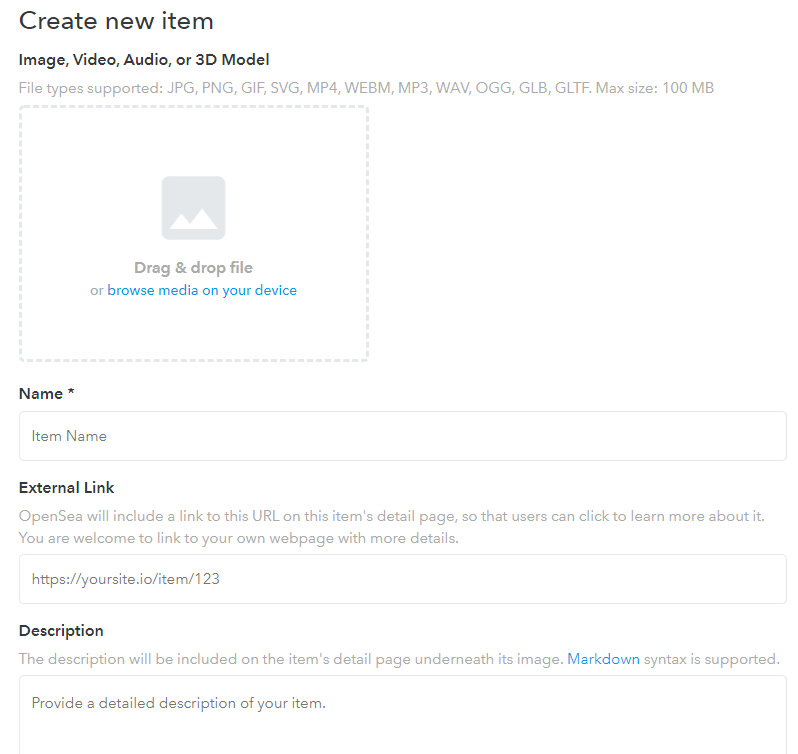

Now you can proceed to creating your first NFT. To do this you need to click the Add New Item button. The Ethereum wallet will again prompt you to sign a message.

A new window will appear where you can upload an image, audio, video or 3D model as the basis for your NFT.

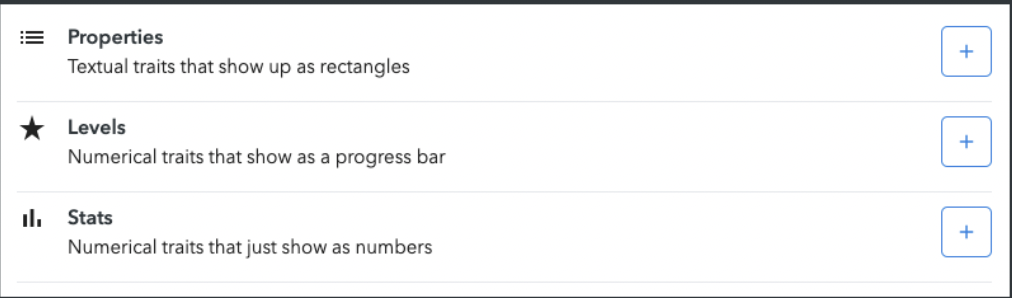

On OpenSea and many other marketplaces you can configure various parameters. For example, authors can enable the option Unlockable Content, the content of which can be viewed only by buyers.

When everything is set and the fields are filled, click Create at the bottom and confirm via your Ethereum wallet to create the token. After that the NFT will appear in your collection.

Where and how to sell or buy NFT

To sell an NFT on OpenSea, you should first place it in a collection. Then select it and click the Sell button. A page with pricing parameters will appear, where you can set the sale terms, whether by auction or fixed price.

On most platforms you can sell NFT for Ethereum and ERC-20 tokens. However some marketplaces support only their native token. For example, VIV3 accepts only FLOW tokens from the Flow blockchain.

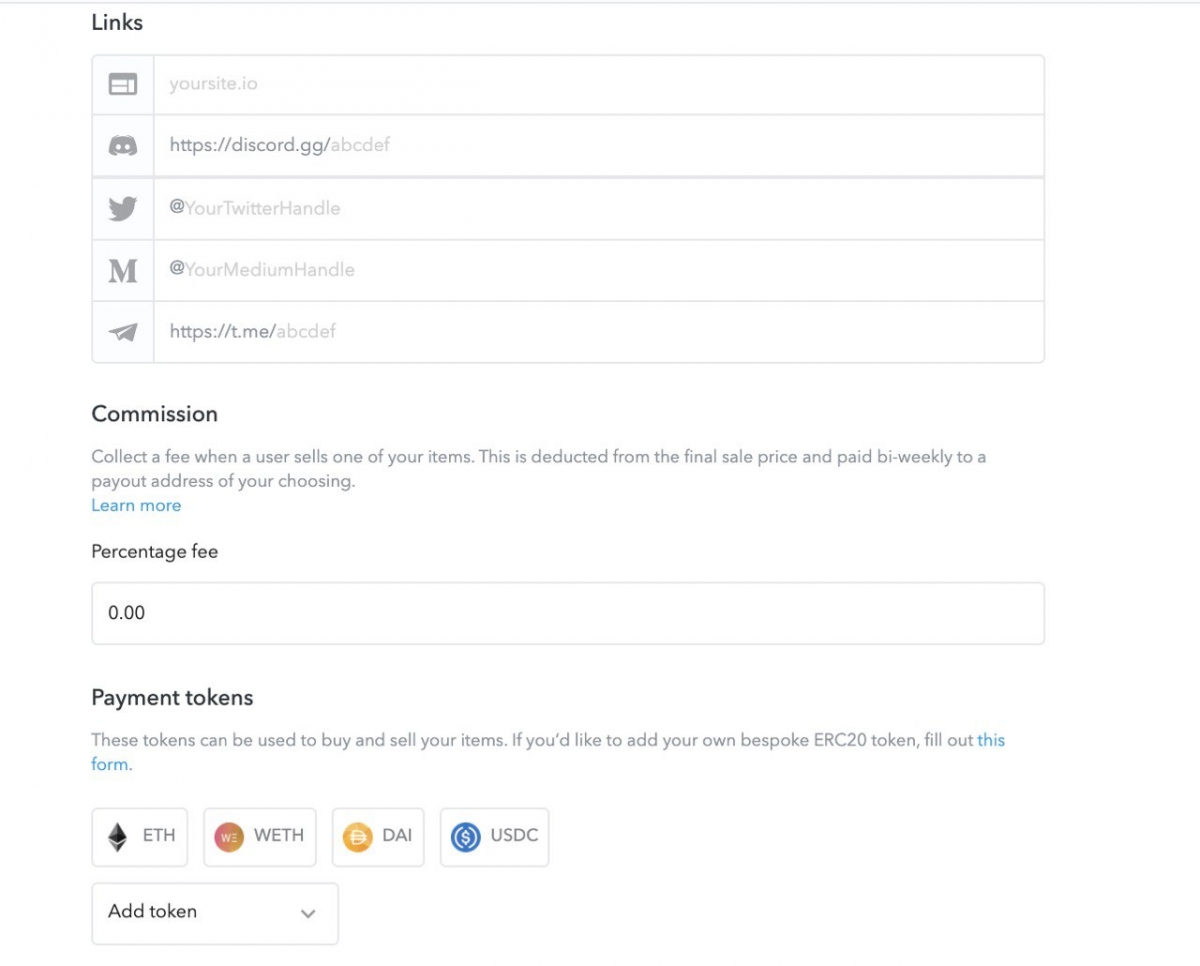

Clicking the Edit button next to a file in the collection on OpenSea will require you to sign a message with your wallet.

Scroll down and you will see the option to set royalties and select assets to receive as payment.

Royalties allow NFT creators to earn commissions on secondary sales. This is a potential source of passive income, automated by smart contracts.

Inspired by the example of Jack Dorsey, many users turn tweets into NFTs in the hope of selling them for crypto assets. For this they use the Valuables platform.

In the screenshot below you can see the tokenised first tweet by the Twitter founder and the $2.5m bid by Binance CEO Changpeng Zhao. Earlier, the founder of Tron Justin Sun offered $2m for this NFT. Subsequently the tweet was sold to Estavi for $2.91m.

Among famous people not only Dorsey tried the service — Binance CEO Changpeng Zhao earned $6,600 for one of his tweets. Subsequently this NFT was resold for $121,000.

Anyone on Twitter can try their luck on Valuables; you don’t have to be a celebrity. Everyone also has the opportunity to bid on a tweet created by someone else.

Technically, an NFT is a small snippet of code that points to a file somewhere on the network. In Valuables, the token contains the tweet text stored on the Matic blockchain. It may also point to the tweet image (if any), hosted on a centralized server.

To interact with Valuables you also need an Ethereum wallet like MetaMask. After connecting you will need to log in with Twitter so the platform can access your account.

After that, Valuables setup is complete. You can bid and list your own tweets for sale. To do this, copy the link to a popular and interesting tweet and paste it into the field paste tweet URL.

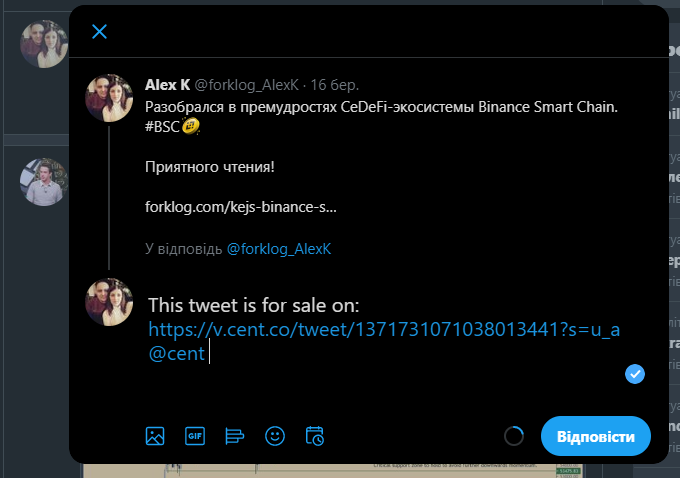

The service will ask: “Would you like to sell the tweet?”. Below there will be a blue button offering to tweet.

After clicking the button, the service will offer to post a link to the lot.

After publication, anyone can visit the Valuables link, place a bid and, possibly, purchase the NFT.

Buy NFT — buying is also straightforward; there are several popular services:

- OpenSea;

- Rarible;

- Nifty Gateway;

- SuperRare;

- Zora;

- Axie Marketplace;

- Foundation;

- NFT ShowRoom;

- BakerySwap;

- VIV3.

The trading platform KnownOrigin, launched in February 2018, may be of interest to designers and artists. With the internal token KnownOriginDigitalAsset (KODA) of the ERC-721 standard, users can purchase artworks, as well as attest to the authenticity and authorship of their work. KnownOrigin offers more than 19,000 artworks for sale.

The project Pixura offers templates for NFT marketplaces, enabling you to launch trading platforms with any ERC-721 tokens.

***

Prices of many “works of art” in NFT form can be perplexing and shocking. Yet buyers’ willingness to pay astronomical sums for tokens testifies to the Austrian school thesis that value is subjective and that price is not determined by time and labour.

NFT technology and its regulation remain the “Wild West.” If such assets become truly mass phenomena, not every blockchain will be able to cope with transactions from millions of users.

It is not inconceivable that, against the backdrop of this renewed hype, efforts to scale will intensify, including Optimism, Rollups and Plasma. Perhaps the move to the second version of Ethereum will accelerate, and new interoperability solutions for systems will emerge.

NFT still has to prove its viability. For now, the hype around this sector resembles the 2017 ICO fever. Then new projects mushroomed after the rain, many — only to vanish with money raised from inexperienced players.

That said, not all ICO-era projects vanished — some survived and are thriving today. Among them are many DeFi projects: Aave, Synthetix (formerly Havven), REN (formerly Republic Protocol), Kyber Network. The popular exchange Binance launched after raising $15 million via an ICO in July 2017.

The Beeple, who sold a token for almost $70 million, compared the current NFT space to the dot-com boom. He stressed that the bursting bubble did not destroy the internet.

Most likely the NFT hype will not fade completely. Developers will improve existing standards and address potential vulnerabilities. In the end, the most viable projects with compelling value propositions will endure.

Subscribe to ForkLog news on Telegram: ForkLog FEED — all the news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!