On which exchanges do Bitcoin whales show the most activity

The number of Bitcoin whales has approached the level seen in September 2017, when Bitcoin moved toward its all-time high around $20,000. The indicator has been rising steadily since the start of the year, suggesting that large market participants are accumulating digital gold, possibly ahead of new price highs.

However, not all whales adhere unwavering to a Buy & Hold investment strategy. This means that a substantial amount of large trades on cryptocurrency exchanges are influencing Bitcoin’s price and the market as a whole.

Kaiko Data researchers analyzed trading data from the largest exchanges, focusing on whale trades. ForkLog offers readers a concise translation of the first part of the company’s report.

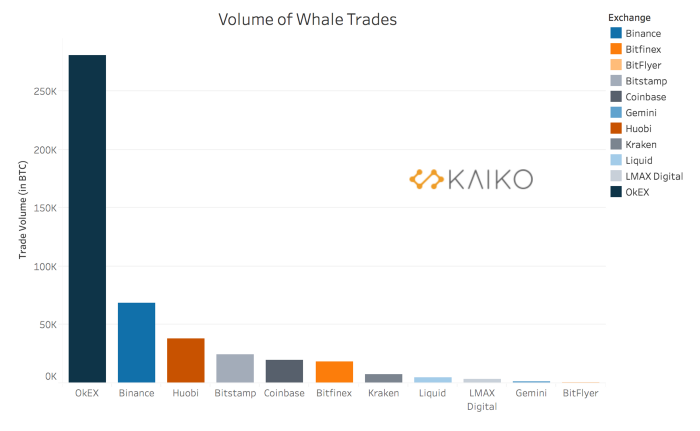

- Major trades occur most on OKEX. The exchange features the highest trading volume and a substantial size of whale trades.

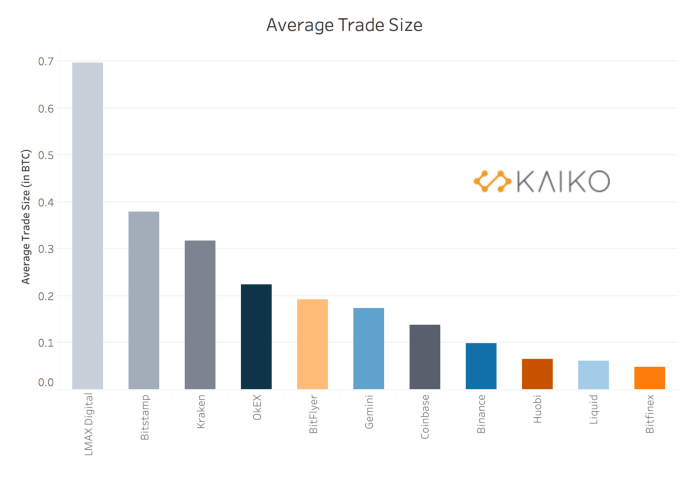

- On the institutional exchange LMAX Digital, the largest average trade size is 0.69 BTC. This is roughly twice that of Bitstamp (0.37 BTC).

- On OKEx, Binance and Huobi the average trade size is relatively small. On these exchanges, oriented mainly toward retail traders, there are whales executing large-sum operations.

- In BTC/USDT pairs there are more whale trades than in BTC/USD.

Profiles of market participants range from the smallest traders to true whales. Many exchanges target different categories of traders via targeted marketing and trading options, to differentiate themselves in a competitive environment. In conducting the study, we found that each exchange has its own unique trade structure, sometimes quite surprising.

Although it is impossible to know who lies behind a given trade, we can use order size to classify market participants into whales and retail traders.

Methodology

We selected a number of exchanges with substantial trading volumes. These venues cater to different user bases in the context of geography, active trading pairs, regulatory features and the industry’s reputation overall.

The study used data from June 2020 across 11 exchanges and the most liquid trading pairs by volume:

- Binance (BTC/USDT);

- Huobi (BTC/USDT);

- Bitstamp (BTC/USD);

- Coinbase (BTC/USD);

- Bitfinex (BTC/USD);

- Kraken (BTC/USD);

- Liquid (BTC/JPY);

- OKEx (BTC/USDT);

- Bitflyer (BTC/JPY);

- LMAX Digital (BTC/USD);

- Gemini (BTC/USD).

We classify a trade as “whale” if its size exceeds 10 BTC.

Exchange statistics

We found that LMAX Digital leads in average trade size — 0.6968 BTC. This is expected, given the exchange’s near-exclusive focus on institutional traders.

The average order size on LMAX Digital is roughly twice that of Bitstamp (0.3783 BTC), which ranks second. Interestingly, on Bitstamp this figure is more than twice that of its closest rivals — Gemini (0.1739 BTC) and Coinbase (0.1373 BTC).

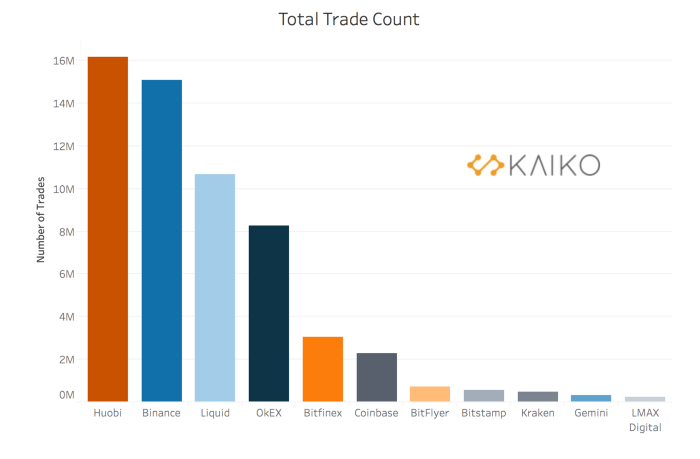

On Binance, Huobi, Liquid and Bitfinex, oriented mainly to retail traders, the average trade size is even lower — 0.0997 BTC, 0.0653 BTC, 0.0612 BTC and 0.0481 BTC respectively. Yet there are a huge number of such small trades. In particular, Huobi leads in the number of trades in the BTC/USDT pair (about 16 million).

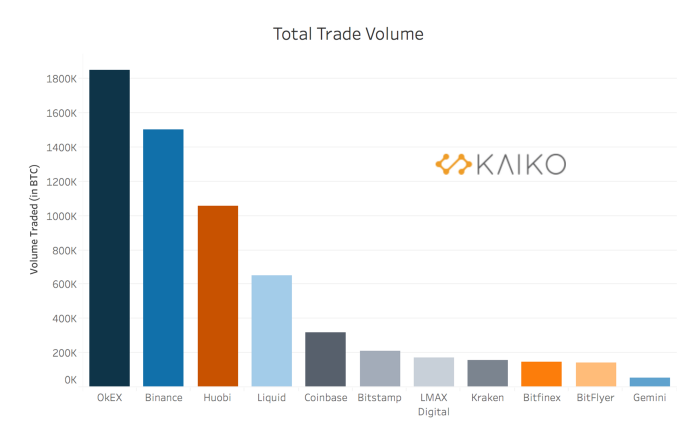

In terms of trade count, OKEx is fourth, yet first in total trading volume. In this metric, the exchange significantly outpaces the other three retail-oriented venues.

By this measure, LMAX Digital also unexpectedly rose from last place to seventh. The exchange nevertheless shows a relatively high average trade size.

Interestingly, the top three in trading volume all feature the BTC/USDT pair. For exchanges offering BTC/USD — Coinbase, Bitstamp, Kraken, Bitfinex, LMAX Digital and Gemini — volumes and trade counts are notably lower.

Whale trades

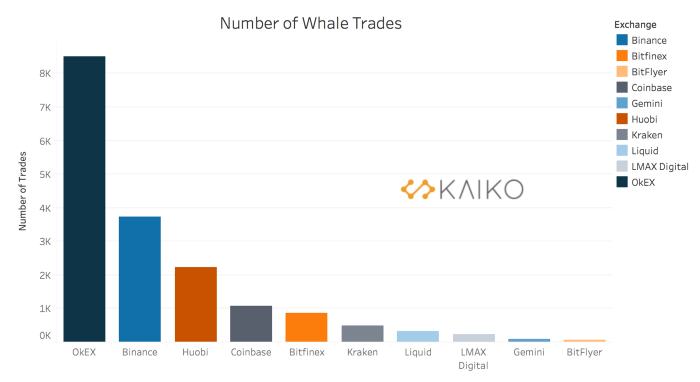

Now, a closer look at the structure of “whale” trades on these exchanges. First, note the total number of trades above 10 BTC per exchange.

OKEx leads in this regard — in June there were 8,500 trades of more than 10 BTC. Binance and Huobi also figure in the top list, though with a substantial gap from the leader.

In the context of whale trading volume, the picture is broadly similar. The main difference is a much larger gap between OKEx and the others.

Conclusions

OKEx leads the market in whale-trade counts and the average size of a large order. The exchange’s total trading volume is among the highest in the industry. Consequently, the platform plays a significant role in price formation.

Large players prefer venues with higher trading volumes. This stands to reason: liquidity matters, it helps prevent price slippage in large trades.

On exchanges supporting the BTC/USDT pair, there are more whale trades than on platforms offering BTC/USD.

A broad volume of large trades occurs on exchanges on a regular basis. This may indicate high order-book liquidity.

Differences between venues oriented toward retail investors and those aimed at institutional players are blurred. Retail exchanges have a substantial user base that regularly conducts large trades.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!