January 2022 in Numbers: NFT Boom Despite Crypto Slump, Fantom Strengthens and FTX’s Rally to $32 Billion

Key takeaways

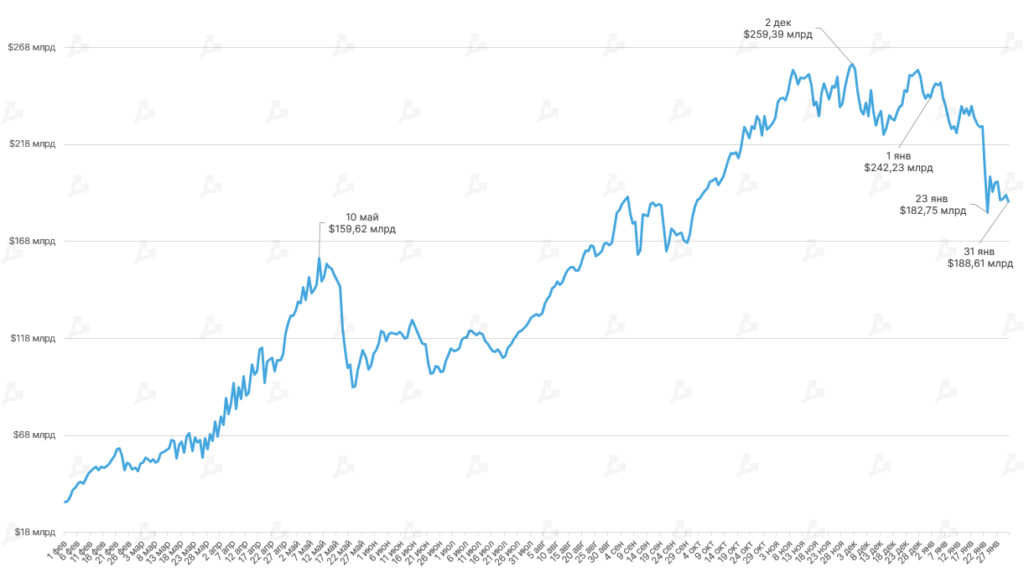

- Market capitalisation fell below $2 trillion, as the top cryptos posted fresh lows not seen since mid-2021.

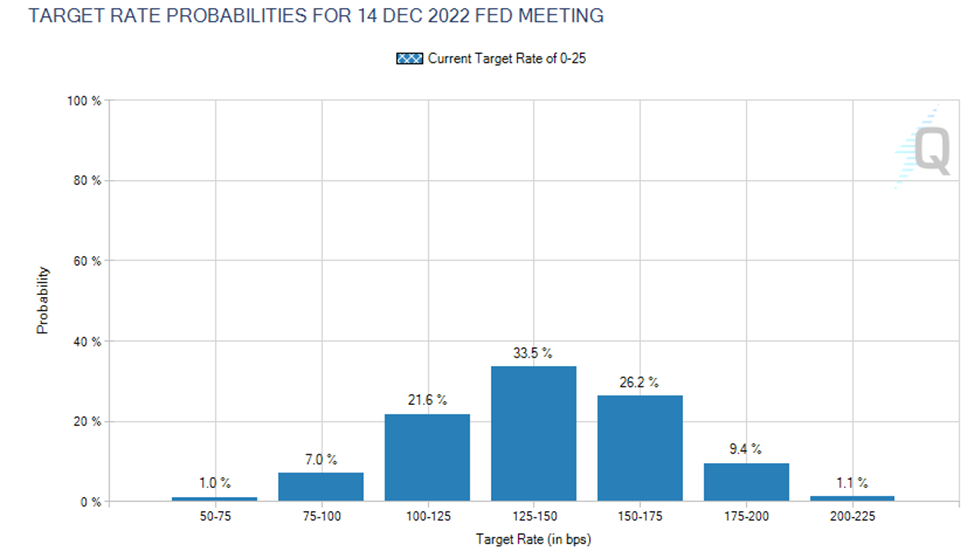

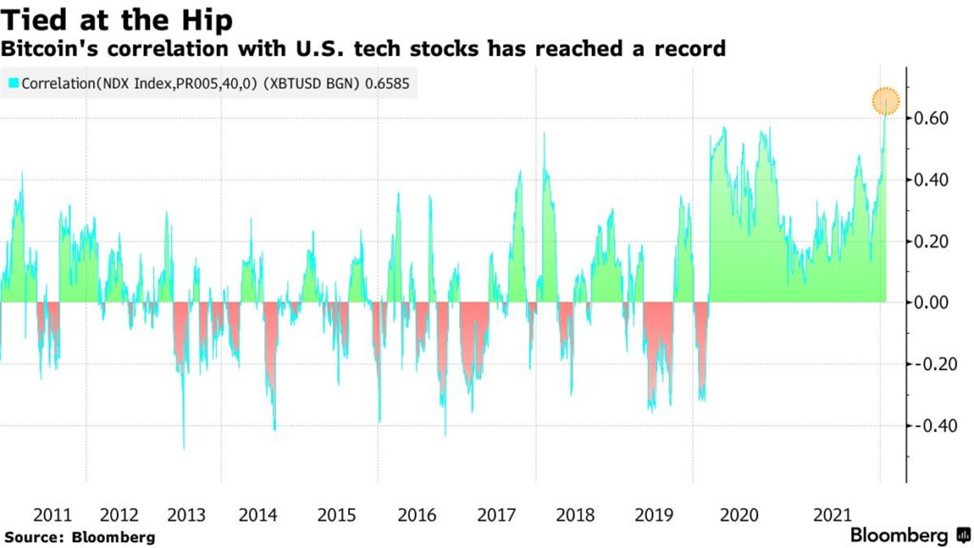

- The Fed’s policy stance and losses on equity markets weighed on Bitcoin’s price.

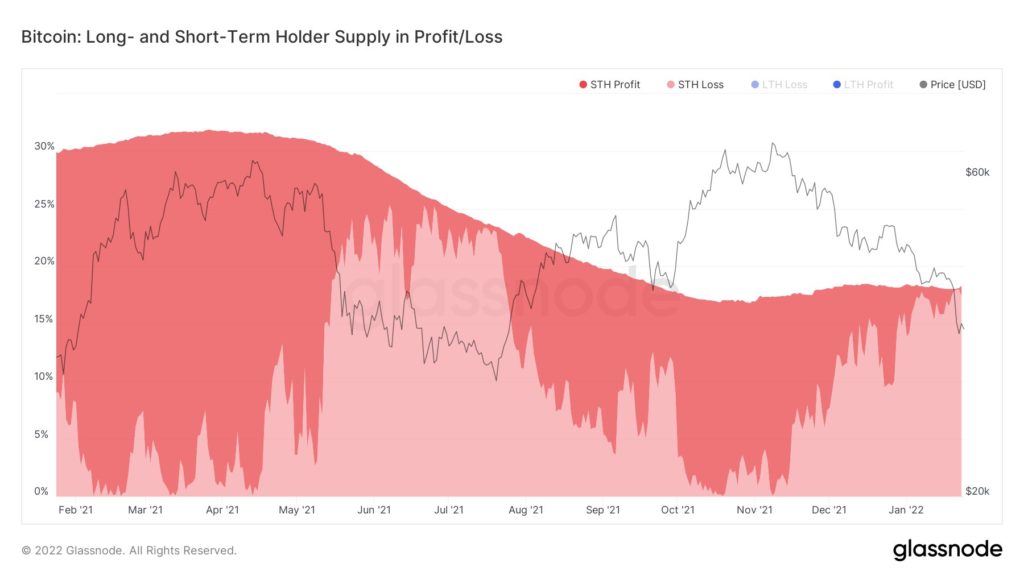

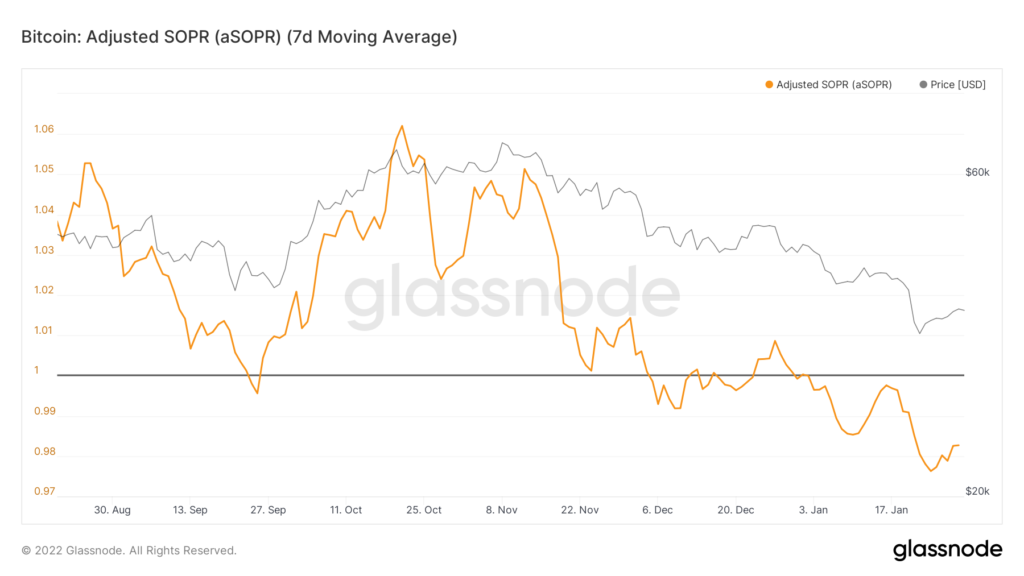

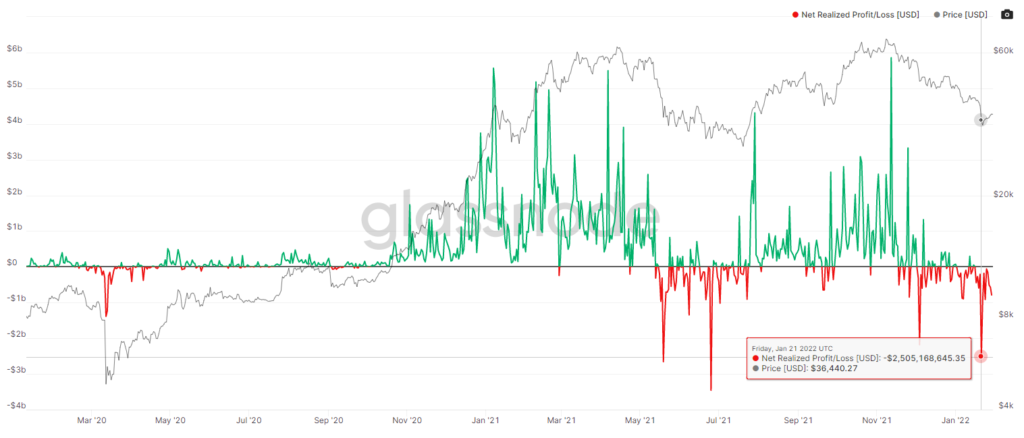

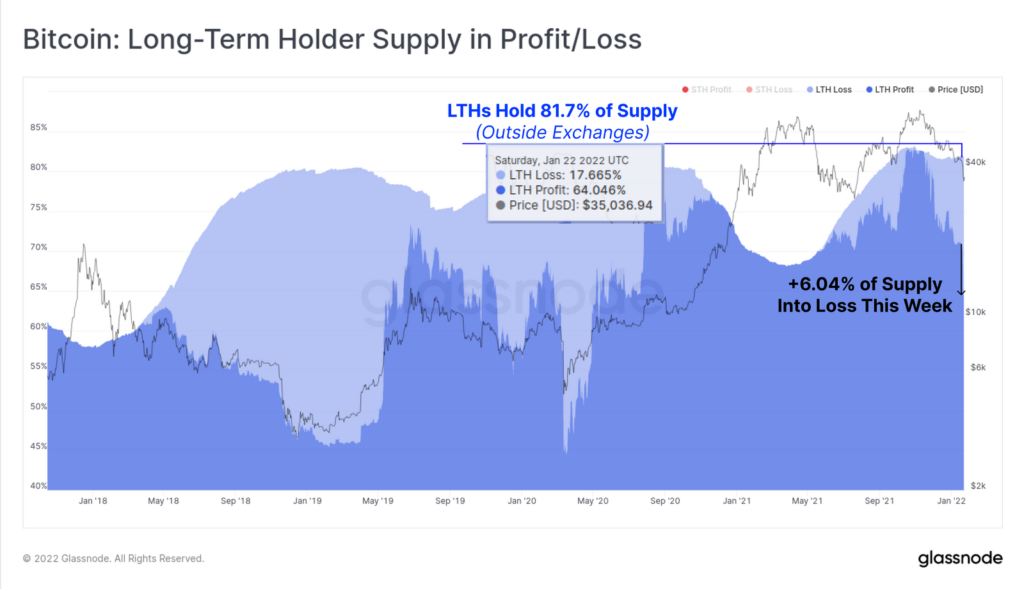

- Short-term investors booked record losses in the past six months, while long-term holders used the moment to buy.

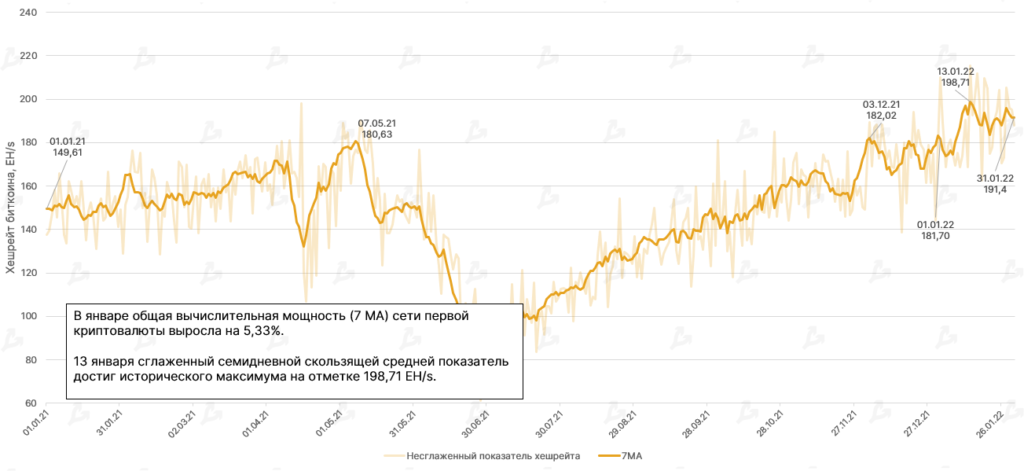

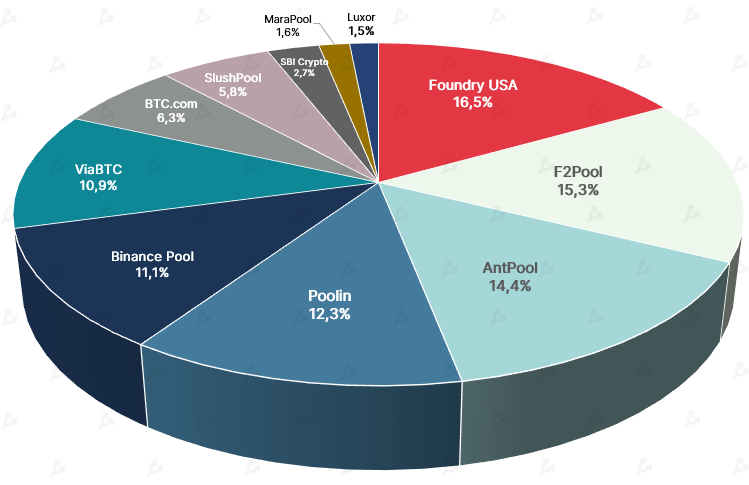

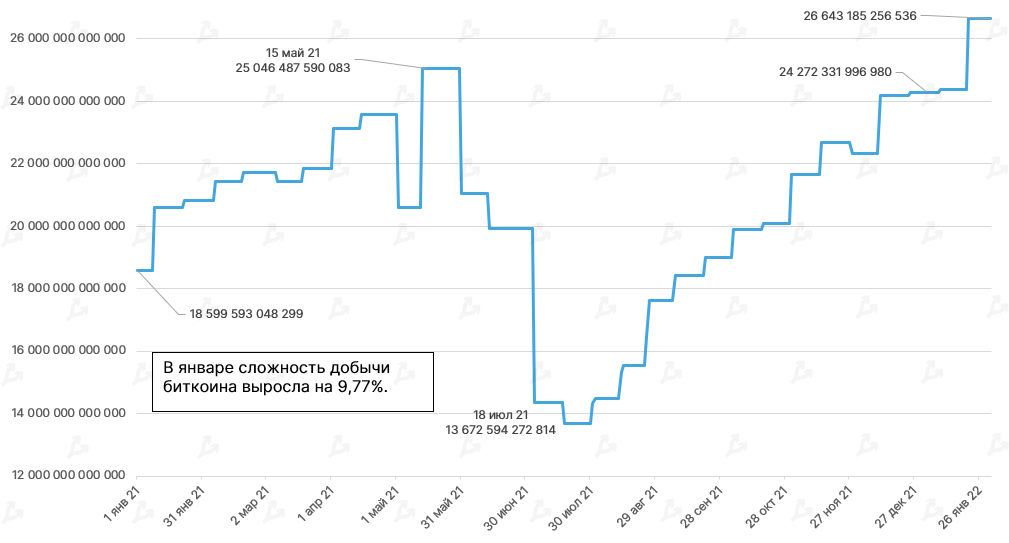

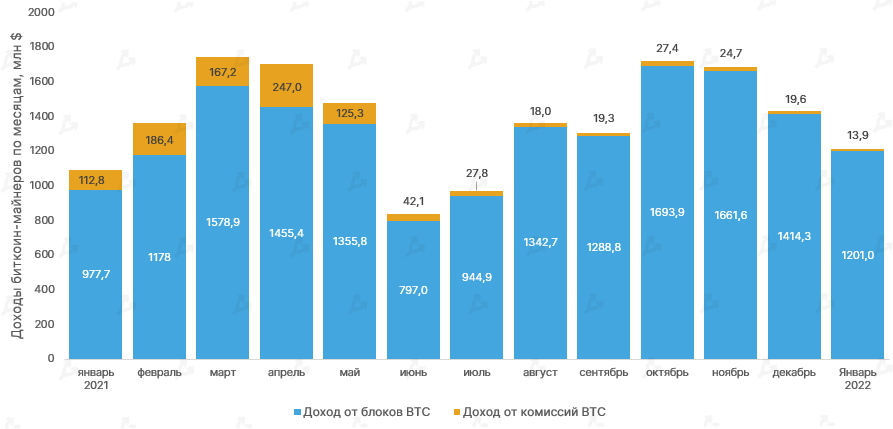

- Bitcoin’s hash rate and mining difficulty reached peak levels.

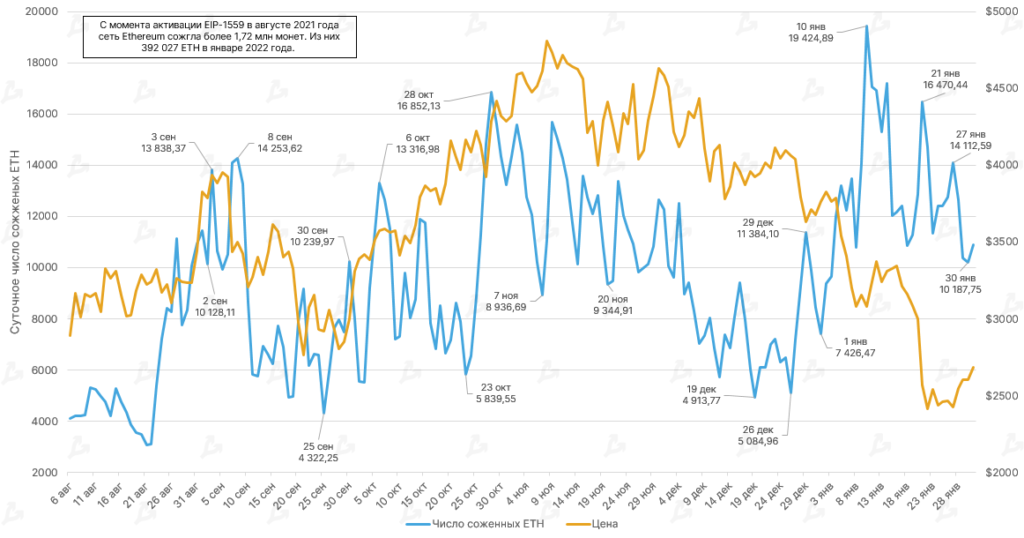

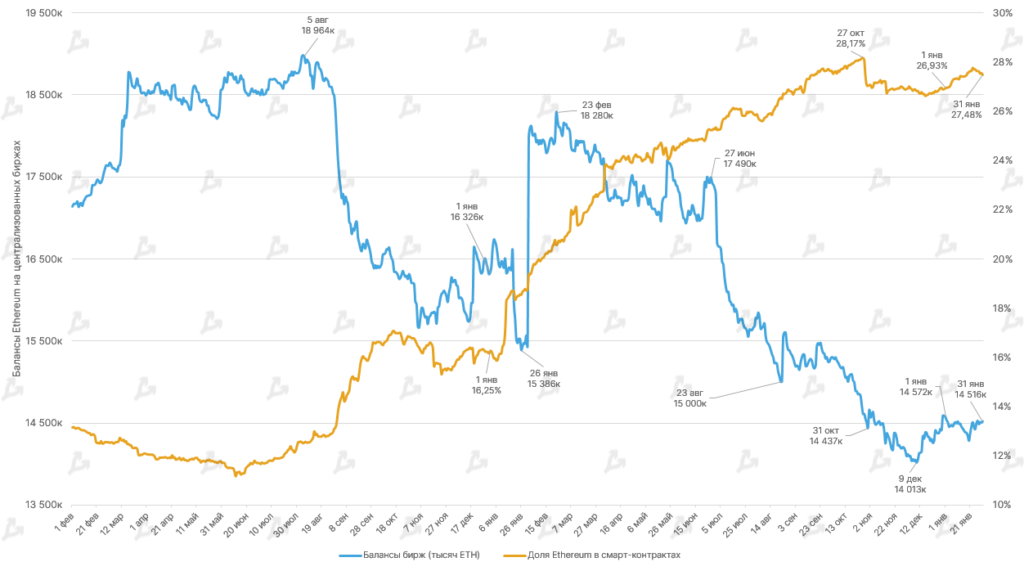

- DeFi protocols on Ethereum locked a record 43 million ETH.

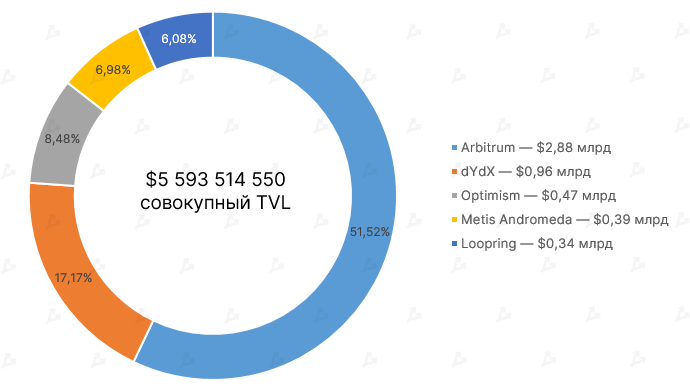

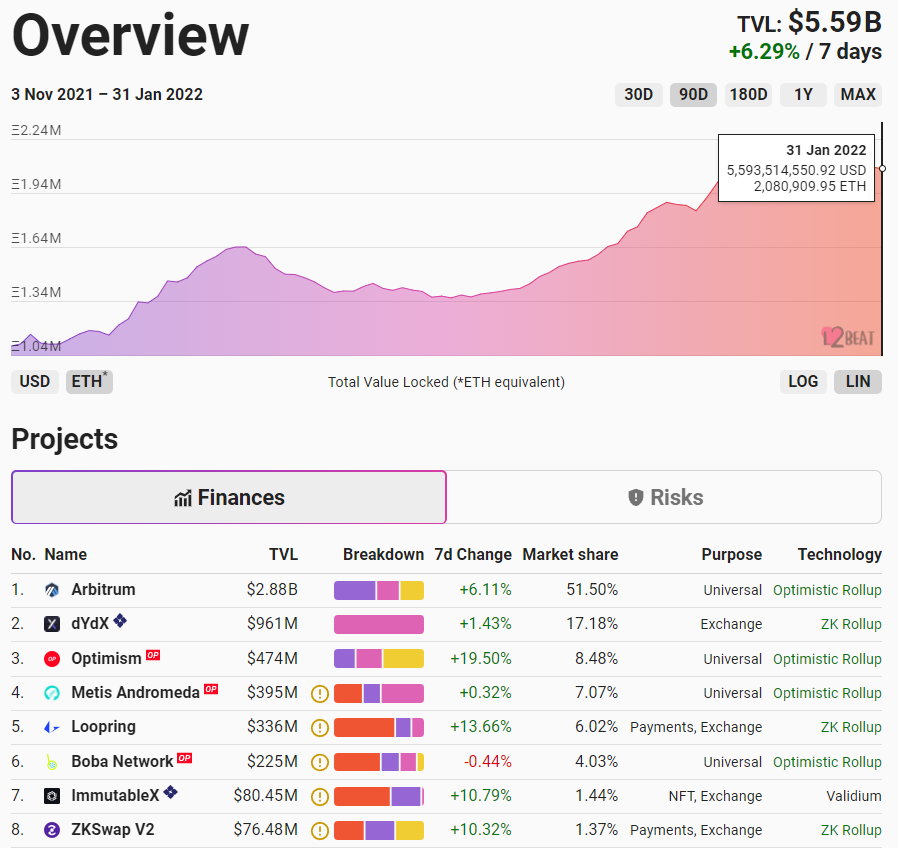

- Over the month, users deposited a quarter of total liquidity into L2 solutions.

- Total market capitalisation of stablecoins surpassed $165 billion.

- NFTs were back in the spotlight: OpenSea’s trading volume neared a record $5 billion.

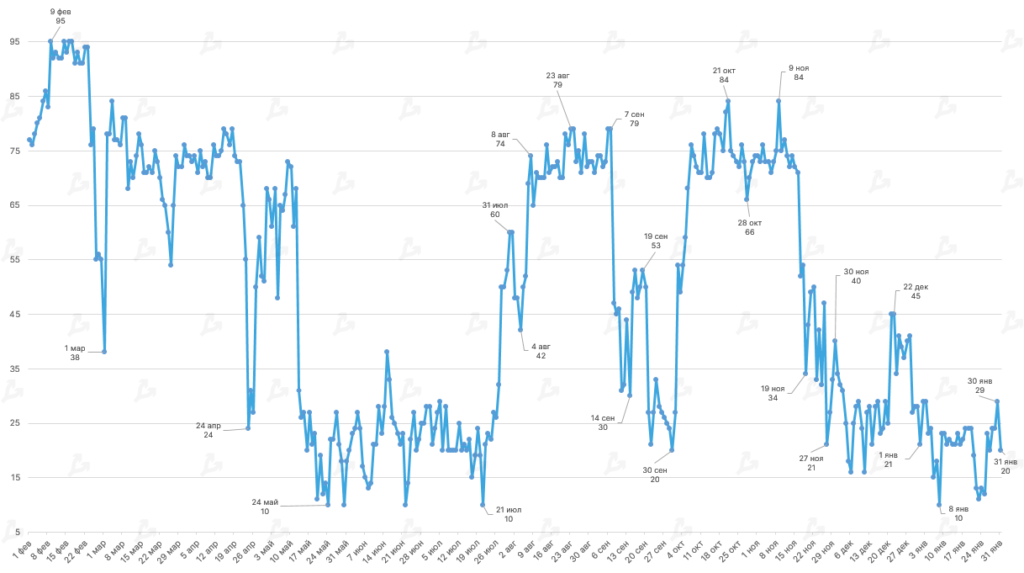

- User interest in NFT on Google Trends exceeded interest in cryptocurrencies.

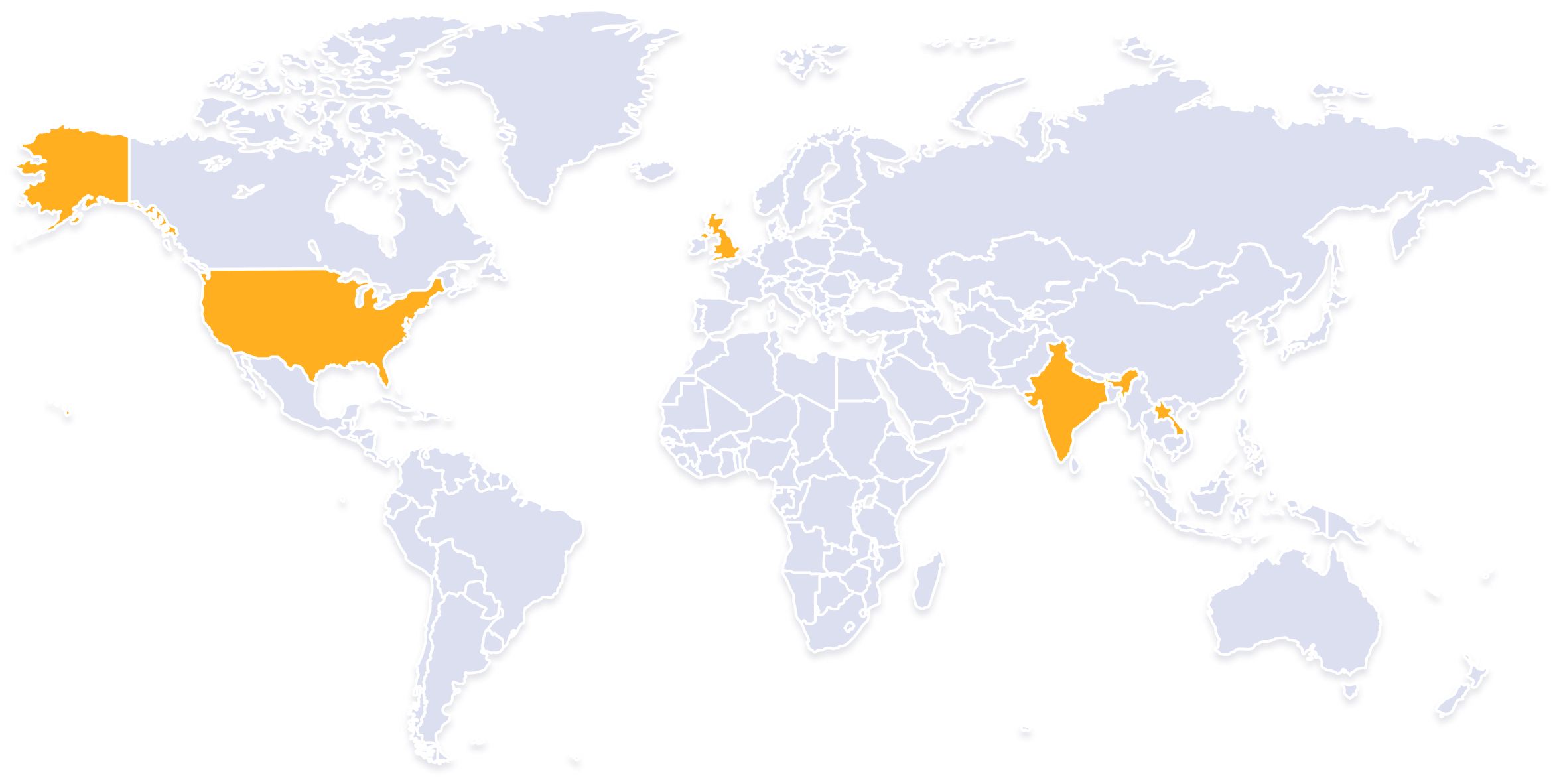

- The central bank and government diverged in views on banning cryptocurrencies and mining in Russia.

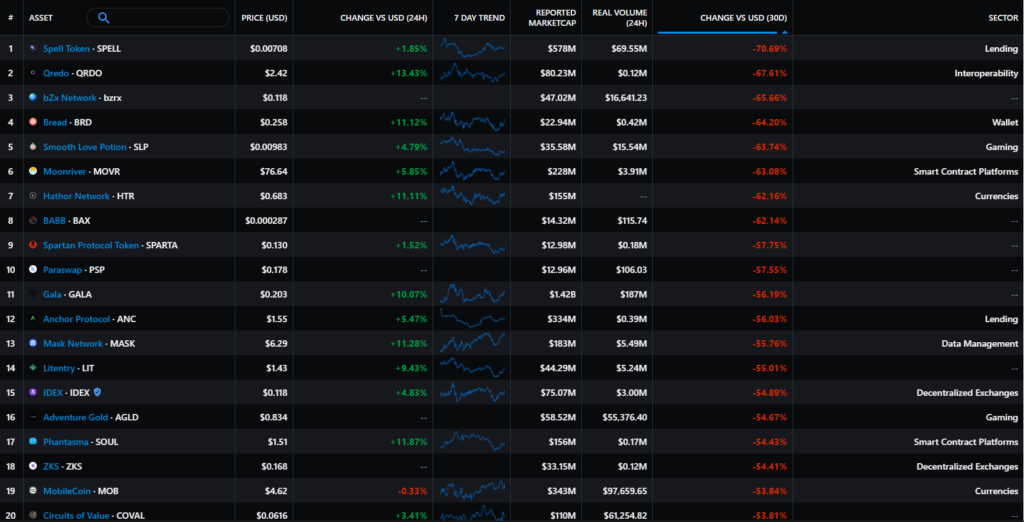

Leading asset dynamics

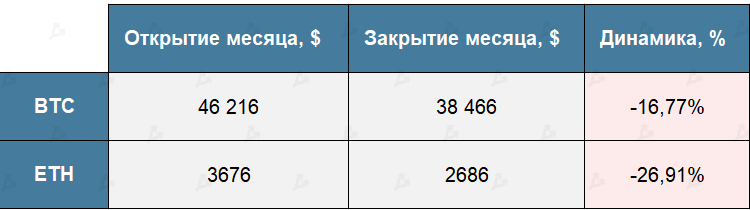

- The January correction that began late last year continued into January.

- Leading cryptos hit local lows not seen since July 2021 — on 24 January Bitcoin briefly touched $32,917 and Ethereum $2,159.

- The total crypto market cap fell 21%—from $2.19 trillion to $1.72 trillion. During the 24 January fall, the metric dropped below $1.5 trillion.

- Bitcoin down 16.7% and Ethereum down 26.9% for the month.

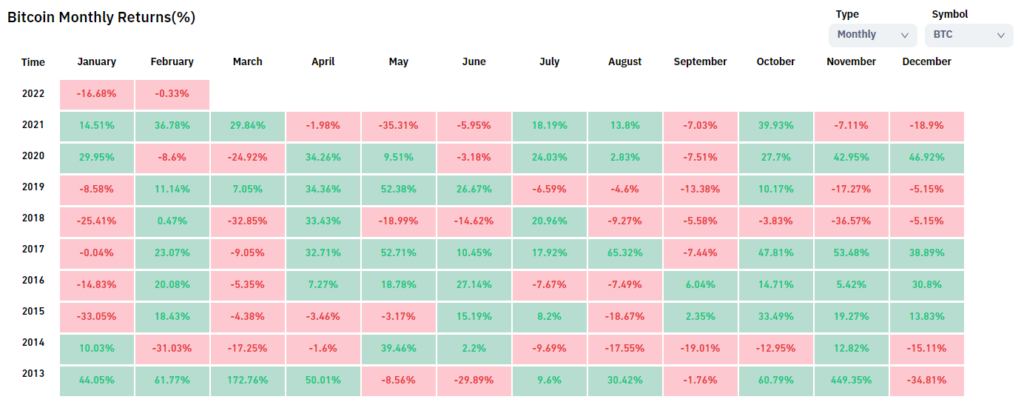

- February is historically favourable coming up next.