JPMorgan analysts see bitcoin at $170,000

Novogratz says the market has yet to peak

As leverage and relative volatility normalise versus gold, the leading cryptocurrency could climb to $170,000 within the next 6–12 months, JPMorgan analysts said, according to The Block.

By their count, the crypto market has corrected by nearly 20% from recent highs. The steepest drop came overnight 10–11 October amid record liquidations in perpetual contracts. Smaller position closures followed on 3 November.

They noted that the November liquidations coincided with a fresh blow to investor confidence — the hack of the Balancer DeFi protocol for $128m. The incident again highlighted the security risks of decentralised projects.

Despite the bouts of selling, the deleveraging phase is “largely done”, the analysts stressed. Open interest in bitcoin perpetual futures relative to the asset’s market capitalisation has fallen from above-average levels back to its historical norm.

A similar picture is visible in Ethereum, though the reduction in leverage there was less pronounced.

“On CME we see the opposite: there were more liquidations in Ethereum futures than in bitcoin,” — added at JPMorgan.

They also said that the outflows from crypto ETFs seen in recent weeks were modest compared with the inflows in the weeks ended 3 and 10 October.

“We think perpetuals are the most important gauge to watch right now. The stabilisation of this metric suggests deleveraging is likely behind us,” — the experts concluded.

Bitcoin at $170,000

JPMorgan argues that higher gold volatility has made the market’s flagship more attractive on a risk‑reward basis.

Bitcoin’s volatility relative to gold has fallen below 2. That means the coin requires roughly 1.8 times more risk capital than gold.

On that basis, the analysts calculate that to match the scale of private investment in the metal, bitcoin’s market value (about $2.1trn) would need to rise by 67%.

“This implies a theoretical price of roughly $170,000,” — they noted.

The current price is about $69,000 below its gold‑adjusted value. In their view, this “mechanical calculation suggests considerable upside over the next 6–12 months”.

At the time of writing bitcoin trades around ~$101,000. Over the past day its price is down 2%.

The market is far from the peak

Galaxy Digital founder Mike Novogratz said the crypto market’s “sluggish dynamics” reflect hodlers rebalancing portfolios. He believes diversifying positions is beneficial in the medium and long term.

$GLXY continues to work day after day building long term shareholder value. Of course, I wish our stock went up every day but we can’t control who buy and sells. What we can do is invest for the future, chase down loose balls, and recruit great talent.

We are excited about…

— Mike Novogratz (@novogratz) November 5, 2025

In the short term, this may weigh on prices.

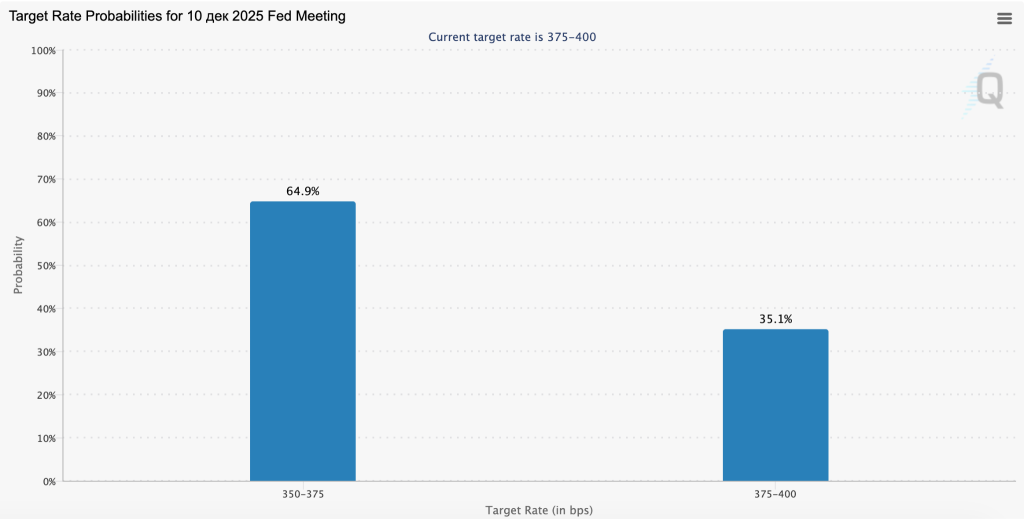

He is not convinced that digital assets have reached the cycle peak. Novogratz expects that a change at the helm of the Fed will favour a more accommodative policy. That, in turn, would provide sufficient impulse for the next leg of growth.

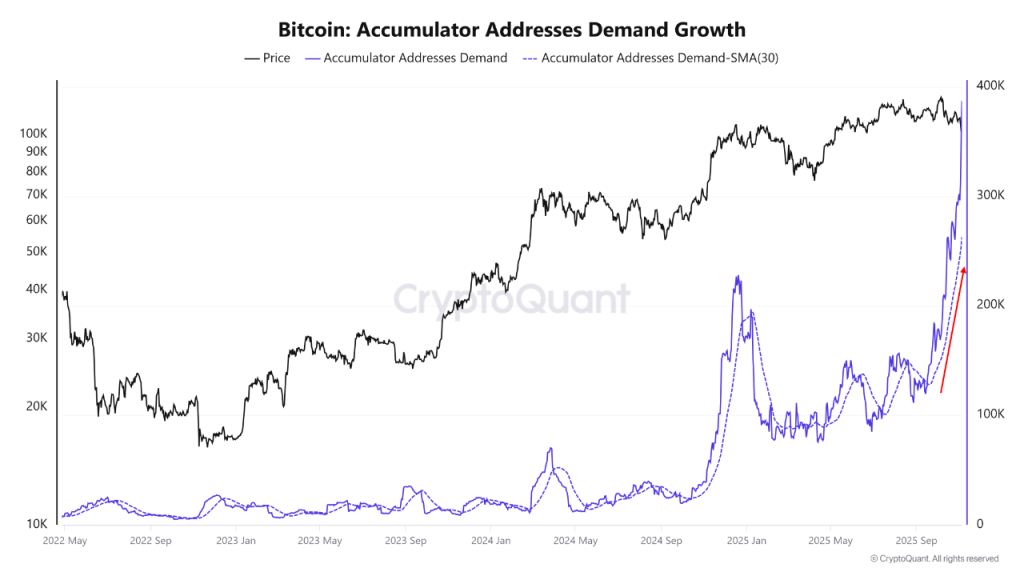

A CryptoQuant analyst going by MAC_D observed accelerated accumulation of bitcoin by long‑term holders — addresses from which no outflows have ever been seen. According to him, this investor cohort is absorbing selling pressure.

The cohort’s realised price continues to increase and is now about $78,520. MAC_D believes a true “crypto winter” would occur only if that level is breached.

“Institutions, funds and whales continue to accumulate assets even at relatively high price levels and are absorbing short‑term pressure,” — the expert noted.

The market is now entering a phase of liquidity expansion, supported by expectations of another key rate cut, the end of quantitative tightening and growth in US dollar M2.

“Given these conditions, the current cycle is more likely to show a rapid recovery in price momentum, unlike previous prolonged declines,” — the analyst concluded.

At the time of writing, market participants assign a near 65% probability to further easing of the Fed’s monetary policy.

Earlier, the MVRV indicator, now at its lowest since April (1.8), indicated a local bitcoin bottom around $100,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!