Justin Sun explains TRON’s USDD collateral model

The TRON team has learned lessons from the Terra ecosystem collapse, so the algorithmic stablecoin USDD will not repeat the fate of its predecessor. заявил Justin Sun, the project’s founder.

Sun said that the push to launch USDD was spurred by the rapid ascent of Terra. At the same time, he stressed that the security of TerraUSD (UST) has always been at risk, even after the creation of a reserve fund by the Luna Foundation Guard (LFG).

“Despite all of LFG’s efforts, the majority of UST’s collateral consisted of LUNA, a highly volatile asset, and less than 15% of the stablecoins were backed by Bitcoin. We have witnessed the consequences of this error over the past two weeks,” he wrote.

Sun emphasized that USDD will be fully backed by a mix of stable and volatile assets. Initially, in the reserve fund of the TRON DAO Reserve (TDR) were stablecoins such as USDT and USDC, as well as Bitcoin and TRX.

“At present, the level of collateralization stands at around 180%–200%. By gradually expanding the USDD supply, we will be prudent in expanding the product,” added the founder of TRON.

The launch of USDD took place in early May 2022. The stablecoin is issued in a model similar to UST — to mint, a corresponding amount of TRX must be burned. Redemption occurs in the same way.

Yet, unlike Terra, at the initial stage only authorised participants of the TDR, whose addresses are whitelisted, can issue USDD. In the future this restriction will be lifted.

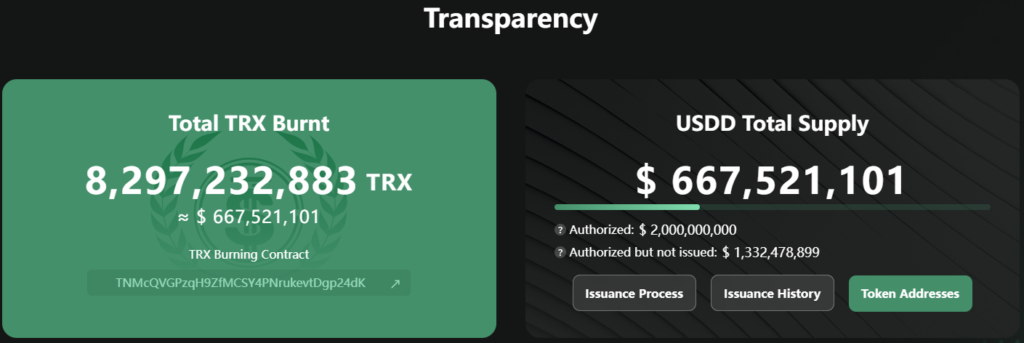

According to the TDR, at the time of writing the asset’s circulating supply stood at over 667.52 million USDD. To issue the stablecoins, participants withdrew more than 8.29 billion TRX from circulation.

Sun noted that in the initial phase the USDD supply is capped at 2 billion coins. During this period, to attract new users, the ecosystem offers an annual yield on deposits of up to 30%.

In the second phase of the project’s development, the USDD cap will be removed, but the interest accrual model will also change. Participants willing to lock liquidity for a period of one year will still receive a high return. Short-term investors will have to work with a lower rate.

“Liquidity is a primary characteristic, so we want to reward early adopters with sufficient returns for the funds they provide. Ultimately, the USDD supply cap will be determined by the asset’s overall trading volume,” Sun explained.

According to the TRON founder, the TDR “plans to guarantee” that USDD will always be backed by a basket of liquid assets. He noted that more than $550 million has already been allocated to the reserve—and as the stablecoin’s supply grows, this amount will rise. By the end of the first phase, the fund’s size will reach $2 billion. In the long term, $10 billion will be allocated for these purposes.

Earlier Sun stated that the TRON ecosystem will not abandon USDD, despite the crash of UST and LUNA.

In May, the amount of funds locked in TRON-based decentralized applications rose by 48%.

Read ForkLog’s bitcoin news in our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!