Inflation slowed sharply. Bitcoin’s response was modest

In May, US consumer prices grew 4% year over year, down from 4.9%, well below the 4.1% forecast. Bitcoin briefly traded at $26,400, with daily gains of 1.7%.

On a monthly basis, prices rose 0.1% versus 0.4% in April, in line with economists’ expectations.

Core inflation, which excludes food and energy, stood at 5.3% year over year and 0.4% month over month. The previous readings were 5.5% and 0.4% respectively.

Analysts had projected readings of 5.2% year over year and 0.4% month over month.

The data from the US Bureau of Labor Statistics is nuanced, prompting a mixed reaction from investors.

Risk appetite across global markets proved fragile. Equities tried to extend the rally of recent days. Bitcoin retraced to its starting levels. The daily pace of gains for the digital gold narrowed to 1%.

The price of Ethereum tested the $1770 level. The second-largest cryptocurrency gave up almost all intraday gains.

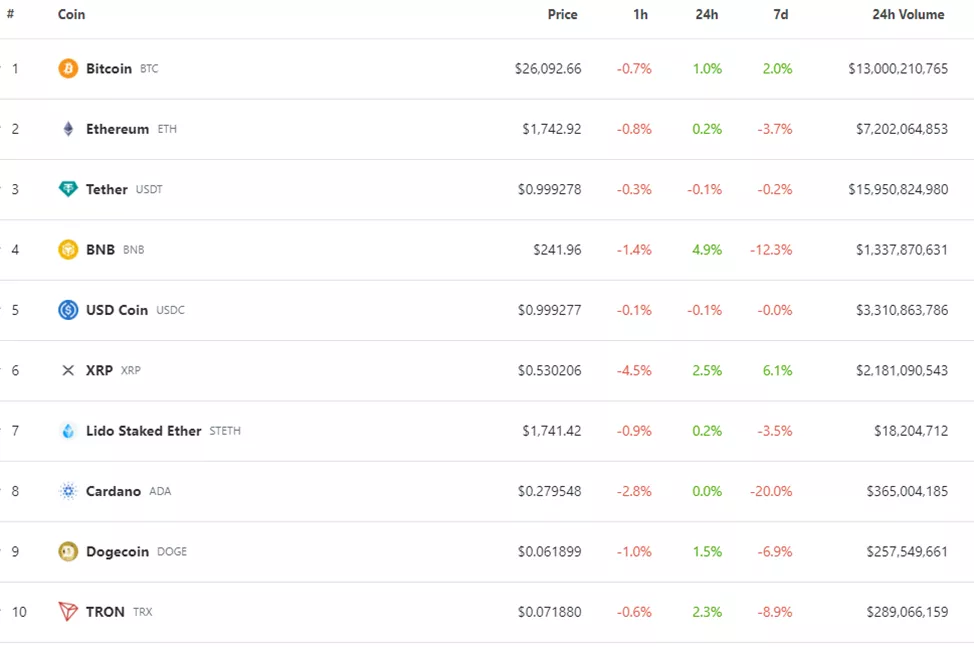

According to CoinGecko, all top-10 assets by market cap over the last hour were in the red. Declines ranged from 0.6% (Tron) to 4.5% (XRP).

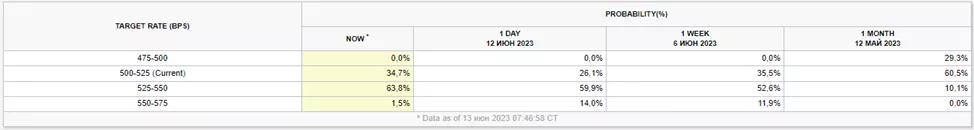

The data helped ease fears about a potential rate increase at the the Fed‘s meeting on June 13-14. The probability that such a move would not occur jumped from 79.1% on the eve to 95.3%, according to the futures market.

The next CPI release in July will play a key role in the Fed’s steps a month hence, Bloomberg noted. Fed Chair Jerome Powell and many of his colleagues had previously signalled a willingness to skip a rate rise at the June meeting, keeping the door open for further tightening, Bloomberg noted.

The outlook for tightening in a month remained largely unchanged — odds stood at two to one against (versus 74% the day before). Similarly, expectations for a first cut were unchanged — a move to 4.75–5% from current 5–5.25% was seen at 36.4% versus 30.3% a day earlier.

In April, Michael Kramer, founder of asset-management firm Mott Capital Management, warned that Bitcoin could slip toward the $20,000 level.

Earlier, former CFTC Timothy Massad said that the future of digital assets depends on the outcomes of the SEC against Binance and Coinbase.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!