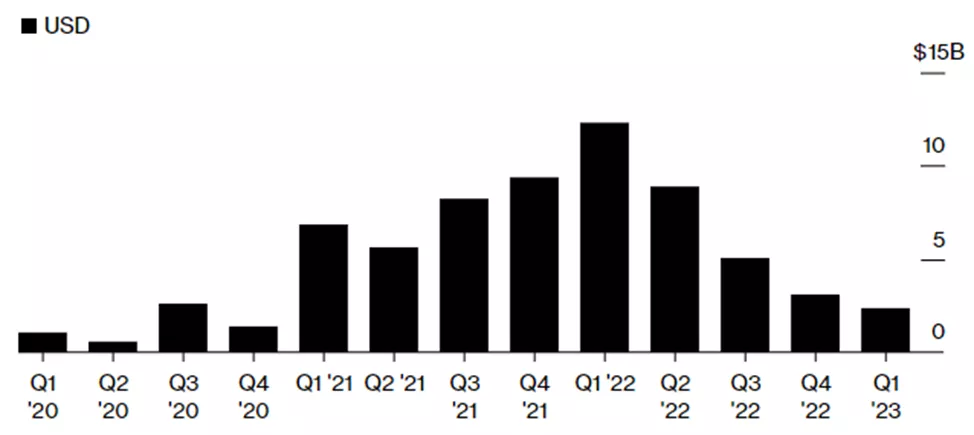

Investment in crypto startups plunges to $2.4 billion in the first quarter

The volume of venture funding for cryptocurrency-related companies in January–March fell to its lowest level in ten quarters, at $2.4 billion. According to PitchBook, from a peak of $12.3 billion the figure has collapsed by 80.5%, Bloomberg reports.

Reasons cited by the companies include regulatory uncertainty, the consequences of unfavourable market conditions, and scandals surrounding players in the industry.

The decline is not unexpected. There are still concerns about the future development trajectory, as the macro environment is highly uncertain — commented PitchBook analyst Robert Le.

The analyst noted that venture funding this year has fallen across all fronts. In addition to the rise in interest rates, The collapse of SVB — the backstop bank for such companies.

This will not be based on FOMO or on what other investors are doing

Aggregated data do not reflect an improvement in month-to-month momentum in February–March. The analyst noted that this could signal the possible end of the worst period of the “financial drought.” Venture capital has money, and there remains interest in backing crypto startups.

“We will gradually start to see investors feel more comfortable,” Le predicted.

As reported, European Web3 startups attracted a record $5.7 billion in venture funding in 2022, according to RockawayX.

In February, Abu Dhabi launched a $2 billion fund to support startups in the industry.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!