QCP Capital questions risks of GBTC lock-up period ending for Bitcoin

The forthcoming unlocks of Grayscale Investments’ Bitcoin Trust shares are not expected to have a material impact on the position of the leading cryptocurrency. This view is held by QCP Capital.

3/ ..institutional holders who subscribed directly to GBTC 6 months ago & this batch consists of all the new Q1/2021 positions, largely ARK’s last tranche. To be clear- we dont expect these unlocks on its own to have significant impact on the overall market outside of GBTC itself pic.twitter.com/LSxTo7OZYF

— QCP Capital (@QCPCapital) July 8, 2021

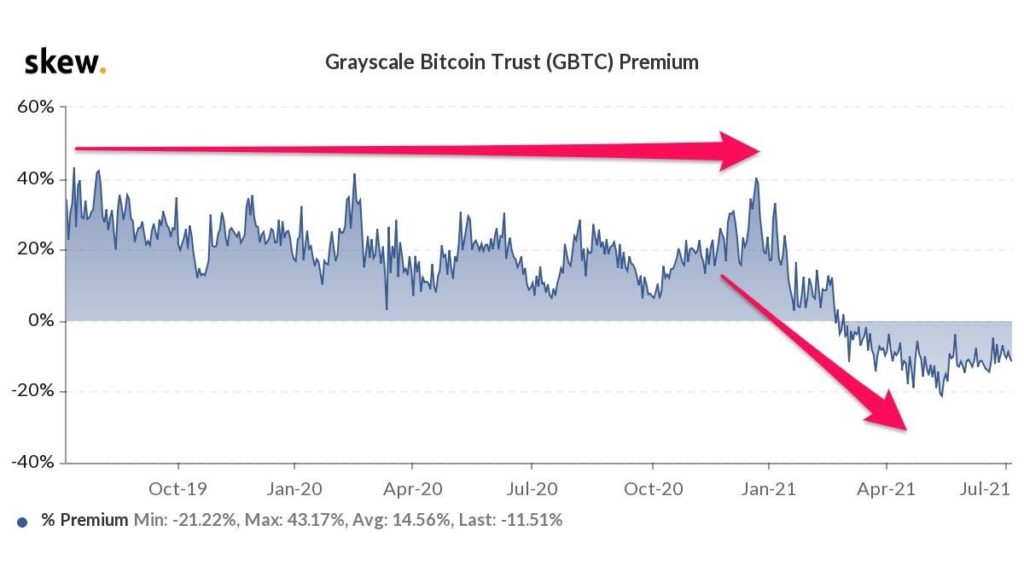

Analysts estimate that earlier GBTC buyers, whose asset unlock occurred previously, refrained from selling the instrument at the current depressed price. A large share of the latest wave of entrants into the Bitcoin Trust belongs to ARK Invest, which has diversified its investments across many ETF.

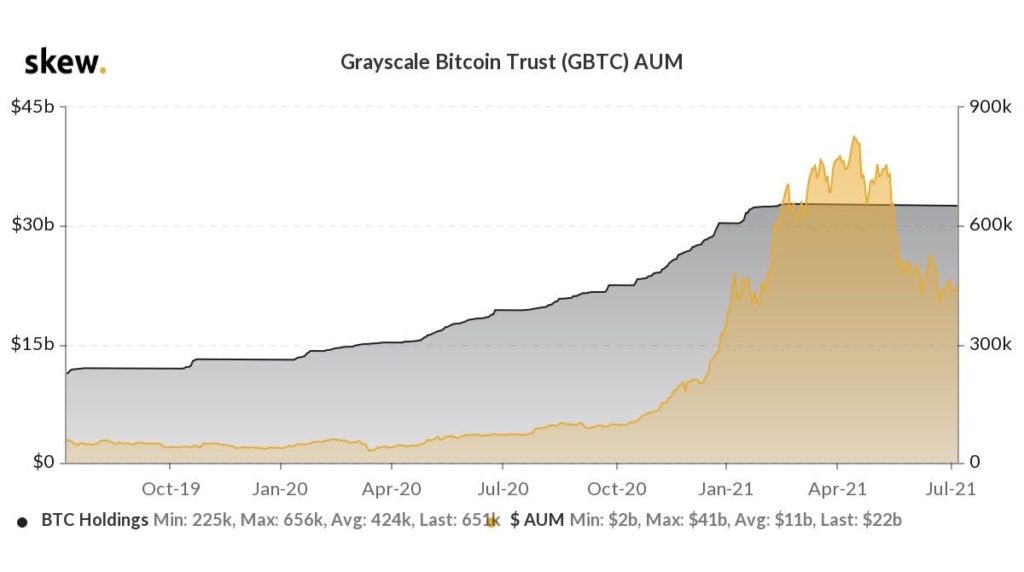

Low financing costs allow Bitcoin Trust holders to wait for the discount to disappear as arbitrage activity exerts influence. Analysts noted that since February holders have sold the equivalent of 5,000 BTC to cover fees and other expenses. GBTC holds a total of 654 600 BTC.

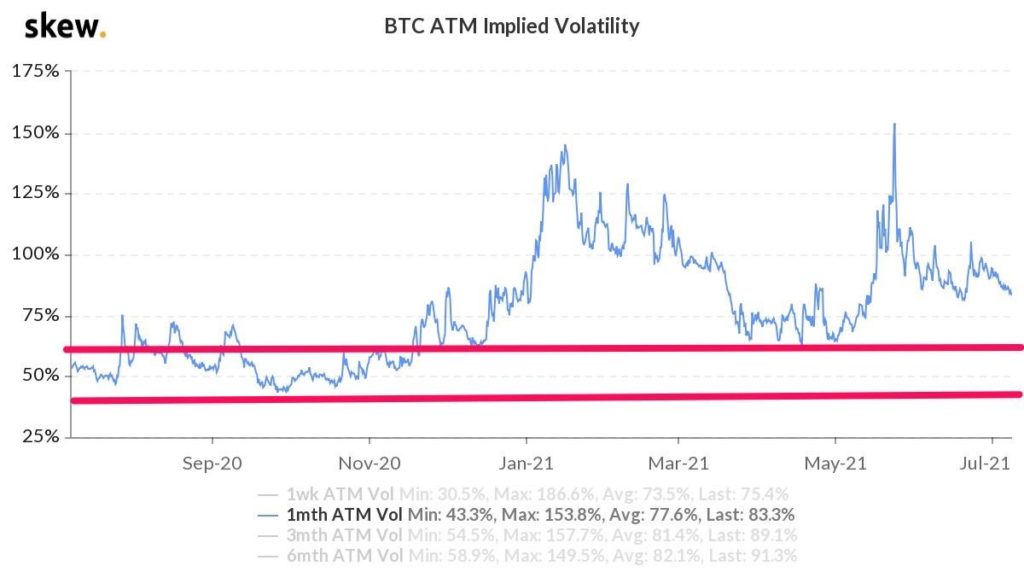

QCP Capital argues that the heightened attention to GBTC signals no real price drivers and reinforces the forecast that Bitcoin will stay in a range of $30 000–$40 000. Analysts expect that by mid-August, one-month implied volatility will continue to ease toward its long-run levels of 50–60%.

Following this, specialists anticipate a renewed upward price dynamic, the trigger for which could be the activation of EIP-1559. They did not rule out a fifth wave of selling in the fourth quarter, prompted by the winding down of the U.S. Federal Reserve’s quantitative easing program.

In the second quarter, analysts cited BlockFi’s sales of the instrument as a reason for the GBTC discount. The lending platform could have redirected its investments into the launched Purpose Bitcoin ETF.

Experts noted that they did not observe interest in reducing positions by other GBTC holders, who could have paused until the premium returns to the NAV, which had previously held steady at 20–30%.

Analysts stressed that, due to the lock-up, arbitrageurs can only affect the magnitude of the discount, but cannot cause it to disappear.

They added that many institutional investors have shifted toward physical ownership of Bitcoin as they gain psychological comfort, and also due to a reluctance to pay Grayscale Investments a 2% management fee.

Experts do not rule out the disappearance of GBTC in the form of a closed-end trust after the SEC approves an exchange-traded fund based on the first cryptocurrency.

As factors that could lead to the disappearance of the discount, analysts cited a buyback of the instrument by shareholders, and also the unlikely at present conversion of the trust into an ETF.

They forecast a compression of the discount after the lock-up ends and the price near its NAV amid the absence of new subscriptions to GBTC.

In March, Grayscale Investments posted nine job openings related to the initiative to launch a Bitcoin-based ETF.

Earlier, in Arcane Research, among the reasons for the discount formation they named the appearance of alternative instruments, the launch of Bitcoin funds, and direct purchases of the leading cryptocurrency by companies.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!