Investors Signal Market Shift by Exiting Shorts Against Strategy

Kynikos Associates closes short position against Strategy's shares.

Kynikos Associates has closed its short position against Strategy’s shares and its long position on the leading cryptocurrency, according to the firm’s founder, James Chanos.

As we have gotten some inquiries, I can confirm that we have unwound our $MSTR/Bitcoin hedged trade as of yesterday’s open. pic.twitter.com/lgrWNy35H8

— James Chanos (@RealJimChanos) November 8, 2025

This move may indicate the end of the decline in the stock prices of public companies holding bitcoin in their reserves.

Chanos explained the decision by noting that the premium to the company’s net asset value (mNAV) fell to 1.23x.

“It makes sense to close this trade with mNAV below 1.25x. Back in July 2025, the figure was around ~2.0x,” wrote Chanos.

According to him, Strategy’s premium—the difference between the company’s market capitalization and the value of its bitcoin reserves of 641,205 BTC—shrank from $70 billion in July to $15 billion. This suggests a more fair market valuation of the company. Chanos added that “the idea has mostly played out.”

The CEO of The Bitcoin Bond Company, Pierre Rochard, described this event as a market reversal signal.

The bitcoin treasury company bear market is gradually coming to an end. Expect continued volatility but this is the kind of signal you want to see for a reversal. https://t.co/Z9OBH57u5J

— Pierre Rochard (@BitcoinPierre) November 8, 2025

“The bear market for bitcoin companies is gradually coming to an end,” he stated.

In recent months, the shares of many of the 200 public firms with bitcoin on their balance sheets have significantly declined. The market value of Strategy dropped by 43%—from $122.1 billion in July to $69.5 billion. Japanese company Metaplanet lost 56% of its capitalization since June 21.

Some firms had to sell part of their bitcoins to pay off debts.

Additional pressure on the market was exerted by the shutdown of the US government. However, the media reported on a budget agreement being reached. Against this backdrop, the price of bitcoin rose by 2% in 50 minutes, reaching $106,430.

“Long DAT, Short Futures”

The introduction of regulated futures on altcoins has opened a new way for traditional investors to profit in the crypto market, stated Chris Perkins, president of CoinFund, to CoinDesk.

The strategy of basis trading involves simultaneously buying shares of companies with crypto assets on their balance sheets (DAT) and selling futures on the underlying asset. This allows for income without direct token ownership.

Digital Asset Treasuries (DAT) are public companies that raise capital through stock issuance and invest it in digital currencies.

Such firms act as a bridge between TradFi and the crypto industry. Their shares provide investors with regulated access to the digital asset market, reducing operational risks.

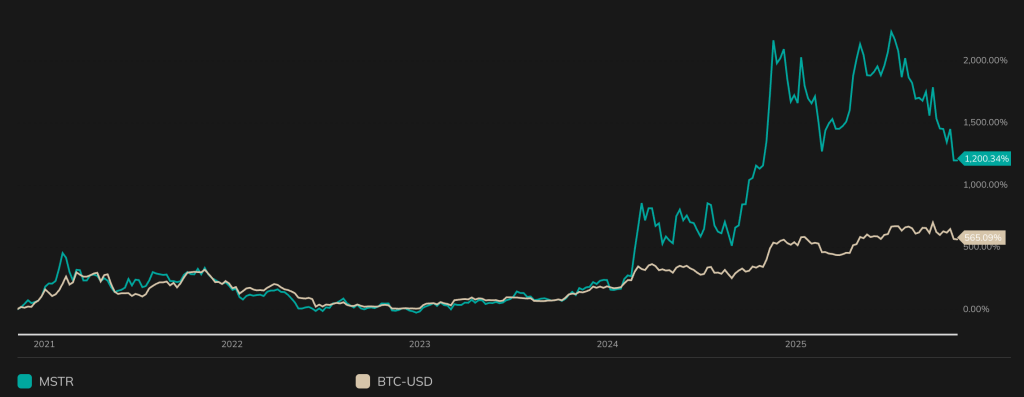

For instance, Strategy’s shares have increased 22 times since it began purchasing bitcoin, while the asset itself has risen tenfold over the same period.

New Opportunities

For a long time, basis trading was limited due to the lack of regulated derivatives. The situation changed following a policy shift by the SEC.

The new head of the Commission, Paul Atkins, stated that “most tokens are not securities.” This paved the way for the launch of futures on various altcoins and increased market liquidity.

How the Strategy Works

An investor buys DAT shares and simultaneously opens a short position on the futures of the same crypto asset. This approach eliminates price risk, and income is generated from the difference between the spot and derivative prices.

When derivatives trade at a premium to the underlying assets (a “contango” situation), the strategy can yield stable income. With altcoins, potential profits may be higher compared to bitcoin.

Perkins noted that the strategy is not without risks. If the market capitalization of a DAT falls relative to the value of its crypto assets, hedging with futures may not cover the losses.

However, he believes these instruments play a crucial role in “normalizing crypto investments on Wall Street.”

“This could be the trade of 2026,” concluded the head of CoinFund.

Back in November, Bitwise’s Chief Investment Officer Matt Hougan pointed out the inefficiency of digital asset treasuries.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!