Options Market Signals Investor Hedging Against Bitcoin Drop to $100,000

Data from the options market indicates traders are attempting to hedge against a drop in Bitcoin’s price to $100,000 amid ongoing global economic uncertainty, analysts at Bloomberg note.

On the Deribit exchange, the put-to-call ratio reached 2.17 within a day, indicating a growing interest in protective strategies.

The highest demand was for short-term contracts, which provide the right (but not the obligation) to sell an asset at a specified price in the future.

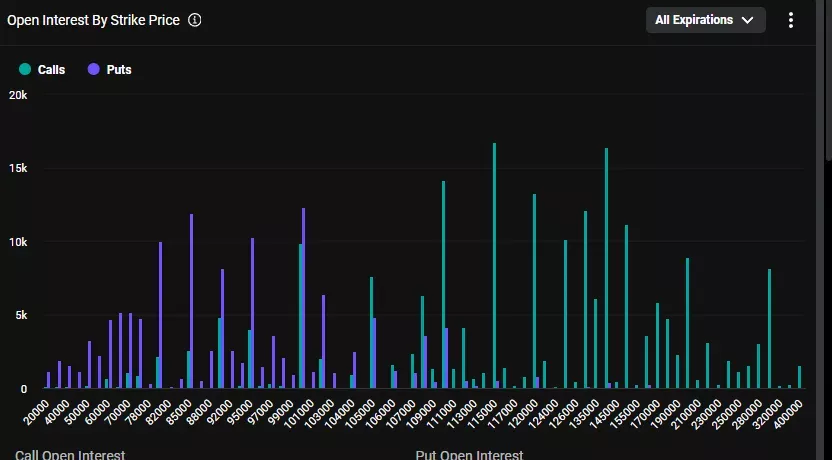

In options expiring on June 20, the greatest open interest is concentrated on puts with a strike price of $100,000. Their ratio to calls is 1.16, reflecting heightened expectations of a possible short-term correction.

The popularity of protective strategies may be partly linked to the Federal Reserve’s decision to maintain the key rate in the range of 4.25–4.5%. Easing monetary policy, on the other hand, could increase demand for riskier assets like tech stocks and cryptocurrencies.

The military conflict between Iran and Israel also significantly impacts global markets.

“A real de-escalation in the Middle East could stimulate interest in risky assets, whereas an escalation could trigger their sell-off,” opined XBTO’s Chief Investment Officer Javier Rodriguez-Alarcon.

He emphasized that geopolitics “remains a factor of uncertainty.”

Earlier, analysts at QCP Capital expressed confidence that an escalation in the Middle East could drive up the price of digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!