JPMorgan: 13% of Americans Have Invested in Cryptocurrencies

The share of US adults who have ever transferred funds to a cryptocurrency-related account rose from 3% in 2020 to 13% as of June 2022, according to JPMorgan’s study.

The analysts analysed a sample of 5 million accounts with monthly transaction volumes of at least $1,000. They identified transfers to crypto platforms and back.

Analysts found that most retail investors first invested in digital assets at price peaks. They noted that such behaviour correlates with traditional markets.

In recent years, retail inflows into crypto accounts far exceeded outflows. The move of funds became more balanced amid the market downturn in the first half of 2022.

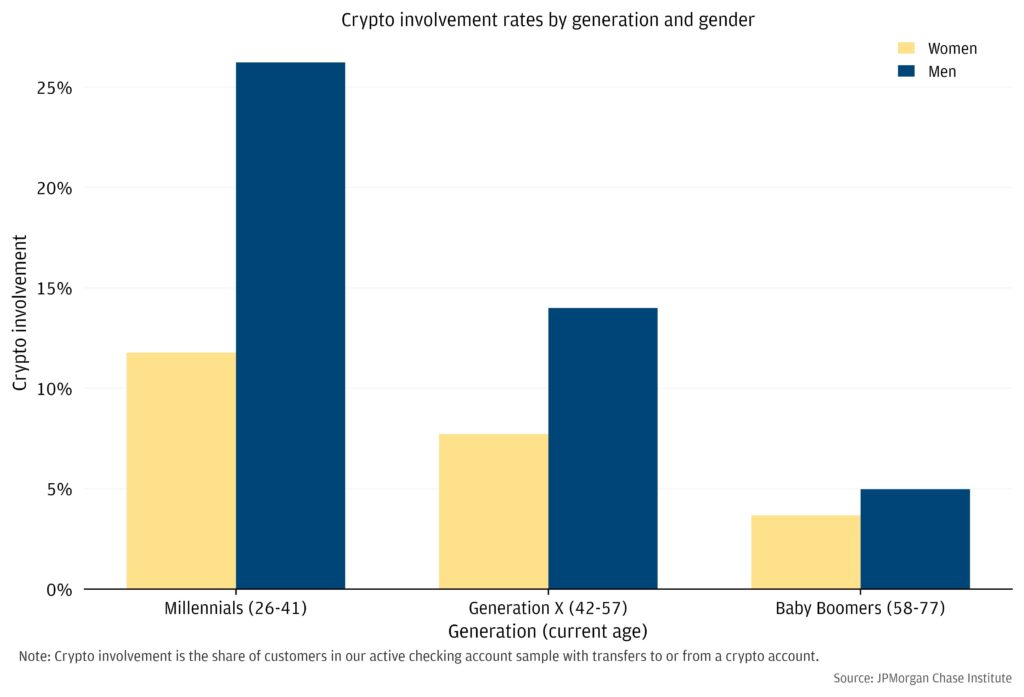

In age bands, researchers found the largest share of crypto investors among Millennials — 20% — versus 11% for Generation X and just 4% for Baby Boomers. Across all groups, men are more engaged in the new asset class.

Analysts at JPMorgan noted that those most inclined to invest in cryptocurrencies come from Asia with high incomes.

At the same time, the researchers found that the size of investments among users is relatively modest. The average transfer to crypto platforms since mid-2015 has been about $620, roughly equal to a week’s pay. Almost 15% of investors allocated more than a month’s earnings to digital assets.

Returning to the interest in cryptocurrencies relative to price movements, analysts noted that most low-income investors bought at higher prices.

For example, the median price at which the first cryptocurrency was purchased among this cohort of Millennials is $45,500, while among their wealthier peers it is $42,400. This trend holds across all generations.

Nearly half of cryptocurrency owners in the US earned profits from investments that were lower than expected, according to a Pew Research Center survey published in August.

Read ForkLog Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!