Options market split on bitcoin’s outlook

QCP says markets doubt bitcoin will set new highs this year.

Market participants are unsure whether the leading cryptocurrency will test new price highs before year-end, QCP analysts noted.

They observe that big players are simultaneously adding call positions targeting $112,000–$150,000 while taking profit by selling spreads around $135,000–$140,000.

The divergence points to uncertainty over bitcoin’s ability to clear key resistance levels in the coming months. The backdrop is worsened by continued selling from long-term holders and outflows from exchange-traded funds.

Even so, QCP highlights the market’s resilience. Hints of an end to the US shutdown were the key catalyst for the latest rebound, they say.

‘Ancient’ bitcoin wallets

In November, long-term investors in the leading cryptocurrency showed their highest level of activity since July, said CryptoQuant contributor Arab Chain.

Older Bitcoin Wallets Move Coins to Binance at Highest Level Since July

“If balance between older deposits and consistent demand from newer maturities persists, we may witness an upward price accumulation in the coming weeks” – By @ArabxChain

Link ⤵️https://t.co/OXiyM3aLpH pic.twitter.com/qen7Zen1U5

— CryptoQuant.com (@cryptoquant_com) November 10, 2025

Coins aged 7–10 years stood out. Such ‘ancient’ holdings are typically moved only amid fundamental shifts in the market, the analyst noted.

According to Arab Chain, activity by long-term whales usually acts as a short-term warning, signalling a readiness to take profit after a long period of dormancy.

“This traditionally marks a turning point—either the start of a broad correction or institutional reallocation ahead of a new phase of growth,” the analyst stressed.

The current set-up, however, looks more balanced. Older coins are hitting exchanges while new investors hold their positions, tempering selling pressure.

A key factor is bitcoin stabilising around $106,000. That suggests a period of ‘quiet’ redistribution rather than a broad sell-off.

In the expert’s view, a continued balance between supply from ‘ancient’ wallets and demand from newer entrants “could lay the groundwork for accumulation and a subsequent rally”.

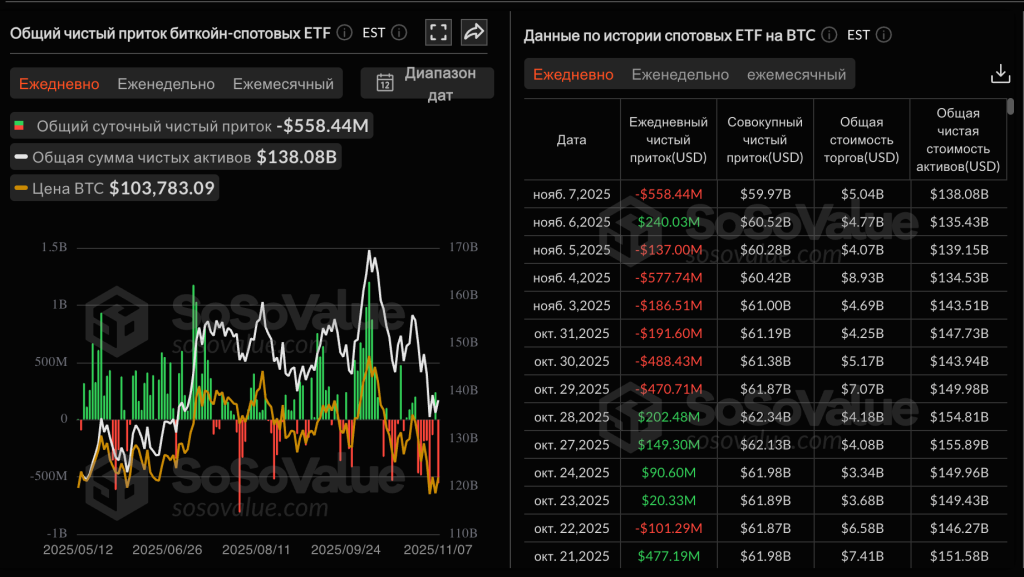

Outflows from spot bitcoin ETFs

After the latest session, exchange-traded funds backed by the leading cryptocurrency lost $558 million. The biggest outflows were from Fidelity’s FBTC (-$256 million), Ark & 21Shares’ ARKB (-$144 million) and BlackRock’s IBIT (-$131 million).

In total, from 31 October to 8 November, $1.17 billion was withdrawn from digital-asset investment products.

Cumulative inflows since the launch of bitcoin ETFs have fallen to $59.9 billion. At the end of October, the figure exceeded $62 billion.

What next?

At the time of writing, digital gold trades around $106,100. The price is up 3.9% over the past 24 hours.

Glassnode noted the next key level is $108,500, a zone that “has historically served as resistance during recovery moves.”

Bitcoin rebounded from the 75th percentile cost basis (~$100K) and is now consolidating near $106.2K.

The next key level is the 85th percentile cost basis (~$108.5K); a zone that has historically served as resistance during recovery moves.📉https://t.co/2geS82By8p https://t.co/SxAJ9C4AsR pic.twitter.com/8kBQOatwba

— glassnode (@glassnode) November 10, 2025

Clearing that threshold would be an important signal for further upside.

According to the analyst known as Darkfost, the resilience of the current trend would be confirmed if bitcoin closes the day above $107,500.

📉 It has now been one month since the price has been trading below the STHs’ realized price, putting them under significant pressure.

I’m not convinced that the current rebound is strong enough to bring them back above water. As we discussed in TA, this looks like a technical… https://t.co/75bU9QZXgr pic.twitter.com/yJyKOVmWdN

— Darkfost (@Darkfost_Coc) November 10, 2025

He noted that for a month bitcoin has traded below the short-term holders’ (STH) realised price, “putting them under significant pressure.” The latest bounce looks more like a technical correction to reset the RSI than a true trend reversal, he stressed.

“This week’s news may act as a catalyst, but, as history shows, last time the price spent about two months below the STH realised price before a full recovery. For now, caution is warranted,” he concluded.

QCP’s analysts reckon the most likely near-term scenario for digital gold is sideways trade. Attempts to push above $118,000 will be capped by selling from ‘ancient’ addresses, in their view.

A durable recovery will require stabilising inflows into exchange-traded funds and reduced activity by long-term holders, the experts concluded.

Earlier, JPMorgan specialists predicted bitcoin would rise to $170,000 by year-end. At the same time, Galaxy Digital lowered its annual forecast for the leading cryptocurrency to $120,000.

One of the firm’s experts, Alex Thorn, said investor interest in digital gold has diminished.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!