Retail crypto transactions up 125% since January

South Asia led digital-asset adoption

From January to September 2025, the volume of global retail transactions in digital assets rose by 125%, according to a report by TRM Labs.

South Asia was the fastest-growing region for crypto adoption, with an 80% jump to $300 billion.

India topped the global ranking. Analysts said its lead is “driven by interest in digital assets among its large young population.”

“Demand for cryptocurrency as an asset class is also growing among institutional investors and high-net-worth investors, which is helping to accelerate the adoption of digital assets in India,” the specialists added.

Pakistan also made the top three, where user-level adoption has been supported by the state. In March the government created a special Crypto Council.

Notably, adoption is also strengthening in countries where digital assets are banned. The top 50 includes Bangladesh (14th), Egypt (20th), Morocco (21st), Algeria (33rd) and Tunisia (42nd).

“This confirms that blanket bans are ineffective and can in fact strengthen incentives for illegal activity via such P2P and OTC deals,” TRM Labs stressed.

United States

The United States ranks second for crypto adoption. According to TRM Labs, the country’s digital-asset transaction volume increased by 50% to more than $1 trillion.

Experts said organic growth began in 2023 but intensified in 2024 and 2025 amid “political, regulatory and structural factors”.

Analysts singled out Donald Trump’s election campaign, which began accepting donations in digital assets. His victory in the US presidential election triggered a surge in crypto activity:

“TRM analysis showed that US web traffic to VASP websites grew by 30% in the six months after the election compared with the prior period.”

Further steps to create clearer rules for the crypto market bolstered participants’ confidence. In particular, specialists highlighted the passage of the GENIUS Act and CLARITY Act and the creation of a digital assets working group under the US president.

Stablecoins

“stablecoins” continue to play the leading role in global crypto adoption, TRM Labs said. They accounted for 30% of digital-asset transaction volume.

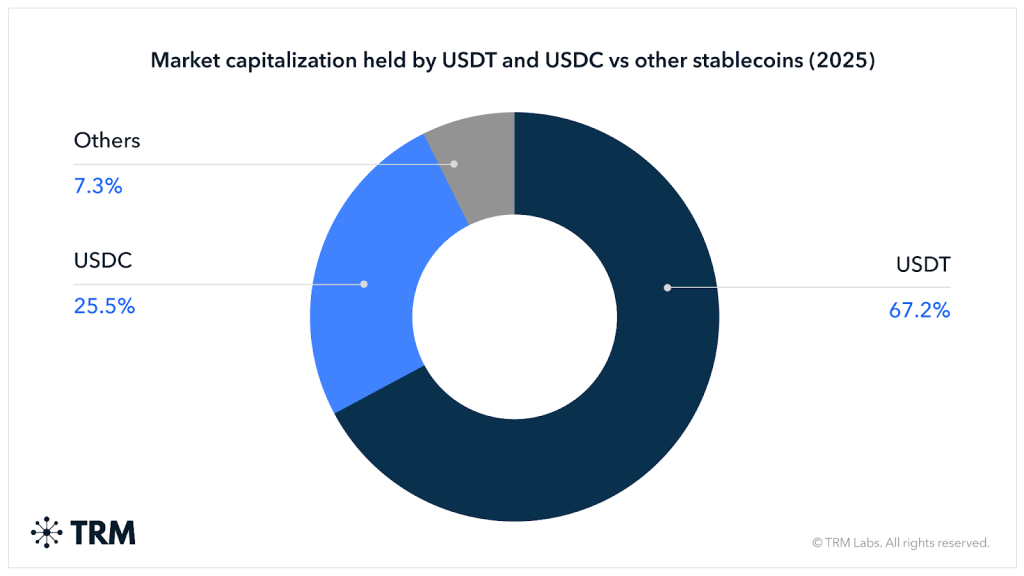

The volume of fiat‑pegged assets reached a record—over $4 trillion—up 83% year on year. The market share of leading stablecoins — USDT and USDC — rose by 52% over the period.

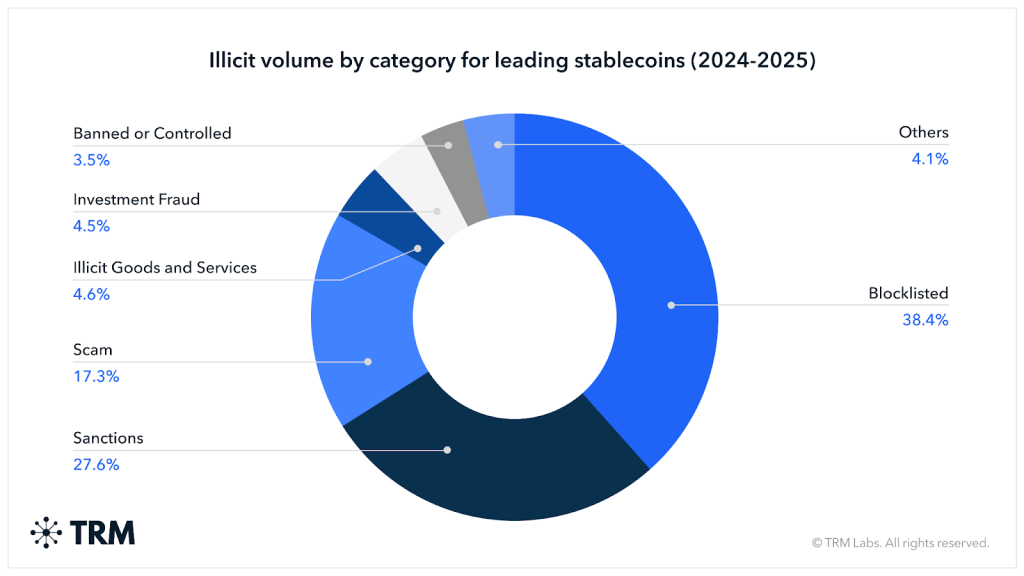

About 99% of stablecoin transactions are unrelated to crime. Yet in the first quarter they accounted for 60% of all illicit crypto volume.

Investment fraud was the main source of growth in illegal activity. But if “stablecoins” are excluded from the analysis, sanctions‑evasion schemes become the primary driver of illicit flows.

In May, Alec Beckman of Psalion forecast that user adoption of digital assets would reach 10% by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!