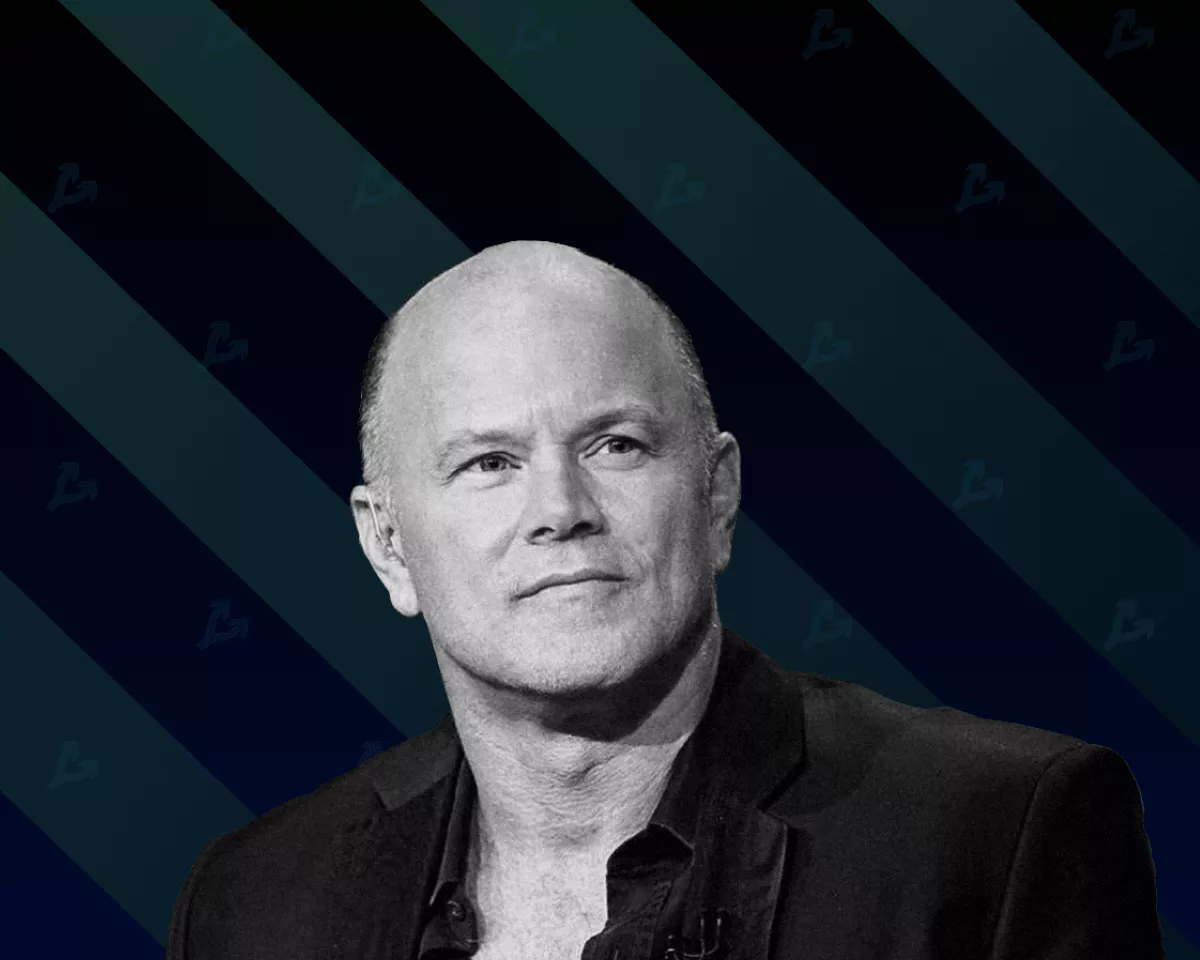

Institutional investors, who discovered cryptocurrencies about six months to a year ago, are not even close to satisfying their interest. We are only at the beginning of the path to the emergence of asset managers, insurance companies and other large players, says Galaxy Digital founder Mike Novogratz.

Galaxy Digital CEO @Novogratz on $BTC: «The institutions who are coming into this space now that weren’t in the space six months ago, [a] year ago, don’t have their fill yet. Not even close. We’re in the first inning of a 9-inning game with insurance companies, asset managers…» pic.twitter.com/hPClp8R9o4

— Yahoo Finance (@YahooFinance) January 13, 2021

The former Goldman Sachs vice president is confident that all such 20% pullbacks, such as in mid-January, will be bought. At the same time, Novogratz sees only a slim chance that in the short term the price of bitcoin will breach the psychological level of $50 000.

“We are witnessing a transition from retail players with leverage to ‘deeper pockets’, ‘longer arms’ [of institutions]. If you are an insurance company buying bitcoin, you are not buying it for a two-month horizon; you are buying it as a long-term asset,” said Galaxy Digital CEO.

Novogratz views bitcoin as digital gold, and altcoins as a means of payment.

According to Bitcoin Treasures data, over the past year institutional investors bought more than 1 million BTC — 5.57% of the cryptocurrency’s circulating supply at the time of writing.

Billionaire Howard Marks was another major investor who admitted that his critique of bitcoin was unfounded. Before him, similar conclusions were reached by Ray Dalio and Stanley Druckenmiller.

Subscribe to the ForkLog channel on YouTube!