JPMorgan Analysts See USDT’s Role Rising Amid Binance’s BUSD Moves

JPMorgan analysts say Binance's move could boost USDT's role in trading.

Automatic conversion Binance stablecoins USDC, USDP and TUSD on user balances into BUSD will heighten the role of USDT in cryptocurrency trading. Analysts at JPMorgan arrived at these conclusions, The Block writes.

The bitcoin-exchange’s initiative will take effect on September 29. The changes will affect nearly all of the platform’s functions and services.

“This decision will likely strengthen the importance of USDT in the stablecoin ecosystem, which had been under threat from USDC,” the analysts wrote.

Experts noted a decline in Tether’s share over the past 18 months. After collapse of TerraUSD, USDC and BUSD managed to strengthen their positions.

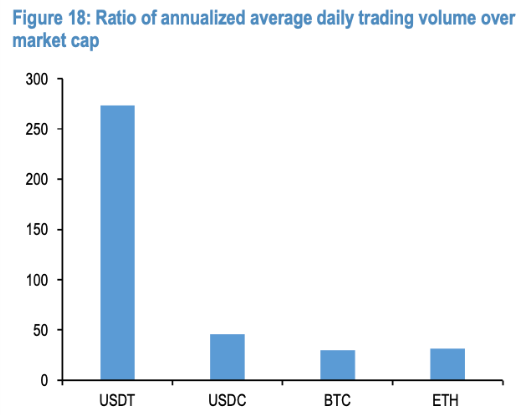

“The importance of USDT is not limited to its market capitalization, but also depends on its use, particularly in trading,” the specialists explained.

Tether is issued on eleven different blockchains, compared with eight for its main rival. Daily trading volumes on a year-to-date basis are also far higher than those of USDC, Bitcoin, and Ethereum. The average daily turnover of Tether is ten times the volume of USD Coin.

The bank’s specialists also noted the potential for an increased BUSD share due to Binance’s policy.

“Binance introduced zero-maker fees on all trading pairs with BUSD and scrapped them for takers in the USDT/BUSD pair”, the analysts explained.

Binance USD’s market capitalization exceeded $20 billion on September 13.

Earlier, Wintermute’s CEO and founder Evgeny Gaevoy said the Binance initiative posed risks for USDT.

In July, Arcane Research analysts forecast that USDC would overtake USDT in market capitalization this autumn.

Read ForkLog’s Bitcoin news in our Telegram — news on cryptocurrencies, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!