Investors sold 36,000 BTC at a loss as bitcoin fell through $75,000

- Support levels for the leading cryptocurrency are $69,000–$70,000 and $71,600.

- There is an active shift of coins from wallets to exchanges, including bitcoins that had been idle for three to five years.

- On technicals, the market looks oversold on RSI.

On April 7, coins sold at a loss totalled 36,000 BTC (over $2.7bn). The catalyst was bitcoin’s drop to a new year-to-date low — below $75,000.

In the past 24 hours, 36K BTC were sold at a loss on exchanges — that’s not a lot compared to other days this year. pic.twitter.com/L73nDYVNlp

— Axel ?? Adler Jr (@AxelAdlerJr) April 7, 2025

The figure is smaller than the sell-offs seen in previous months.

According to IntoTheBlock, $69,000 is now a key support for digital gold. Around this level, about 1.22m addresses accumulated roughly 464,000 BTC.

According to @intotheblock , $69,000 is now a key $BTC support zone.

Over 1.22M addresses bought 464K+ BTC around this level—showing strong historical demand and conviction. pic.twitter.com/qtNpQtTO5P

— Kapoor Kshitiz (@kshitizkapoor_) April 8, 2025

Glassnode highlighted support at $71,600 and $69,900.

?The downside may slow down a bit from here —

between $74k and $70k, there’s a total of ~175k $BTC in cost basis clusters.?The single largest level within this range is $71.6k, holding ~41k $BTC.

?The next more substantial support sits at $69.9k, where ~68k $BTC are held.

— glassnode (@glassnode) April 7, 2025

CryptoQuant estimates that investors currently hold 5.12m BTC at a loss (25.8% of the circulating supply).

Bitcoin in Loss: 5,124,348 BTC (25.8%)

That’s a significant chunk of the circulating supply sitting in the red.

While it might seem alarming, it’s not unprecedented.

In fact, we saw similar dips in 2024.

?️ Jan 22, 2024: 24.1% — 4.72M BTC

?️ July 06, 2024: 22.4% — 5.13M BTC… pic.twitter.com/PpmfAID3ZF— CryptoQuant.com (@cryptoquant_com) April 7, 2025

“Although this may seem alarming, it is not unprecedented. In fact, we saw a similar dip in 2024,” the specialists said.

Attention, whales!

Separately, analysts warned of 7,933 BTC “waking up” after three to five years of dormancy. In their view, the coins may be linked to Coinbase. The experts noted persistent movements of large tranches of bitcoin.

Old hands waking up! ??

7,933 $BTC aged 3–5 years just moved on-chain — a clear spike in long-term holder activity.

This cohort (likely Coinbase) has been consistently moving large chunks lately. Something’s up, stay sharp. https://t.co/0DMwX65ukB pic.twitter.com/KkJ9vNxaLM

— Maartunn (@JA_Maartun) April 7, 2025

“Something’s up, stay sharp,” they said.

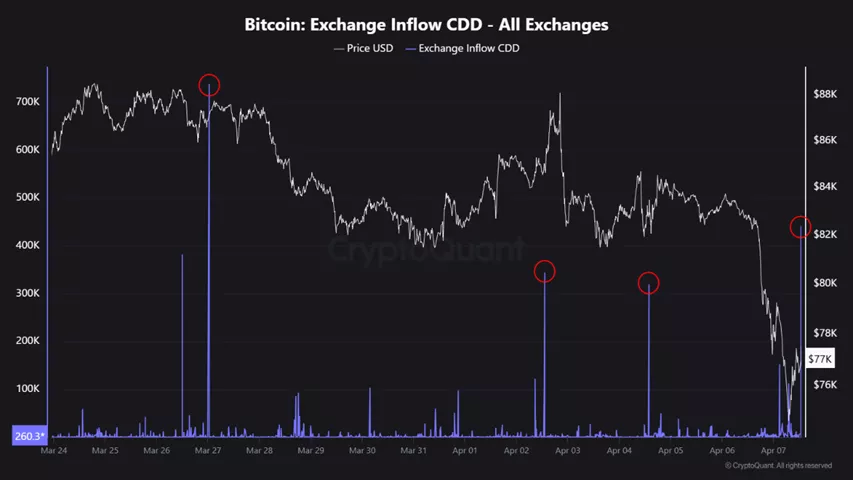

The Exchange Inflow CDD indicator confirmed an increase in transfers from wallets to exchanges. The last time this happened, it preceded a drop in the leading cryptocurrency’s price from $82,000 to $76,000, the analysts noted.

Technical picture

The drawdown from the ATH in the current cycle has widened to 26.62%. For comparison, it reached 83% and 73% in 2018 and 2022.

Bitcoin’s current price drawdown is about to become the largest of the current cycle. pic.twitter.com/JQpck1lsdt

— Julio Moreno (@jjcmoreno) April 7, 2025

On the weekly chart, bitcoin tested the 50-week MA for the first time since September 2024. A close below this level would signal the start of a bear market, according to Cointelegraph.

According to the publication, the $74,000 level (the all-time high from early 2024) is of interest. A daily demand zone between $65,000 and $69,000 could prove significant, with the upper boundary marked by the 2021 cycle peak.

Cointelegraph also drew attention to the Relative Strength Index falling to 43, its lowest since January 2023.

The crypto trader known as Rekt Capital, using this indicator, suggested that prices down to $70,000 could be the bottom of the current correction.

As a result, historical Daily RSI trends in this cycle suggest anything from current prices to ~$70000 is likely to be the bottom on this correction$BTC #Crypto #Bitcoin https://t.co/tHobd5BWpy pic.twitter.com/0WgOx5D3Yh

— Rekt Capital (@rektcapital) April 7, 2025

Earlier, the firm’s specialists said that bearish conditions in bitcoin are strengthening.

Nansen forecast that the crypto market would find a bottom before June.

CryptoQuant founder and CEO Ki Young Ju said the bull run is over for digital gold. In his view, over the next six to 12 months prices will decline or move sideways.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!